HTC 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

210 211

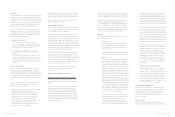

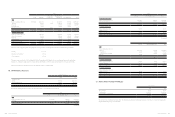

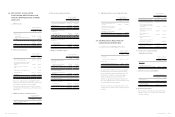

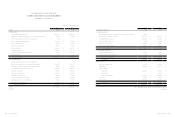

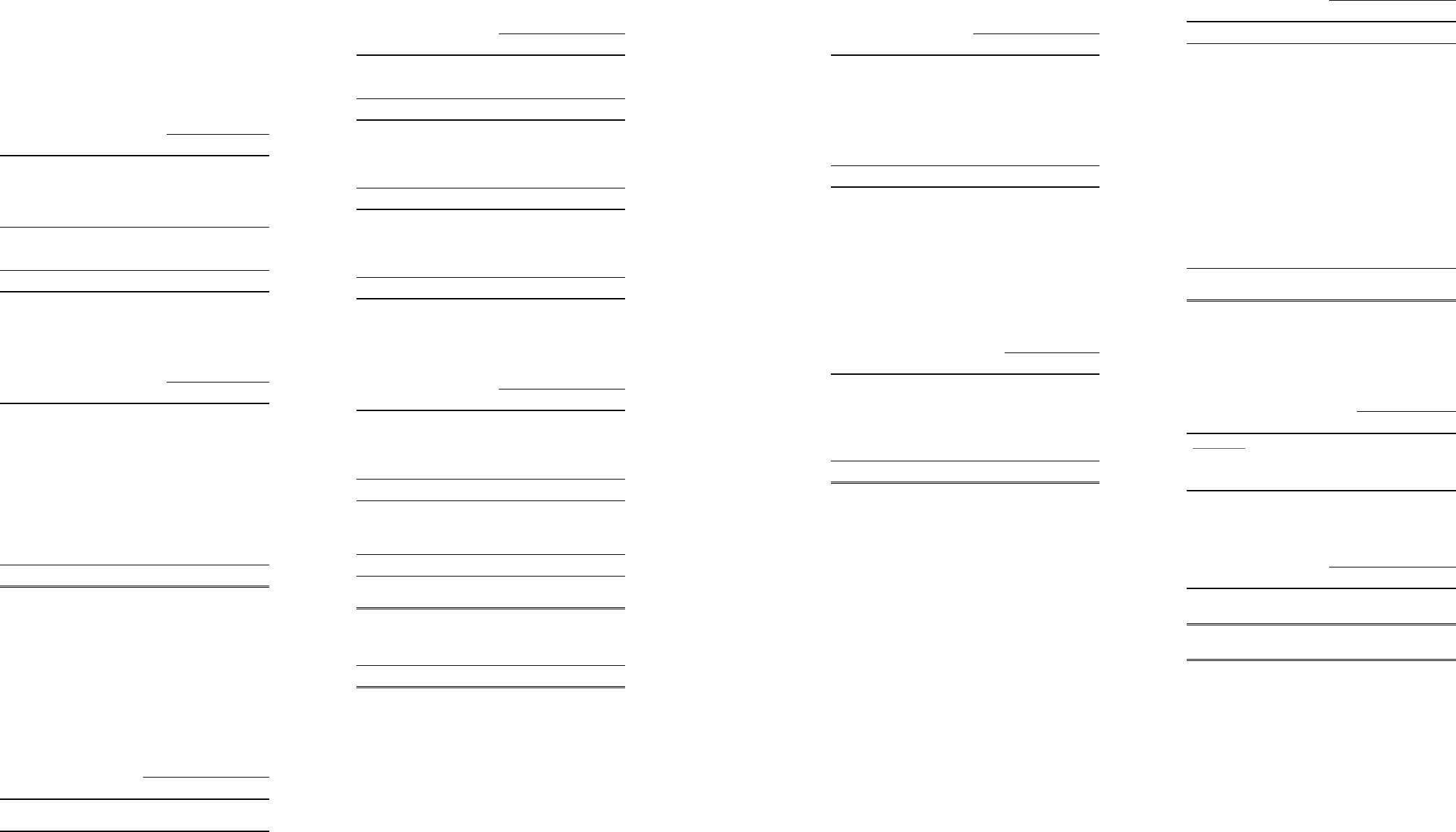

23. NET PROFIT (LOSS) FROM

CONTINUING OPERATIONS AND

OTHER COMPREHENSIVE INCOME

AND LOSS

a. Other income

For the Year Ended

December 31

2014 2013

Interest income

Cash in bank

Held-to-maturity financial assets

Loan

$214,092

-

-

$214,746

794

211,139

214,092 426,679

Others 178,669 248,980

$392,761 $675,659

b. Other gains and losses

For the Year Ended

December 31

2014 2013

Net foreign exchange gains $50,904 $482,568

Net gains arising on financial assets

and liabilities classified as held for

trading

240,120

162,297

Ineffective portion of cash flow

hedge

1,939

151,305

Gain on disposal of intangible assets - 110,602

Impairment losses (174,253) (111,085)

Other losses (32,901) (37,678)

$85,809 $758,009

Gain or loss on financial assets and liabilities held for

trading was derived from forward exchange transactions.

