HTC 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

260 261

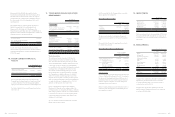

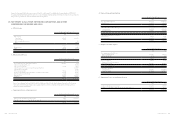

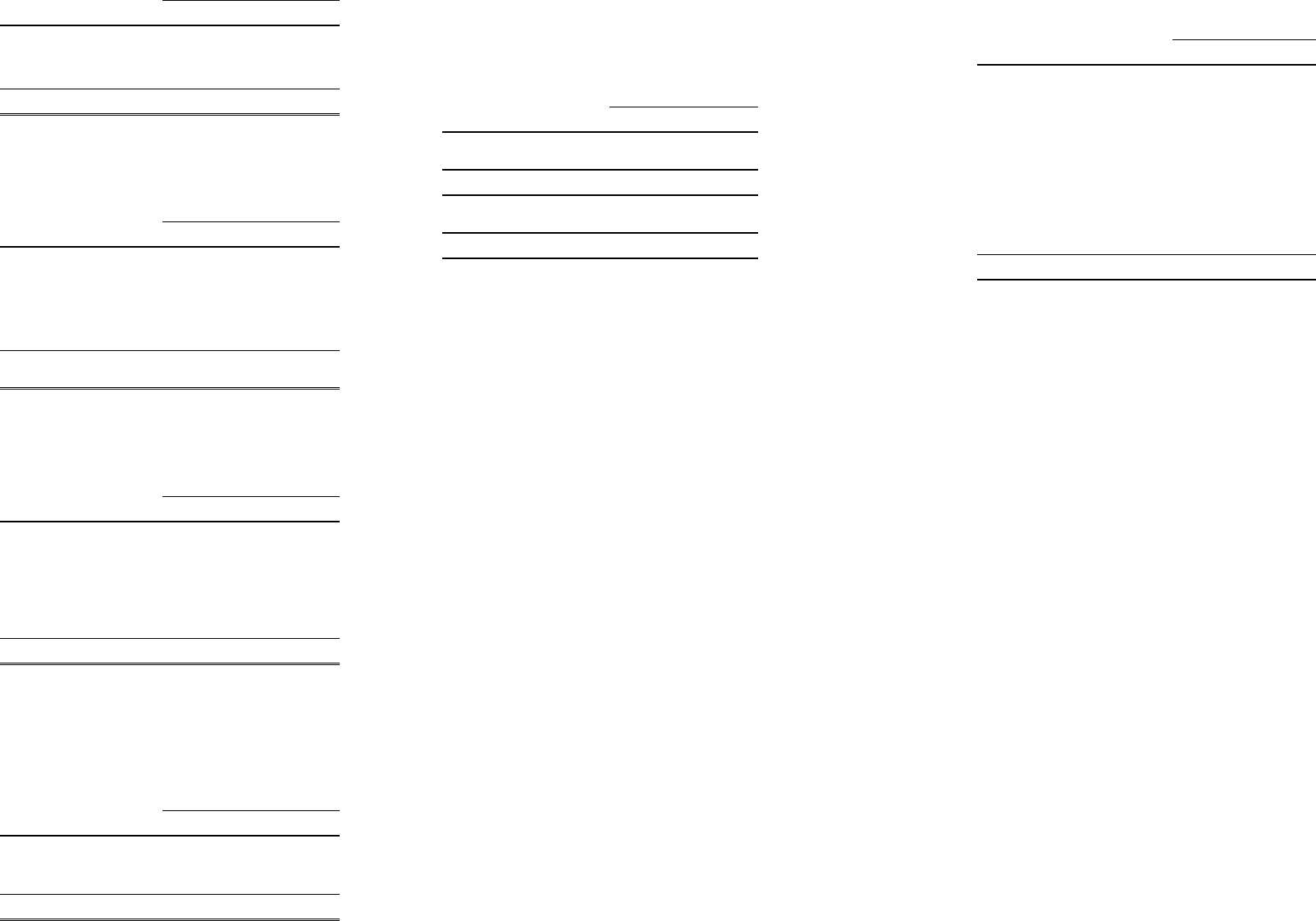

December 31

2014 2013

Present value of funded

defined benefit obligation $(443,642) $ (413,220)

Fair value of plan assets 552,780 538,935

Defined benefit assets $ 109,138 $ 125,715

Movements in the present value of the defined benefit

obligations were as follows:

For the Year Ended December 31

2014 2013

Opening defined benefit

obligation

Current service cost

Interest cost

Actuarial losses

Benefits paid

$ 413,220

9,864

7,744

34,762

(21,948)

$ 394,681

4,599

6,408

13,851

(6,319)

Closing defined benefit

obligation $ 443,642 $ 413,220

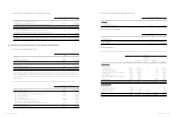

Movements in the present value of the plan assets in the

current year were as follows:

For the Year Ended December 31

2014 2013

Opening fair value of plan

assets

Expected return on plan assets

Actuarial losses

Contributions from the

employer

Benefits paid

$ 538,935

11,017

1,416

23,360

(21,948)

$ 513,954

9,885

(3,255)

24,670

(6,319)

Closing fair value of plan assets $ 552,780 $ 538,935

The major categories of plan assets at the end of the

reporting period for each category were disclosed based

on the information announced by Bureau of Labor Funds,

Ministry of Labor:

December 31

2014 2013

Equity instruments

Debt instruments

Others

49.69%

47.48%

2.83%

44.77%

54.44%

0.79%

100.00% 100.00%

The Company expects to make a contribution of NT$23,797

thousand to the defined benefit pension plan within one year

from December 31, 2014.

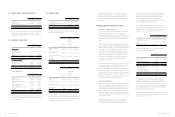

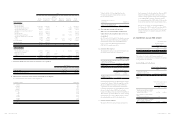

21. EQUITY

Share Capital

a. Common stock

December 31

2014 2013

Authorized shares (in thousands

of shares) 1,000,000 1,000,000

Authorized capital $ 10,000,000 $ 10,000,000

Issued and fully paid shares

(in thousands of shares) 834,952 842,351

Issued capital $ 8,349,521 $ 8,423,505

In September and November 2013, the Company retired

1,912 thousand treasury shares amounting to NT$19,126

thousand and 7,789 thousand treasury shares amounting

to NT$77,890 thousand, respectively. Also, in February

and October 2014, the Company retired 1,999 thousand

treasury shares amounting to NT$19,984 thousand

and 10,000 thousand treasury shares amounting to

NT$100,000 thousand, respectively. In November 2014,

the Company issued 4,600 thousand restricted shares

for employees amounting to NT$46,000 thousand. As

a result, the amount of the Company’s outstanding

common stock as of December 31, 2014 decreased to

NT$8,349,521 thousand, divided into 834,952 thousand

common shares at NT$10 par value. Every common

stock carries one vote per share and a right to dividends.

50,000 thousand shares of the Company’s shares

authorized were reserved for the issuance of employee

share options.

b. Global depositary receipts

In November 2003, HTC issued 14,400 thousand

common shares corresponding to 3,600 thousand

units of Global Depositary Receipts (“GDRs”). For

this GDR issuance, HTC’s stockholders, including

Via Technologies, Inc., also issued 12,878.4 thousand

common shares, corresponding to 3,219.6 thousand

GDR units. Thus, the entire offering consisted of 6,819.6

thousand GDR units. Taking into account the effect of

stock dividends, the GDRs increased to 8,782.1 thousand

units (36,060.5 thousand shares). The holders of these

GDRs requested HTC to redeem the GDRs to get HTC’s

common shares. As of December 31, 2014, there were

8,328.6 thousand units of GDRs redeemed, representing

33,314.3 thousand common shares, and the outstanding

GDRs represented 2,746.2 thousand common shares or

0.33% of HTC’s outstanding common shares.

Capital Surplus

December 31

2014 2013

Arising from issuance of common

shares $ 14,432,437 $ 14,640,983

Arising from treasury share

transactions - 631,791

Arising from merger 23,801 24,145

Arising from employee share options 250,470 26,742

Arising from expired stock options 36,124 36,646

Arising from employee restricted

shares 397,855 -

$ 15,140,687 $ 15,360,307

The capital surplus arising from shares issued in excess of

par (including share premium from issuance of common

shares, treasury share transactions, merger and expired

stock options) and donations may be used to offset a deficit;

in addition, when the Company has no deficit, such capital

surplus may be distributed as cash dividends or transferred

to share capital (limited to a certain percentage of the

Company’s capital surplus and once a year).

In September and November 2013, the retirement of

treasury shares caused decreases of NT$168,625 thousand

in additional paid-in capital - issuance of shares in excess of

par, NT$9,727 thousand in capital surplus - treasury shares,

NT$278 thousand in capital surplus - merger and NT$422

thousand in capital surplus - expired stock options. The

difference the carrying value of treasury shares retired

in excess of the sum of its par value and premium from

issuance of common share was firstly offset against capital

surplus - treasury shares by NT$1,088,940 thousand, and the

rest offset against unappropriated earnings amounting to

NT$814,170 thousand.

In February and October 2014, the retirement of treasury

shares caused decreases of NT$208,546 thousand in

additional paid-in capital - issuance of shares in excess of

par, NT$1,499 thousand in capital surplus - treasury shares,

NT$344 thousand in capital surplus - merger and NT$522

thousand in capital surplus - expired stock options. The

difference the carrying value of treasury shares retired

in excess of the sum of its par value and premium from

issuance of common share was firstly offset against capital

surplus - treasury shares by NT$630,292 thousand, and the

rest offset against unappropriated earnings amounting to

NT$8,208,915 thousand.

For details of capital surplus - employee share options and

employee restricted shares, please refer to Note26.

Retained Earnings and Dividend Policy

Under HTC’s Articles of Incorporation, HTC should make

appropriations from its net income in the following order:

a. To pay taxes.

b. To cover accumulated losses, if any.

c. To appropriate 10% legal reserve unless the total legal

reserve accumulated has already reached the amount of

HTC’s authorized capital.

d. To recognize or reverse special reserve return earnings.

e. To pay remuneration to directors and supervisors

at 0.3% maximum of the balance after deducting the

amounts under the above items (a) to (d).

f. To pay bonus to employees at 5% minimum of the

balance after deducting the amounts under the above

items (a) to (d), or such balance plus the unappropriated

retained earnings of previous years. However, the

bonus may not exceed the limits on employee bonus

distributions as set out in the Regulations Governing the

Offering and Issuance of Securities by Issuers. Where

bonus to employees is allocated by means of new share

issuance, the employees to receive bonus may include

the affiliates’ employees who meet specific requirements

prescribed by the board of directors.

g. For any remainder, the board of directors should

propose allocation ratios based on the dividend policy

set forth in HTC’s Articles and propose them at the

stockholders’ meeting.

As part of a high-technology industry and as a growing

enterprise, HTC considers its operating environment,

industry developments, and long-term interests of

stockholders as well as its programs to maintain operating

efficiency and meet its capital expenditure budget and

financial goals in determining the stock or cash dividends to

be paid. HTC’s dividend policy stipulates that at least 50% of

total dividends may be distributed as cash dividends.

The employee bonus for the year ended December 31,

2014 should be appropriated at 5% of net income before

deducting employee bonus expenses. If the actual amounts

subsequently resolved by the stockholders differ from the

proposed amounts, the differences are recorded in the

year of stockholders’ resolution as a change in accounting

estimate. If bonus shares are resolved to be distributed to

employees, the number of shares is determined by dividing

the amount of bonus by the closing price (after considering

the effect of cash and stock dividends) of the shares of the

day immediately preceding the stockholders’ meeting.