Haier 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2008

二零零八年年報

海爾電器集團有限公司

Haier Electronics Group Co., Ltd

123

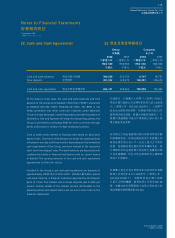

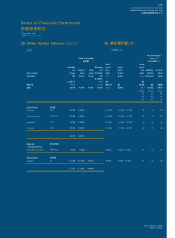

Notes to Financial Statements

財務報表附註

31 December 2008

二零零八年十二月三十一日

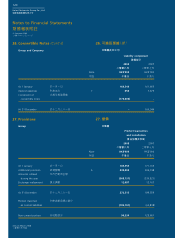

28. Deferred Tax (Cont’d)

Except for the deferred tax liabilities of HK$10,890,000, which

represents the withholding taxes for the earnings of the PRC

subsidiaries to be remitted, as at 31 December 2008, no deferred tax

has been recognised for withholding taxes that would be payable

on the unremitted earnings that are subject to withholding taxes

of the Group’s subsidiaries established in Mainland China. In the

opinion of the directors, it is not probable that these subsidiaries will

distribute such earnings in the foreseeable future. The aggregate

amount of temporary differences associated with investments in

subsidiaries in Mainland China for which deferred tax liabilities

have not been recognised totalled approximately HK$21,004,000 at

31 December 2008 (2007: Nil).

There are no income tax consequences attaching to the payment

of dividends by the Company to its shareholders.

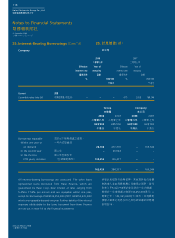

29. Issued Equity

Group

Issued equity

已發行權益

HK$’000

千港元

At 1 January 2007 於二零零七年一月一日 1,212,960

Exercise of share options 行使購股權 35,250

At 31 December 2007 and 於二零零七年

beginning of year 十二月三十一日及年初 1,248,210

Conversion of 兌換可換股票據

convertible notes 192,094

Shares repurchased 購回股份 (1,302 )

At 31 December 2008 於二零零八年十二月三十一日 1,439,002

28. 遞延稅項

(續)

除遞延稅項負債10,890,000港元外(該款項為

中國附屬公司於二零零八年十二月三十一日將

匯寄盈利之預扣稅),概無就本集團於中國內地

成立之附屬公司須繳付預扣稅之未匯寄盈利之

預扣稅確認遞延稅項負債。董事認為,該等附

屬公司不大可能會於可見未來分派所有該等盈

利。與中國內地附屬公司投資有關而遞延稅項

負債尚未確認之暫時差異總額於二零零八年十

二月三十一日約為21,004,000港元(二零零七

年:無)。

本公司向其股東派付之股息概無附帶任何所得

稅後果。

29. 已發行權益

本集團

56432.27c!Opuft/joee!!!23456432.27c!Opuft/joee!!!234 33050311:!!!5;25;5:33050311:!!!5;25;5: