Haier 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

HAIER ELECTRONICS GROUP CO., LTD ANNUAL REPORT 2009

108

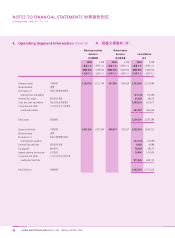

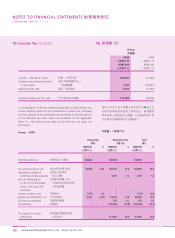

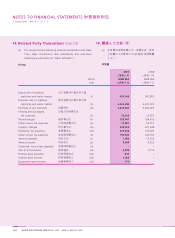

10. Income Tax (Cont’d)

Group

2009 2008

年

RMB’000 RMB’000

Current – Mainland China – 109,861 21,550

Underprovision/(overprovision)

in prior year 1,070 (24,817 )

Deferred (note 28) 28 6,761 27,657

Total tax charge for the year 117,692 24,390

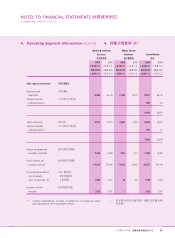

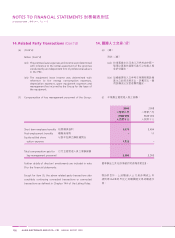

A reconciliation of the tax expense applicable to profit before tax

at the statutory rates for the jurisdictions in which the Company

and the majority of its subsidiaries are domiciled to the tax expense

at the effective tax rates, and a reconciliation of the applicable

rates (i.e., the statutory tax rates) to the effective tax rates, are

as follows:

Group – 2009

Hong Kong Mainland China Total

RMB’000 % RMB’000 % RMB’000 %

Profit/(loss) before tax (24,422 ) 562,468 538,046

Tax at the statutory tax rate (4,030 ) 16.5 140,617 25.0 136,587 25.4

Adjustments in respect of

current tax of previous periods – – 1,070 0.2 1,070 0.2

Effect of withholding tax

at 10% on the distributable 10%

profits of the Group’s PRC

subsidiaries – – – – – –

Income not subject to tax (115 ) 0.5 – – (115 ) (0.1 )

Expenses not deductible for tax 4,145 (17.0 ) 81,355 14.4 85,500 15.9

Tax losses not recognised – – 555 0.1 555 0.1

Tax exemption – – (105,905 ) (18.8 ) (105,905 ) (19.7 )

Tax charge at the Group’s

effective rate – – 117,692 20.9 117,692 21.8

10.

年