Haier 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

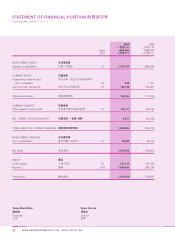

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 71

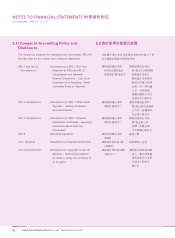

2.4 Summary of Significant Accounting

Policies

Subsidiaries

A subsidiary is an entity whose financial and operating policies the

Company controls, directly or indirectly, so as to obtain benefits

from its activities.

The results of subsidiaries are included in the Company’s income

statement to the extent of dividends received and receivable. The

Company’s interests in subsidiaries are stated at cost less any

impairment losses.

Impairment of non-financial assets other than goodwill

Where an indication of impairment exists, or when annual

impairment testing for an asset is required (other than inventories,

deferred tax assets and financial assets), the asset’s recoverable

amount is estimated. An asset’s recoverable amount is the higher

of the asset’s or cash-generating unit’s value in use and its fair value

less costs to sell, and is determined for an individual asset, unless the

asset does not generate cash inflows that are largely independent

of those from other assets or groups of assets, in which case the

recoverable amount is determined for the cash-generating unit to

which the asset belongs.

An impairment loss is recognised only if the carrying amount of

an asset exceeds its recoverable amount. In assessing value in use,

the estimated future cash flows are discounted to their present

value using a pre-tax discount rate that reflects current market

assessments of the time value of money and the risks specific to

the asset. An impairment loss is charged to the income statement

in the period in which it arises.

An assessment is made at the end of each reporting period as

to whether there is any indication that previously recognised

impairment losses may no longer exist or may have decreased.

If such an indication exists, the recoverable amount is estimated.

A previously recognised impairment loss of an asset other than

goodwill is reversed only if there has been a change in the estimates

used to determine the recoverable amount of that asset, but not

to an amount higher than the carrying amount that would have

been determined (net of any depreciation/amortisation) had no

impairment loss been recognised for the asset in prior years. A

reversal of such an impairment loss is credited to the income

statement in the period in which it arises.

2.4