Haier 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

136

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

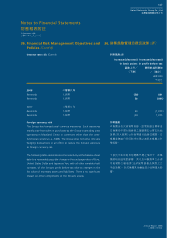

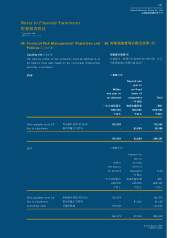

36. Financial Risk Management Objectives and

Policies

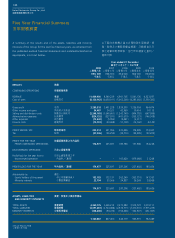

The Group’s principal financial instruments comprise interest-bearing

borrowings, convertible notes and cash and short term deposits.

The main purpose of these financial instruments is to raise finance

for the Group’s operations or acquisitions. The Group has various

other financial assets and liabilities such as trade and bills receivables

and trade, which arise directly from its operations.

It is, and has been, throughout the year under review, the

Group’s policy that no trading in financial instruments shall be

undertaken.

The main risks arising from the Group’s financial instruments are

interest rate risk, foreign currency risk, credit risk and liquidity risk.

The board review and agrees policies for managing each of these

risks and they are summarised below.

Interest rate risk

The Group’s exposure to the risk of changes in market interest rates

relates primarily to the Group’s borrowings with floating interest

rates. The Group does not use derivative financial instruments to

hedge its exposure to interest rate risk.

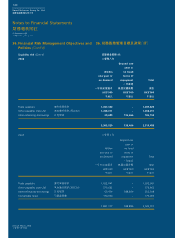

The following table demonstrates the sensitivity to a reasonably

possible change in interest rates, with all other variables held

constant, of the Group’s profit before tax (through the impact on

floating rate borrowings). There is no significant impact on other

components of the Group’s equity.

36. 財務風險管理目標及政策

本集團之主要金融工具包括計息借貸、可換股

票據及現金與短期存款。該等金融工具之主要

目的是為本集團營運或收購集資。本集團有多

種其他財務資產及負債,如直接來自業務之應

收貿易賬款及票據。

於整個回顧年度,本集團之政策為不進行任何

金融工具買賣。

來自本集團金融工具之主要風險為利率風險、

外幣風險、信貸風險及流動資金風險。董事會

檢討及協定各類風險之管理政策概述如下。

利率風險

本集團之市場利率變動風險主要有關本集團之

浮息借貸。本集團並無使用衍生金融工具對沖

其利率風險。

下表列示在所有其他變數不變之情況下,對本

集團除稅前溢利利率合理可能變動之敏感度(透

過對浮息借貸造成之影響)。對本集團其他權益

部分並無重大影響。

56432.27c!Opuft/joee!!!24756432.27c!Opuft/joee!!!247 33050311:!!!5;25;6733050311:!!!5;25;67