Haier 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

109

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

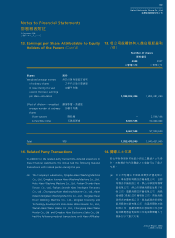

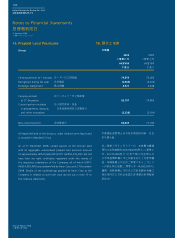

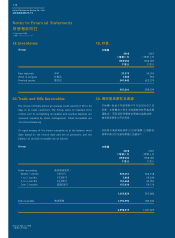

18. Interests in Subsidiaries

Company

2008 2007

二零零八年 二零零七年

HK$’000 HK$’000

千港元 千港元

Unlisted investments, at cost 非上市投資,按成本 1,982,417 1,982,417

Due from subsidiaries 應收附屬公司款項 163,171 163,575

2,145,588 2,145,992

Impairment for unlisted 非上市投資減值

(附註)

investments (note) (2,356 ) (2,356 )

2,143,232 2,143,636

Note: An impairment was recognised for certain unlisted

investments with a carrying amount of HK$2,356,000

because the relevant subsidiaries had suffered losses for

many years.

The amounts due from and to subsidiaries included in the

Company’s non-current assets and non-current liabilities of

HK$163,171,000 (2007: HK$163,575,000) and HK$85,088,000

(2007: HK$81,060,000), respectively, are unsecured, interest-free

and have no fixed terms of repayment. The carrying amounts of

these amounts due from and to subsidiaries approximate to their

fair values.

18. 附屬公司權益

本公司

附註︰

由於相關附屬公司多年來出現虧損,故

已就賬面值2,356,000港元之若干非上

市投資確認減值。

計入本公司非流動資產及非流動負債之應收及

應付附屬公司款項分別163,171,000港元(二零

零七年:163,575,000港元)及85,088,000港元

(二零零七年:81,060,000港元)為無抵押、免

息及並無固定還款期。該等應收及應付附屬公

司款項之賬面值與其公平值相若。

56432.27b!Opuft/joee!!!21:56432.27b!Opuft/joee!!!21: 33050311:!!!5;27;3833050311:!!!5;27;38