Haier 2009 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

海爾電器集團有限公司 151

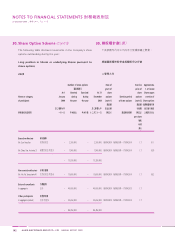

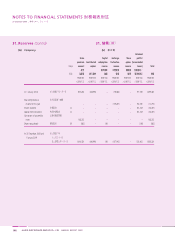

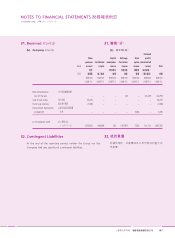

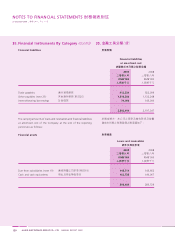

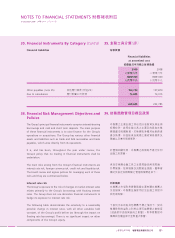

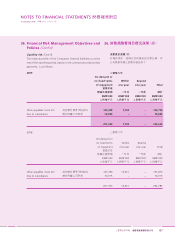

35. Financial Instruments By Category (Cont’d)

Financial liabilities

Financial liabilities

at amortised cost

2009 2008

年

RMB’000 RMB’000

Other payables (note 25) 25 154,750 157,870

Due to subsidiaries 74,885 74,915

229,635 232,785

35.

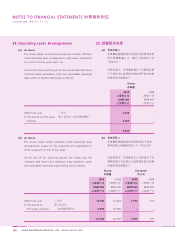

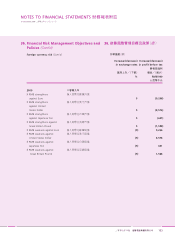

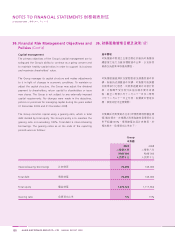

36. Financial Risk Management Objectives and

Policies

The Group’s principal financial instruments comprise interest-bearing

borrowings and cash and short term deposits. The main purpose

of these financial instruments is to raise finance for the Group’s

operations or acquisitions. The Group has various other financial

assets and liabilities such as trade and bills receivables and trade

payables, which arise directly from its operations.

It is, and has been, throughout the year under review, the

Group’s policy that no trading in financial instruments shall be

undertaken.

The main risks arising from the Group’s financial instruments are

interest rate risk, foreign currency risk, credit risk and liquidity risk.

The board review and agrees policies for managing each of these

risks and they are summarised below.

Interest rate risk

The Group’s exposure to the risk of changes in market interest rates

relates primarily to the Group’s borrowings with floating interest

rates. The Group does not use derivative financial instruments to

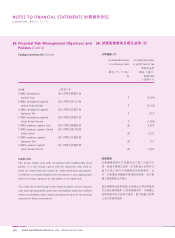

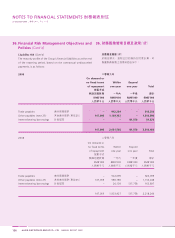

hedge its exposure to interest rate risk.

The following table demonstrates the sensitivity to a reasonably

possible change in interest rates, with all other variables held

constant, of the Group’s profit before tax (through the impact on

floating rate borrowings). There is no significant impact on other

components of the Group’s equity.

36.