Haier 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

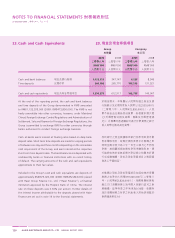

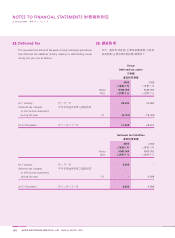

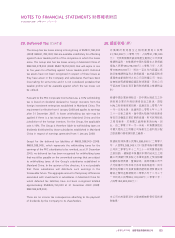

31 December 2009

NOTES TO FINANCIAL STATEMENTS 財務報表附註

HAIER ELECTRONICS GROUP CO., LTD ANNUAL REPORT 2009

140

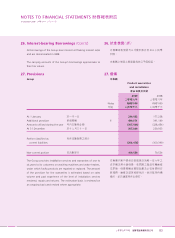

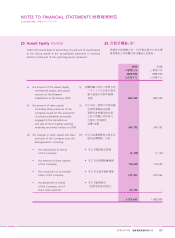

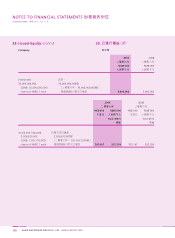

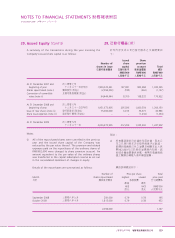

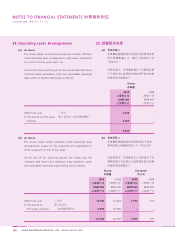

29. Issued Equity (Cont’d)

(ii) On 18 January 2008, the outstanding aggregate principle

amount of the convertible notes were fully converted and

resulted in the issue of 94,444,444 additional ordinary

shares.

(iii) On 23 March 2009, the Company issued 75,000,000 shares of

the Company at HK$0.65 per share (the “Placing Shares”) to

the subscribers in a share placing. In addition, the Company

issued 300,000,000 non-listed warrants, on the basis of four

warrants for each Placing Share issued, at no initial issue price.

This entitles the holder of each warrant to subscribe for one

new share of the Company at an exercise price of HK$0.66 at

any time for a period of four years from the date of issue of

such warrant. There was no exercise of the warrants during

the year.

At the end of the reporting period, the Company had

300,000,000 warrants outstanding. The exercise in full of

the outstanding warrants would, under the present capital

structure of the Company, result in the issue of 300,000,000

additional shares at HK$0.66 each.

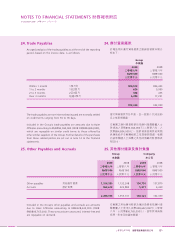

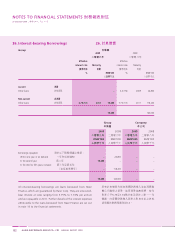

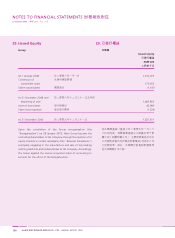

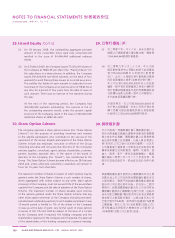

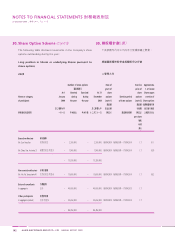

30. Share Option Scheme

The Company operates a share option scheme (the “Share Option

Scheme”) for the purpose of providing incentives and rewards

to the eligible participants who contribute to the success of the

operations of the Group. Eligible participants of the Share Option

Scheme include any employee, executive or officer of the Group

(including executive and non-executive directors of the Company)

and any supplier, consultant, agent, adviser, shareholder, customer,

partner, business associate who, in the option of the board of

directors of the Company (the “Board”), has contributed to the

Group. The Share Option Scheme became effective on 28 February

2002 and, unless otherwise cancelled or amended, will remain in

force for 10 years from that date.

The maximum number of shares in respect of which options may be

granted under the Share Option Scheme is such number of shares,

when aggregated with shares subject to any other share option

scheme(s) of the Company, must not exceed 10% of the issued share

capital of the Company as at the date of adoption of the Share Option

Scheme. The maximum number of shares issuable upon exercise

of the options granted under the Share Option Scheme and any

other share option scheme(s) of the Company (including exercised,

cancelled and outstanding options) to each eligible participant in any

12-month period is limited to 1% of the shares of the Company

in issue as at the date of grant. Any further grant of share options

in excess of this 1% limit shall be subject to the issue of a circular

by the Company (and if required, the holding company) and the

shareholders’ approval of the Company (and if required, the approval

of the shareholders of the holding company) at a general meeting.

29.

(ii)

94,444,444

(iii)

0.65

75,000,000

300,000,000

0.66

300,000,000

0.66300,000,000

30.

10

10%

1%1%