Haier 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

96

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

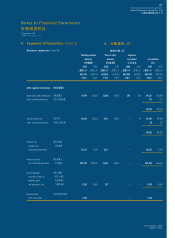

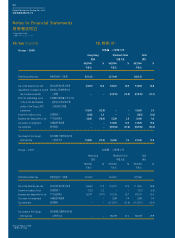

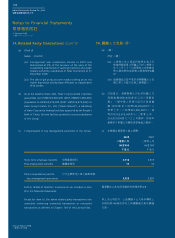

10. Tax (Cont’d)

Group – 2008

Hong Kong Mainland China Total

香港 中國大陸 總計

HK$’000 % HK$’000 % HK$’000 %

千港元 千港元 千港元

Profit/(loss) before tax 除稅前溢利/(虧損) (15,131 ) 217,444 202,313

Tax at the statutory tax rate 按法定稅率計算之稅項 (2,497 ) 16.5 54,361 25.0 51,864 25.6

Adjustments in respect of current 因前期之即期稅項作出

tax of previous periods 之調整 – – (27,815 ) (12.8 ) (27,815 ) (13.7 )

Effect of withholding tax at 本集團中國附屬公司可分派

10% on the distributable 盈利按10%稅率計算

profits of the Group’s PRC 之預扣稅之影響

subsidiaries 10,890 (72.0 ) – – 10,890 5.4

Income not subject to tax 非課稅收入 (363 ) 2.4 – – (363 ) (0.2 )

Expenses not deductible for tax 不可扣稅開支 2,860 (18.9 ) 5,329 2.5 8,189 4.0

Tax losses not recognised 未確認稅項虧損 – – 31,505 14.5 31,505 15.6

Tax exemption 稅項豁免 – – (46,934 ) (21.6 ) (46,934 ) (23.2 )

Tax charge at the Group’s 按本集團之實際稅率計算

effective rate 之稅項支出 10,890 (72.0 ) 16,446 7.6 27,336 13.5

10. 稅項

(續)

本集團-二零零八年

Hong Kong Mainland China Total

香港 中國大陸 總計

HK$’000 % HK$’000 % HK$’000 %

千港元 千港元 千港元

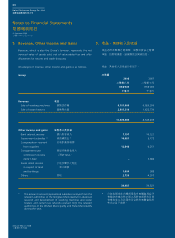

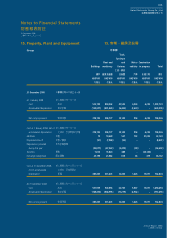

Profit/(loss) before tax 除稅前溢利╱(虧損) (32,320 ) 354,276 321,956

Tax at the statutory tax rate 按法定稅率計算之稅項 (5,656 ) 17.5 116,911 33.0 111,255 34.6

Income not subject to tax 非課稅收入 (723 ) 2.2 – – (723 ) (0.2 )

Expenses not deductible for tax 不可扣稅開支 6,379 (19.7 ) 91,136 25.7 97,515 30.2

Tax losses not recognised 未確認稅項虧損 – – 1,289 0.4 1,289 0.4

Tax exemption 稅項豁免 – – (113,077 ) (31.9 ) (113,077 ) (35.1 )

Tax charge at the Group’s 按本集團之實際稅率計算

effective rate 之稅項支出 – – 96,259 27.2 96,259 29.9

Group – 2007 本集團-二零零七年

56432.27b!Opuft/joee!!!:756432.27b!Opuft/joee!!!:7 33050311:!!!5;27;3133050311:!!!5;27;31