Haier 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

142

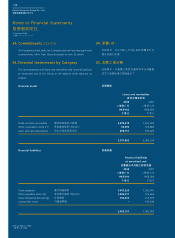

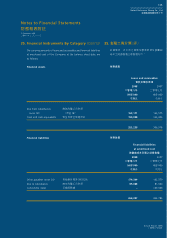

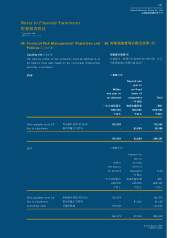

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

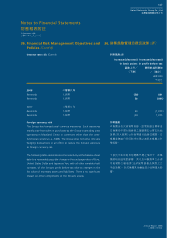

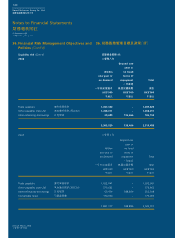

36. Financial Risk Management Objectives and

Policies (Cont’d)

Capital management

The primary objectives of the Group’s capital management are to

safeguard the Group’s ability to continue as a going concern and

to maintain healthy capital ratios in order to support its business

and maximise shareholders value.

The Group manages its capital structure and makes adjustments

to it, in light of changes in economic conditions. To maintain or

adjust the capital structure, the Group may adjust the dividend

payment to shareholders, return capital to shareholders or issue

new shares. The Group is not subject to any externally imposed

capital requirements. No changes were made in the objectives,

policies or processes for managing capital during the years ended

31 December 2008 and 31 December 2007.

The Group monitors capital using a gearing ratio, which is total

debt divided by the total equity. The Group’s policy is to maintain

the gearing ratio not exceeding 100%. Total debt includes interest-

bearing borrowings and convertible notes. The gearing ratios as at

the balance sheet dates were as follows:

Group

2008 2007

二零零八年 二零零七年

HK$’000 HK$’000

千港元 千港元

Interest-bearing borrowings 計息借貸 162,420 214,973

Convertible notes 可換股票據 – 169,344

Total debt 債務總值 162,420 384,317

Total equity 權益總值 1,269,095 942,124

Gearing ratio 負債資本比率 13% 41%

36. 財務風險管理目標及政策

(續)

資本管理

本集團資本管理之主要目標在於維持本集團持

續經營之能力及維持穩健資本比率,以支持其

業務及為股東爭取最高價值。

本集團根據經濟狀況變動管理及調整其資本架

構。為維持或調整資本架構,本集團可能調整

向股東派付之股息、向股東退還資本或發行新

股。本集團不受任何外在施加資本要求所規

限。截至二零零八年十二月三十一日及二零零

七年十二月三十一日止年度,有關資本管理目

標、政策或程序並無變動。

本集團採用負債資本比率(即債務總值除權益總

值)監控資本。本集團之政策為維持負債資本比

率不超過100%。債務總值包括計息借貸及可

換股票據。於結算日,負債資本比率如下:

本集團

56432.27c!Opuft/joee!!!25356432.27c!Opuft/joee!!!253 33050311:!!!5;25;6:33050311:!!!5;25;6: