HTC 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

170 171

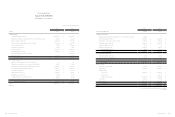

(3) Consolidated Financial Analysis - IFRS

Item

Year As of

2015.03.31

2014 2013 2012 2011 2010

Capital Structure

Analysis

Debt Ratio(%) 51 55 61

Financial analysis was based

on ROC GAAP

52

Long-term Fund to Fixed Assets Ratio(%) 343 304 309 349

Liquidity Analysis

Current Ratio(%) 132 118 108 133

Quick Ratio(%) 104 87 85 101

Debt Services Coverage Ratio(%) 118 (22) 11,347 346

Operating

Performance

Analysis

Average Collection Turnover(Times)6.41 5.83 5.27 4.87

Days Sales Outstanding 57 63 69 75

Average Inventory Turnover(Times)6.34 5.81 6.96 6.25

Average Payment Turnover(Times)3.27 2.69 2.84 2.91

Average Inventory Turnover Days 58 63 52 58

Fixed Assets Turnover(Times)8.02 7.96 11.12 1.82

Total Assets Turnover(Times)1.15 1.18 1.39 0.25

Profitability

Analysis

Return on Total Assets(%) 0.88 (0.69) 7.61 0.22

Return on Equity(%) 1.88 (1.68) 19.3 0.45

Ratio of income before tax to paid-in capital

(%) 23.75 (2.32) 228.37 6.21

Net Margin(%) 0.79 (0.65) 6.1 0.87

Basic Earnings Per Share(NT$)1.80 (1.60) 20.21 0.43

Cash Flow

Cash Flow Ratio(%) (0.41) (17.17) 18.69 (2.77)

Cash Flow Adequacy Ratio(%) 105.69 109.71 126.39 101.45

Cash Flow Reinvestment Ratio(%) (0.36) (19.78) (10.66) (2.50)

Leverage

Operating Leverage 37.00 (5.87) 2.37 259.23

Financial Leverage 1 1 1 1

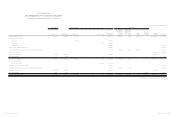

1. Capital Structure & Liquidity Analyses

As of year-end 2014, our debt ratio stood at 51%, slightly lower than the 2013 level and current and quick ratios were

both lower at 132% and 104%, respectively. This was because the weight of decrease in current and quick ratio for

2014 was lower than that in current liabilities. The long-term funds to fixed asset ratio for 2014 increased to 343%

compared to 2013 due to profiting from loss with increased equity.

2. Operating Performance Analysis

Compared to the previous year, total asset turnover decreased because of a decrease in operating income. As no fixed

asset of a large amount was purchased for this year and continued to recognized depreciation, the decrease in total

amount of fixed asset caused the increase in fixed asset turnover compared to the previous year. Collection turnover

increased compared to the previous year due to normal receipt of account receivables and extent of decrease in

account receivables amount more than that in operating income. Moreover, operating cost decreased in response to

decrease in operating income. Given the extent of decrease in inventory and account payable that is larger than that

in operating cost, both the turnover of inventory and payable rose compared to the previous year.

3. Profitability Analysis

Though experiencing decrease in revenue for 2014 due to competition in international markets, HTC managed to

profit in 2014 from loss with effective control on operating costs and savings on operating expenses. Profitability ratio

rose compared to the previous year with $1.80 for basic earnings per share.

4. Cash Flow Analysis

In 2014, HTC managed to profit from loss with a good inventory management and end-term receipt of cash for its

account receivables. Net cash flow from operating activities outflow decreased while both cash flow ratio and cash

reinvestment ratio turned positive. Cash flow adequacy ratio decreased to 105.69% compared to 2013 because of

decrease in cash flow in 2014 from the operating activities for the last five years.

