HTC 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

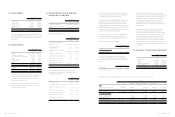

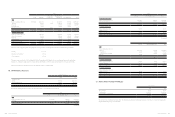

• Financial information Financial information •

182 183

HTC CORPORATION

NOTES TO PARENT COMPANY ONLY FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2014 AND 2013

(In Thousands of New Taiwan Dollars, Unless Stated Otherwise)

1. ORGANIZATION AND OPERATIONS

HTC Corporation (the “Company”) was incorporated on May 15, 1997 under the Company Law of the Republic of China to design,

manufacture, assemble, process, and sell smart mobile devices and provide after-sales service.

In March 2002, the Company had its stock listed on the Taiwan Stock Exchange. On November 19, 2003, the Company listed some of its

shares of stock on the Luxembourg Stock Exchange in the form of global depositary receipts.

The parent company only financial statements are presented in the Company’s functional currency, New Taiwan dollars.

2. APPROVAL OF FINANCIAL STATEMENTS

The parent company only financial statements were approved by the board of directors and authorized for issue on February 6, 2015.

3. APPLICATION OF NEW AND REVISED STANDARDS, AMENDMENTS AND

INTERPRETATIONS

a. The amendments to the Guidelines Governing the Preparation of Financial Reports by Securities Issuers

and the 2013 version of the International Financial Reporting Standards (IFRS), International Accounting

Standards (IAS), Interpretations of IFRS (IFRIC), and Interpretations of IAS (SIC) in issue but not yet

effective.

Rule No. 1030010325 issued by the Financial Supervisory Commission (FSC) on April 3, 2014, stipulated that the Company should

apply the 2013 version of IFRS, IAS, IFRIC and SIC (collectively, the “IFRSs”) endorsed by the FSC and the related amendments to

the Guidelines Governing the Preparation of Financial Reports by Securities Issuers starting January 1, 2015.

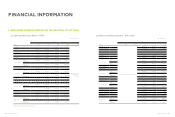

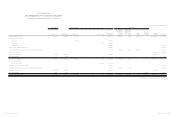

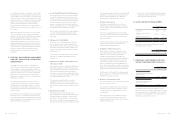

New, Amended and Revised Standards and Interpretations (the “New IFRSs”) Effective Date Announced by IASB (Note)

Improvements to IFRSs (2009) - amendment to IAS 39 January 1, 2009 and January 1, 2010, as appropriate

Amendment to IAS 39 “Embedded Derivatives”Effective for annual periods ending on or after

June 30, 2009

Improvements to IFRSs (2010) July 1, 2010 and January 1, 2011, as appropriate

Annual Improvements to IFRSs 2009-2011 Cycle January 1, 2013

Amendment to IFRS 1 “Limited Exemption from Comparative IFRS 7 Disclosures for First-

time Adopters”

July 1, 2010

Amendment to IFRS 1 “Severe Hyperinflation and Removal of Fixed Dates for First-time

Adopters”

July 1, 2011

New, Amended and Revised Standards and Interpretations (the “New IFRSs”) Effective Date Announced by IASB (Note)

Amendment to IFRS 1 “Government Loans”January 1, 2013

Amendment to IFRS 7 “Disclosure - Offsetting Financial Assets and Financial Liabilities”January 1, 2013

Amendment to IFRS 7 “Disclosure - Transfer of Financial Assets”July 1, 2011

IFRS 11 “Joint Arrangements”January 1, 2013

IFRS 12 “Disclosure of Interests in Other Entities”January 1, 2013

Amendments to IFRS 10, IFRS 11 and IFRS 12 “Consolidated Financial Statements, Joint

Arrangements and Disclosure of Interests in Other Entities: Transition Guidance”

January 1, 2013

Amendments to IFRS 10 and IFRS 12 and IAS 27 “Investment Entities”January 1, 2014

IFRS 13 “Fair Value Measurement”January 1, 2013

Amendment to IAS 1 “Presentation of Other Comprehensive Income”July 1, 2012

Amendment to IAS 12 “Deferred Tax: Recovery of Underlying Assets”January 1, 2012

IAS 19 (Revised 2011) “Employee Benefits”January 1, 2013

IAS 27 (Revised 2011) “Separate Financial Statements”January 1, 2013

IAS 28 (Revised 2011) “Investments in Associates and Joint Ventures”January 1, 2013

Amendment to IAS 32 “Offsetting Financial Assets and Financial Liabilities”January 1, 2014

IFRIC 20 “Stripping Costs in Production Phase of a Surface Mine”January 1, 2013

Note: Unless stated otherwise, the above New IFRSs are effective for annual periods beginning on or after the respective effective dates.

(Concluded)

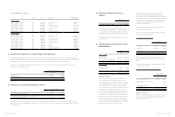

Except for the following, whenever applied, the initial application of the above 2013 IFRSs version and the related amendments to

the Guidelines Governing the Preparation of Financial Reports by Securities Issuers would not have any material impact on the

Company’s accounting policies:

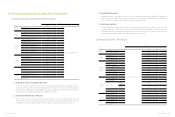

1. IFRS 13 “Fair Value Measurement”

IFRS 13 establishes a single source of guidance for fair value measurements. It defines fair value, establishes a framework for

measuring fair value, and requires disclosures about fair value measurements. The disclosure requirements in IFRS 13 are more

extensive than those required in the current standards. For example, quantitative and qualitative disclosures based on the three-

level fair value hierarchy currently required for financial instruments only will be extended by IFRS 13 to cover all assets and

liabilities within its scope.

The fair value measurements under IFRS 13 will be applied prospectively from January 1, 2015.

2. Amendment to IAS 1 “Presentation of Other Comprehensive Income”

The amendment to IAS 1 requires items of other comprehensive income to be grouped into those items that (1) will not be

reclassified subsequently to profit or loss; and (2) may be reclassified subsequently to profit or loss. Income taxes on related

items of other comprehensive income are grouped on the same basis. Under current IAS 1, there were no such requirements.

The Company will apply the above amendments in presenting the statement of comprehensive income, starting from the year

2015. Items not expected to be reclassified to profit or loss are remeasurements of the defined benefit plans and actuarial gain

(loss) arising from defined benefit plans. Items expected to be reclassified to profit or loss are the exchange differences on

translating foreign operations, unrealized gain (loss) on available-for-sale financial assets and cash flow hedges. However, the

application of the above amendments will not result in any impact on the net profit for the year, other comprehensive income for

the year (net of income tax), and total comprehensive income for the year.

(Continued)