HTC 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

252 253

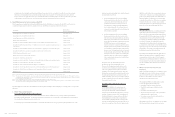

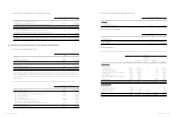

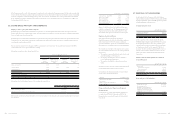

Management believed that the above unlisted equity

investments and mutual funds held by the Company, whose

fair value cannot be reliably measured due to the range of

reasonable fair value estimates was so significant; therefore,

they were measured at cost less impairment at the end of

reporting period.

The Company disposed of the investments in Primavera

Capital (Cayman) Fund L.L.P. and Shanghai F-road

Commercial Co., Ltd. in May 2014. Furthermore, the

Company made a partial disposal of shares of KKBOX Inc. in

August 2014. These transactions resulted in the recognition of

a gain in profit or loss, calculated as follows:

Proceeds of disposal $ 2,358,135

Less: Carrying amount of investment

on the date of disposal (2,200,140)

Gain recognized $ 157,995

In 2014, the Company determined that the recoverable

amount of financial assets measured at cost was less than its

carrying amount and thus recognized an impairment loss of

$373,257 thousand.

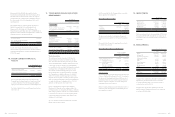

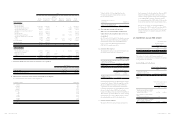

10. OTHER CURRENT FINANCIAL

ASSETS

December 31

2014 2013

Time deposits with original

maturities more than three months $ 334,954 $ 411,982

Trust assets for employee benefit - 2,359,041

$ 334,954 $ 2,771,023

To protect the rights and interests of its employees, the

Company deposited unpaid employee bonus in a new trust

account in September 2012. The Company had paid the

employee bonus and close the trust account in August 2014.

For details of pledged other current financial assets, please

refer to Note 31.

As of the reporting date, the Company had no receivables

that are past due but not impaired.

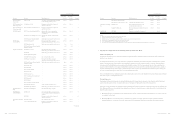

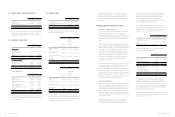

Age of impaired trade receivables

December 31

2014 2013

1-90 days

91-180 days

Over 181 days

$ 2,946,423

-

-

$ 3,714,226

1,468,049

803,422

$ 2,946,423 $ 5,985,697

The above was shown after deducting the allowance for

impairment loss and analyzed on the basis of the past due

date.

Movement in the allowance for impairment loss on trade

receivables were as follow:

Movement in the allowances for impairment loss

For the Year Ended

December 31

2014 2013

Balance, beginning of the year

Add: Impairment losses

recognized on receivables

Less: Amounts written off as

uncollectible

Disposal of subsidiary

Translation adjustment

$ 3,050,907

3,875

-

-

-

$ 2,086,085

1,010,405

(13,943)

(32,453)

813

Balance, end of the year $ 3,054,782 $ 3,050,907

Other Receivables

Receivable from disposal of investments is derived from sale

of shares of Saffron Media Group Ltd. in 2013. According to

the agreement, the principle and interest will be received

in full in September 2018 and could be repaid by the buyer

in whole or in part, at any time. For details of disposal of

subsidiaries, please refer to Note 27.

Others were primarily prepayments on behalf of vendors or

customers, grants from suppliers and withholding income

tax of employees’ bonuses.

11. TRADE RECEIVABLES AND OTHER

RECEIVABLES

December 31

2014 2013

Trade receivables

Trade receivables

Trade receivables - related parties

Less: Allowances for impairment

loss

$ 32,194,141

925

(3,054,782)

$ 26,420,770

1,309

(3,050,907)

$ 29,140,284 $ 23,371,172

Other receivables

Receivables from disposal of

investments

VAT refund receivables

Interest receivables

Others

$ 1,251,073

246,900

102,771

327,005

$ 1,182,393

355,442

10,878

1,771,333

$ 1,927,749 $ 3,320,046

Current - other receivables $ 584,936 $ 2,137,653

Non-current - other receivables 1,342,813 1,182,393

$ 1,927,749 $ 3,320,046

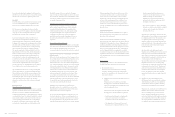

Trade Receivables

The credit period on sales of goods is 30-75 days. No

interest is charged on trade receivables before the due

date. Thereafter, interest is charged at 1-18% per annum

on the outstanding balance, which is considered to be non-

controversial, to some of customers. In determining the

recoverability of a trade receivable, the Company considered

any change in the credit quality of the trade receivable

since the date credit was initially granted to the end of

the reporting period. For customers with low credit risk,

the Company has recognized an allowance for doubtful

debts of 1-5% against receivables past due beyond 31-90

days and of 5-100% against receivables past due beyond 91

days. For customers with high credit risk, the Company has

recognized an allowance for impairment loss of 10-100%

against receivables past due more than 31 days.

Before accepting any new customer, the Company’s

Department of Financial and Accounting evaluates the

potential customer’s credit quality and defines credit limits

and scorings by customer. The factor of overdue attributed

to customers are reviewed once a week and the Company

evaluates the financial performance periodically for the

adjustment of credit limits.

The concentration of credit risk is limited due to the fact

that the customer base is diverse.

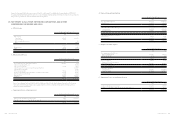

12. INVENTORIES

December 31

2014 2013

Finished goods

Work-in-process

Semi-finished goods

Raw materials

Inventory in transit

$ 2,925,203

686,398

3,692,029

9,491,854

417,576

$ 3,487,921

521,423

8,244,216

11,074,773

271,225

$ 17,213,060 $ 23,599,558

The losses on inventories decline amounting to NT$521,692

thousand and NT$417,166 thousand were recognized as cost

of revenues for the years ended December 31, 2014 and 2013,

respectively.

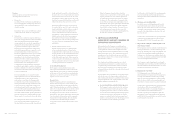

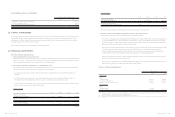

13. PREPAYMENTS

December 31

2014 2013

Royalty

Net input VAT

Prepayments to suppliers

Software and hardware

maintenance

Service

Prepaid equipment

Land use right

Molding expenses

Others

$ 12,068,674

1,848,355

1,577,566

205,415

203,186

168,983

139,502

29,151

303,121

$ 12,007,756

1,918,462

2,492,197

139,958

113,661

194,200

138,376

304,411

234,123

$ 16,543,953 $ 17,543,144

Current

Non-current

$ 6,626,106

9,917,847

$ 5,803,744

11,739,400

$ 16,543,953 $ 17,543,144

Prepayments for royalty were primarily for getting royalty

right and were classified as current or non-current in

accordance with their nature. For details of content of

contracts, please refer to Note 34.

Prepayments to suppliers were primarily for discount

purposes and were classified as current or non-current in

accordance with their nature.