The Company entered into forward exchange

transactions to manage exposures related to exchange

rate fluctuations of foreign currency denominated assets

and liabilities.

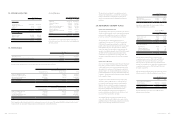

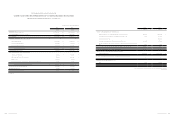

c. Impairment losses on financial assets

For the Year Ended

December 31

2014 2013

Trade receivables (included in

operating expense)

$-

$991,821

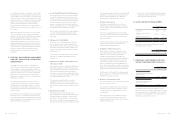

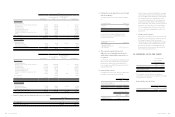

d. Depreciation and amortization

For the Year Ended

December 31

2014 2013

Property, plant and equipment $1,774,782 $1,602,946

Intangible assets 649,887 651,632

$2,424,669 $2,254,578

Classification of depreciation -

by function

Cost of revenues

Operating expenses

$967,355

807,427

$873,928

729,018

$1,774,782 $1,602,946

Classification of amortization -

by function

Cost of revenues

Operating expenses

$-

649,887

$-

651,632

$649,887 $651,632

e. Employee benefits expense

For the Year Ended

December 31

2014 2013

Post-employment benefits

(Note 20)

Defined contribution plans

Defined benefit plans

$381,930

6,595

$428,469

1,128

388,525 429,597

Share-based payments

Equity-settled share-based

payments

244,346

23,443

Other employee benefits 10,493,645 10,529,260

Total employee benefits

expense

$11,126,516

$10,982,300

Classification - by function

Cost of revenues

Operating expenses

$4,413,610

6,712,906

$5,625,526

5,356,774

$11,126,516 $10,982,300

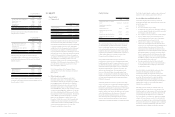

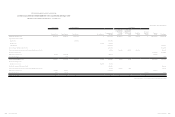

f. Impairment losses on non-financial assets

For the Year Ended

December 31

2014 2013

Inventories (included in cost of

revenues)

$557,580

$439,139

Investments accounted for by

the equity method (included in

other gains and losses)

174,253

-

Intangible assets (including in

other gains and losses)

-

111,085

$731,833 $550,224

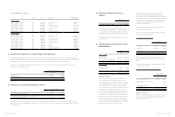

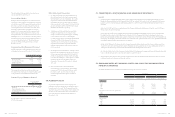

24. INCOME TAXES RELATING TO

CONTINUING OPERATIONS

a. Income tax recognized in profit or loss

For the Year Ended

December 31

2014 2013

Current tax

In respect of the current period $44,578 $3,525

Deferred tax

In respect of the current period 3,591 35,053

Income tax recognized in profit or loss $48,169 $38,578

On April 9, 2014, the Ministry of Finance promulgated

the amendments to the Assessment Rules Governing

Income Tax Returns of Profit-Seeking Enterprises, the

Tax Ruling No. 10304540780, and the amendments

apply to the filing of income tax returns for 2013

onwards. The applications of such amendments were

not to have significant effect on current and deferred tax

assets and liabilities for the Company.

The income tax for the years ended December 31, 2014

and 2013 can be reconciled to the accounting profit (loss)

as follows:

For the Year Ended

December 31

2014 2013

Profit (loss) before income tax $1,531,215 $(1,285,207)

Income tax calculated at 17% 260,306 -

Effect of expenses that were

not deductible in determining

taxable profit

54,623

29,858

Share of the profit or loss of

subsidiaries, associates and

joint ventures

(99,899)

182,898

Effect of temporary

differences

(211,439)

(177,703)

Effect of investment tax

credits

-

(1,126,249)

Additional 10% income tax on

unappropriated earnings

-

1,126,249

Overseas income tax 44,578 3,525

Income tax recognized in

profit or loss

$48,169

$38,578

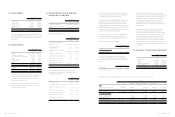

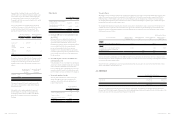

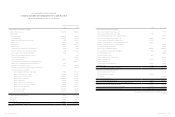

b. Income tax recognized in other

comprehensive income

For the Year Ended

December 31

2014 2013

Deferred tax

Recognized in current year

Actuarial gain and loss (tax benefit)

$(3,980)

$(1,771)

c. Current tax assets and liabilities

December 31

2014 2013

Current tax assets

Tax refund receivable

$45,994

$24,192

Current tax liabilities

Income tax payable

$11,982

$303

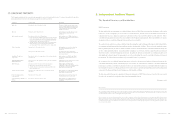

d. Deferred tax balances

The movements of deferred tax assets and deferred tax

liabilities for the years ended December 31, 2014 and

2013 were as follows: