Haier 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 141

30. Share Option Scheme (Cont’d)

Share options granted to a director, chief executive or substantial

shareholder of the Company, or to any of their respective associates,

are subject to the approval in advance by the independent non-

executive directors of the Company (and if required, the independent

non-executive directors of the holding company), excluding the

independent non-executive director(s) of the Company and the

holding company who is/are the grantee(s) of the options. In

addition, any share option granted to a substantial shareholder or

an independent non-executive director of the Company, or to any

of their respective associates, in excess of 0.1% of the shares of

the Company in issue as at the date of grant or with an aggregate

value (based on the closing price of the shares of the Company as at

the date of grant) in excess of RMB5 million, within any 12-month

period, is subject to the issue of a circular by the Company (and if

required, the holding company) and the shareholders’ approval of

the Company (and if required, the approval of the shareholders of

the holding company) in advance at a general meeting.

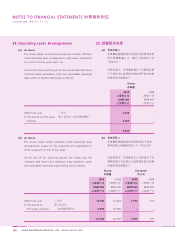

The offer of a grant of share options may be accepted within 28 days

from the date of the offer, upon payment of a nominal consideration

of RMB1 in total by the grantee. The exercise period of the share

options granted is determinable by the Board, and commences on a

specified date and ends on a date which is not later than 10 years

from the date of grant of the share options or the expiry date of

the Share Option Scheme, whichever is earlier.

The exercise price of the share options is determinable by the Board,

but may not be less than the highest of (i) the closing price of the

shares of the Company as stated in the daily quotation sheet of

the Stock Exchange on the date of grant, which must be a trading

day; (ii) the average closing price of the shares of the Company as

stated in the Stock Exchange’s daily quotation sheets for the five

trading days immediately preceding the date of grant; and (iii) the

nominal value of the shares of the Company.

Share options do not confer rights on the holders to dividends or

to vote at shareholders’ meetings.

30.

0.1%

5,000,000

28

1

(i)

(ii)

(iii)