Haier 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

95

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

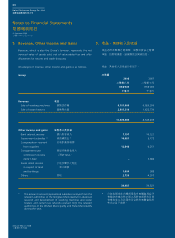

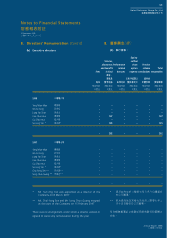

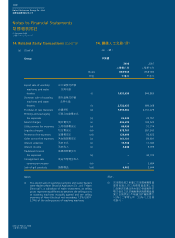

10. Tax

No provision for Hong Kong profits tax has been made as the Group

did not generate any assessable profits arising in Hong Kong during

the year (2007: Nil).

Tax on profits assessable in Mainland China has been calculated

at the applicable PRC corporate income tax (“CIT”) rates. Certain

subsidiaries of the Group are entitled to preferential tax treatments

including a reduction in CIT and a full exemption from CIT for two

years starting from their first profit-making year followed by a 50%

reduction in CIT for the next consecutive three years.

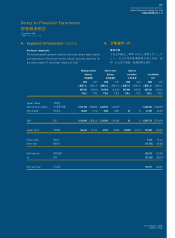

Group

2008 2007

二零零八年 二零零七年

HK$’000 HK$’000

千港元 千港元

Current – Mainland China 即期—中國大陸 24,010 116,160

Overprovision in prior years 過往年度超額撥備 (27,815 ) –

Deferred (note 28) 遞延

(附註28)

31,141 (19,901 )

Total tax charge for the year 年內稅項支出總額 27,336 96,259

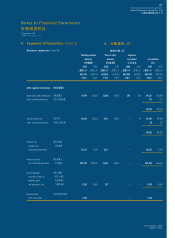

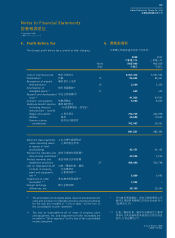

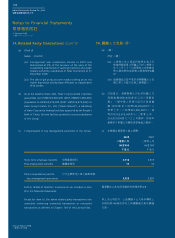

A reconciliation of the tax expense applicable to profit before

tax using the statutory rates for the jurisdictions in which the

Company and the majority of its subsidiaries are domiciled to the

tax expense at the effective tax rates, and a reconciliation of the

applicable rates (i.e., the statutory tax rates) to the effective tax

rates, are as follows:

10. 稅項

年內,本集團並無任何源自香港之應課稅溢

利,因此並無作出香港利得稅撥備(二零零七

年:無)。

於中國內地就應課稅溢利之稅項,乃按照中國

企業所得稅(「企業所得稅」)適用稅率計算。本

集團若干附屬公司有權享有稅項優惠待遇,包

括獲扣減企業所得稅,以及自首個獲利年度起

計兩個年度獲全數豁免企業所得稅,並於其後

連續三年獲豁免50%企業所得稅。

本集團

按本公司及大部分附屬公司所在司法權區之法

定稅率計算除稅前溢利之稅項支出,與按實際

稅率計算之稅項支出之對賬,以及適用稅率(即

法定稅率)與實際稅率之對賬如下:

56432.27b!Opuft/joee!!!:656432.27b!Opuft/joee!!!:6 33050311:!!!5;27;2:33050311:!!!5;27;2: