Haier 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

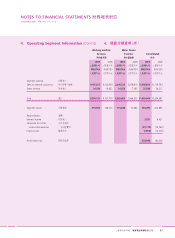

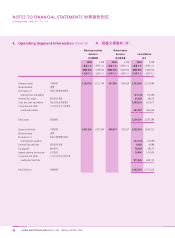

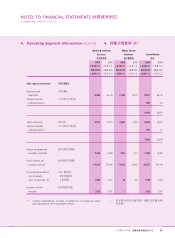

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 107

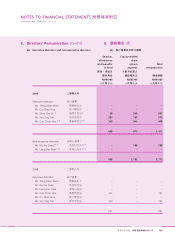

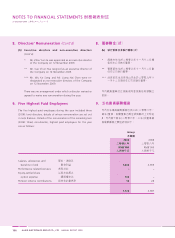

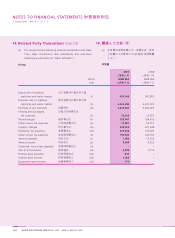

9. Five Highest Paid Employees (Cont’d)

The number of non-director, highest paid employees whose

remuneration fell within the following bands is as follows:

Number of employees

2009 2008

年

Nil to RMB1,000,000 1,000,000 2 2

RMB2,500,001 to RMB3,000,000 2,500,0013,000,000 – 1

2 3

9.

30

10.

50%

15%

During the year, share options were granted to a non-director,

highest paid employee in respect of his services to the Group,

further details of which are included in the disclosures in note 30

to the financial statements. The fair value of such options, which

has been recognised in the income statement over the vesting

period, was determined as at the date of grant and the amount

included in the financial statements for the current year is included

in the above non-director, highest paid employees' remuneration

disclosures.

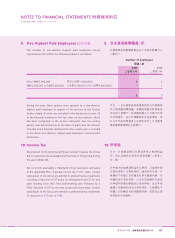

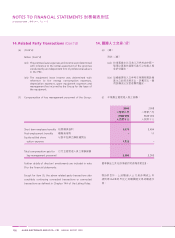

10. Income Tax

No provision for Hong Kong profits tax has been made as the Group

did not generate any assessable profits arising in Hong Kong during

the year (2008: Nil).

Tax on profits assessable in Mainland China have been calculated

at the applicable PRC corporate income tax (“CIT”) rates. Certain

subsidiaries of the Group are entitled to preferential tax treatments

including a reduction in CIT and a full exemption from CIT for two

years starting from their first profit-making year followed by a

50% reduction in CIT for the next consecutive three years. Certain

subsidiaries of the Group are entitled to preferential tax treatments

of reduction in CIT rate to 15%.