Haier 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

97

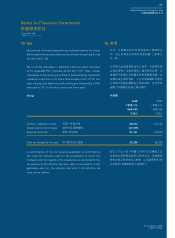

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

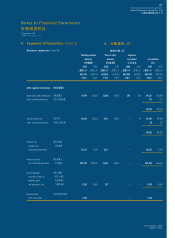

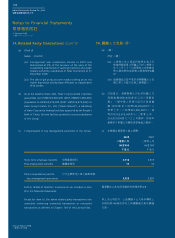

10. Tax (Cont’d)

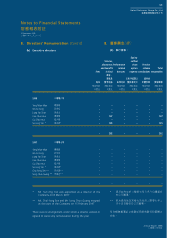

On 16 March 2007, the National People’s Congress approved the

Corporate Income Tax Law of the PRC (the “New CIT Law”), which

is effective from 1 January 2008. Under the New CIT Law, the CIT

rate applicable to domestic companies will decrease from 33% to

25% from 1 January 2008. According to HKAS 12, deferred tax

assets and deferred tax liabilities are measured at the tax rates that

are expected to apply to the period when the asset is realised or

the liability is settled. The change in CIT rate has had no significant

impact on the results and financial position of the Group for the

year ended 31 December 2008.

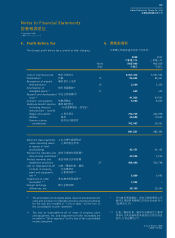

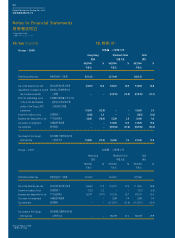

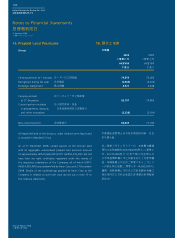

11. Profit Attributable to Equity Holders of the

Parent

Of the Group’s profit attributable to equity holders of the parent of

HK$152,183,000 (2007: HK$172,131,000), a loss of HK$25,262,000

(2007: loss of HK$31,882,000) has been dealt with in the financial

statements of the Company (note 31(b)).

12. Dividends

2008 2007

二零零八年 二零零七年

HK$’000 HK$’000

千港元 千港元

Interim dividend – HK2 cents 中期股息-每股普通股2港仙

per ordinary share (二零零七年:無)

(2007: Nil) 39,054 –

Special interim dividend – 特別中期股息-每股

HK2 cents per ordinary 普通股2港仙

share (2007: Nil) (二零零七年:無) 39,054 –

78,108 –

10. 稅項

(續)

於二零零七年三月十六日,全國人民代表大會

批准中國企業所得稅法(「新企業所得稅法」),

自二零零八年一月一日起生效。根據新企業所

得稅法,國內企業之適用企業所得稅率自二零

零八年一月一日起由33%減至25%。根據香港

會計準則第12號,遞延稅項資產及遞延稅項負

債按變現資產或償還負債期間之預期適用稅率

計算。企業所得稅率變動對本集團截至二零零

八年十二月三十一日止年度之業績及財政狀況

並無重大影響。

11. 母公司股權持有人應佔溢利

在母公司股權持有人應佔本集團溢利

152,183,000港元(二零零七年︰ 172,131,000

港元)中,虧損25,262,000港元(二零零七年︰

虧損31,882,000港元)已在本公司之財務報表內

處理(附註31(b))。

12. 股息

56432.27b!Opuft/joee!!!:856432.27b!Opuft/joee!!!:8 33050311:!!!5;27;3233050311:!!!5;27;32