Haier 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

143

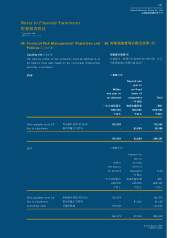

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

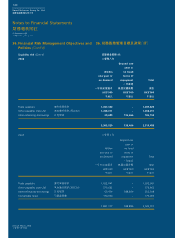

37. Post Balance Sheet Events

On 25 February 2009, the Company entered into a placing agreement

with Roofer Securities Limited (“Roofer Securities”), pursuant to

which the Company appointed Roofer Securities to procure not

fewer than six placees to subscribe for up to 75,000,000 shares

of the Company at a placing price of HK$0.66 per each placing

share (the “Placing Shares”). In addition, the Company has agreed

to issue non-listed warrants, on the basis of four warrants for each

placing share issued at no initial price. This entitles the holder of

each warrant to subscribe for one new share at an exercise price

of HK$0.66 at any time for a period of four years from the date

of issue of such warrant (the “Warrants”).

The share placement was completed on 23 March 2009 and the

Placing Shares represent approximately 3.7% of the Company’s

issued share capital as enlarged by the placing and the net proceeds

of HK$47.4 million were raised by the placing. If allotted and

issued, the Warrants would give rise to 300,000,000 new shares

of the Company, which represents approximately 12.89% of the

Company’s issued share capital as enlarged by the issue of the

placing shares and the warrant shares. The net proceeds from

the exercise of all of the Warrants will be approximately HK$198

million.

38. Approval of the Financial Statements

The financial statements were approved and authorised for issue

by the board of directors on 17 April 2009.

37. 結算日後事項

於二零零九年二月二十五日,本公司與路華

證券有限公司(「路華證券」)訂立配售協議,

據此,本公司委任路華證券促成最少六位承

配人按配售價每股配售股份0.66港元認購最多

75,000,000股本公司股份(「配售股份」)。此

外,本公司已同意發行非上市認股權證,以每

發行一股配售股份獲發四份認股權證之基準(並

無初步發行價),賦予每份認股權證之持有人

權利於發行有關認股權證(「認股權證」)當日起

四年期間隨時按行使價0.66港元認購一股新股

份。

股份配售已於二零零九年三月二十三日完成。

配售股份佔本公司經配售事項擴大之已發行

股本約3.7%。配售事項已帶來所得款項淨額

47,400,000港元。倘已配發及發行,認股權證

將使本公司發行300,000,000股新股份,佔本公

司經發行配售股份及認股權證股份擴大之已發

行股本約12.89%。行使全數認股權證之所得款

項淨額將約為198,000,000港元。

38. 財務報表之批准

財務報表已於二零零九年四月十七日經董事會

批准及授權刊發。

56432.27c!Opuft/joee!!!25456432.27c!Opuft/joee!!!254 33050311:!!!5;26;1133050311:!!!5;26;11