Haier 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT OF THE DIRECTORS 董事會報告書

海爾電器集團有限公司 51

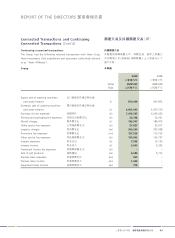

Connected Transactions and Continuing

Connected Transactions (Cont’d)

Continuing connected transaction (Cont’d)

Notes: (Cont’d)

(x) The interest expenses and income were determined with reference

to the standard rates published by the People’s Bank of China.

The maximum loan balance taken out and the bank deposits

placed with Haier Group Finance Co., Ltd. (“Haier Finance”) related

to the above interest expenses and income during 2009 were

RMB143,000,000 and RMB699,738,000, respectively.

(xi) The trademark licence fee expenses were charged at a nominal

consideration of RMB1 during the year.

(xii) The sales of gift products were made at selling prices not higher

than those sold by Haier Affiliates to independent third parties.

(xiii) The premise lease expenses and income were determined with

reference to the rental assessment of the premises conducted by

an independent firm of professional valuers in the PRC.

(xiv) The equipment lease income was determined with reference to

the energy consumption expenses, depreciation expenses, spare

equipment expenses and management fee incurred by the Group

for the lease of the equipment.

Except for the premise lease expenses and income and equipment lease

income, the above transactions were defined as the Continuing Connected

Transactions in the circulars to the shareholders of the Company dated

26 November 2007 and 26 May 2008, respectively, and were approved

by the shareholders at special general meetings of the Company held

on 12 December 2007 and 20 June 2008, respectively.

The independent non-executive directors of the Company have reviewed

the premise lease expenses and income, equipment lease income and the

Continuing Connected Transactions set out above and have confirmed

that they were entered into:

(i) in the usual and ordinary course of business of the Group;

(ii) either on normal commercial terms or, if there are not sufficient

comparable transactions to judge whether they are on normal

commercial terms, on terms no less favourable to the Group than

terms available to or from (as appropriate) independent third parties;

and

(iii) in accordance with the relevant agreements governing them on

terms that were fair and reasonable and in the interests of the

shareholders of the Company as a whole.

(x)

143,000,000699,738,000

(xi) 1

(xii)

(xiii)

(xiv)

(i)

(ii)

(iii)