Haier 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

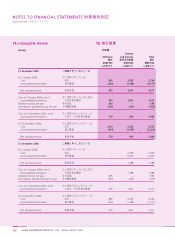

31 December 2009

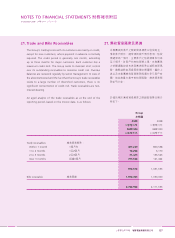

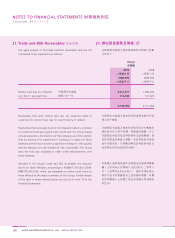

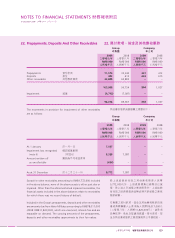

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 119

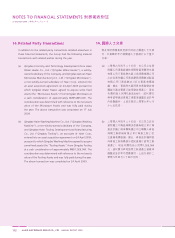

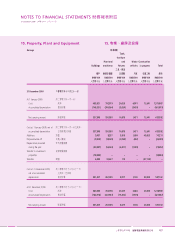

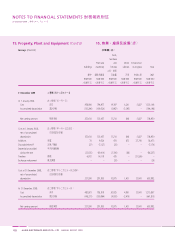

15. Property, Plant and Equipment (Cont’d)

All buildings of the Group are erected on land in Mainland China

held under medium term leases.

As at 31 December 2009, certain of the Group's buildings with an

aggregate net book value of approximately RMB211,910,000 (2008:

RMB236,364,000) did not have building ownership certificates

registered under the names of the respective subsidiaries of the

Company.

With respect to the above properties and the Group’s investment

properties, on 24 February 2005 and 20 September 2006, Haier

Corp issued two undertakings to the Company, pursuant to which

Haier Corp agreed to provide other suitable properties to the Group

to ensure the operations of certain subsidiaries of the Company

operating in Qingdao and Wuhan and indemnify the Group against

any losses arising from the above defective property title issue

and for any moving cost/loss incurred, if, for any reason, the

respective subsidiaries were not able to continue to use the buildings

before the related acquisition and registration procedures have

been completed. The aggregate net book value of the Group’s

buildings and investment properties indemnified by Haier Corp as

at 31 December 2009 amounted to approximately RMB129,166,000

(2008: RMB155,712,000).

In the opinion of the directors, the Group is entitled to lawfully

and validly occupy and use the buildings and investment properties

for its daily operations, notwithstanding the fact that the related

building ownership certificates have not yet been obtained.

15.

211,910,000

236,364,000

129,166,000

155,712,000