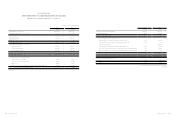

(4) Consolidated Financial Analysis – ROC GAAP

Item (Note 1)

Year

2014 2013 2012 2011 2010

Capital

Structure

Analysis

Debt Ratio(%)

Financial analysis was based on IFRS

61 60 61

Long-term Fund to Fixed Assets Ratio(%) 313 476 533

Liquidity

Analysis

Current Ratio(%) 111 126 146

Quick Ratio(%) 85 102 120

Debt Services Coverage Ratio(%) 11,342 2,307 12,624

Operating

Performance

Analysis

Average Collection Turnover(Times)5.27 7.23 6.14

Days Sales Outstanding 69 50 59

Average Inventory Turnover(Times)6.96 10.55 10.06

Average Payment Turnover(Times)2.79 4.66 4.35

Average Inventory Turnover Days 52 35 36

Fixed Assets Turnover(Times)11.27 21.65 19.88

Total Assets Turnover(Times)1.40 1.82 1.46

Profitability

Analysis

Return on Total Assets(%) 8 28 26

Return on Equity(%) 19 70 56

Paid-in Capital Ratio(%)

Operating

Income 221 807 540

Pre-tax

Income 228 838 550

Net Margin(%) 6 13 14

Basic Earnings Per Share(NT$)20.17 73.32 46.18

Cash Flow

Cash Flow Ratio(%) 18 58 40

Cash Flow Adequacy Ratio(%) 126 158 150

Cash Flow Reinvestment Ratio(%) (11) 53 32

Leverage

Operating Leverage 2.37 1.35 1.43

Financial Leverage 1 1 1

Note 1: Glossary

a. Financial Structure

(1) Debt Ratio =Total Liabilities / Total Assets.

(2) Ratio of Long-Term Capital To Property, Plant And Equipment =

(Total Equity + Non-Current Liabilities) / Net Worth of Property,

Plant And Equipment

b. Solvency

(1) Current Ratio =Current Assets / Current Liabilities.

(2) Quick Ratio =(Current Assets - Inventories - Prepaid Expenses) /

Current Liabilities.

(3) Interest Coverage Ratio = Income before Income Tax And Interest

Expenses / Current Interest Expenses

c. Operating ability

(1) Receivables (including accounts receivable and notes receivable

arising from business oeprations) turnover rate = net sales / average

receivables (including accounts receivable and notes receivable

arising from business operations) for each period

(2) Days Sales Outstanding =365 / Average Collection Turnover.

(3) Average Inventory Turnover =Cost of Sales / Average Inventory.

(4) Payables (Including Accounts Payable and Notes Payable Arising

from Business Operations) Turnover Rate = Cost of Sale / Average

Payables (Including Accounts Payable and Notes Payable Arising

from Business Operations) For Each Period

(5) Average Inventory Turnover Days =365 / Average Inventory Turnover.

(6) Property, Plant and Equipment Turnover Rate = Net Sales / Average Net Worth of

Property, Plant and Equipment

(7) Total Asset Turnover Rate = Net Sales / Average Total Assets

d. Profitability

(1) Return on Total Assets =(Net Income + Interest Expenses * (1 - Effective Tax Rate)

) / Average Total Assets.

(2) Return on Equity =Net Income / Average Total Equity.

(3) Profit Margin before Tax = Net Income / Net Sales

(4) Earnings per Share = (Profit And Loss Attributable to Owners of the Parent –

Dividends on Preferred Shares) / Weighted Average Number of Issued Shares

e. Cash Flow

(1) Cash Flow Ratio =Net Cash Provided by Operating Activities / Current Liabilities.

(2) Net Cash Flow Adequacy Ratio = Net Cash Flow from Operating Activities for

the Most Recent Five Years / (Capital Expenditures + Inventory Increase + Cash

Dividend) Additions, and Cash Dividend.

(3) Cash Flow Reinvestment Ratio = (Net Cash Flow from Operating Activities – Cash

Dividend) / Gross Property, Plant and Equipment Value + Long-Term Investment +

Other Non-Current Assets + Working Capital)

f. Leverage

(1) Operating Leverage = (Net Operating Revenue – Variable Operating Costs and

Expenses) / Operating Income

(2) Financial Leverage = Operating Income / (Operating Income / Interest Expenses)