Haier 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

31 December 2009

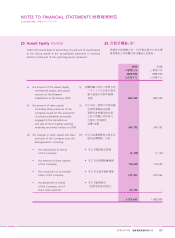

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 127

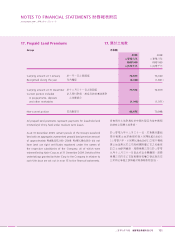

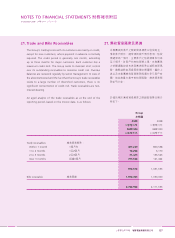

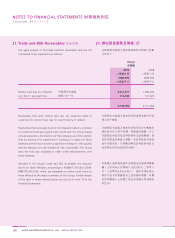

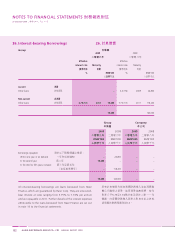

21. Trade and Bills Receivables

The Group's trading terms with its customers are mainly on credit,

except for new customers, where payment in advance is normally

required. The credit period is generally one month, extending

up to three months for major customers. Each customer has a

maximum credit limit. The Group seeks to maintain strict control

over its outstanding receivables to minimise credit risk. Overdue

balances are reviewed regularly by senior management. In view of

the aforementioned and the fact that the Group’s trade receivables

relate to a large number of diversified customers, there is no

significant concentration of credit risk. Trade receivables are non-

interest-bearing.

An aged analysis of the trade receivables as at the end of the

reporting period, based on the invoice date, is as follows:

Group

2009 2008

年

RMB’000 RMB’000

Trade receivables:

Within 1 month 1 457,259 800,538

1 to 2 months 12 72,298 6,170

2 to 3 months 23 71,415 133,526

Over 3 months 3 215,646 121,422

816,618 1,061,656

Bills receivable 1,930,305 1,050,000

2,746,923 2,111,656

21.