HTC 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

276 277

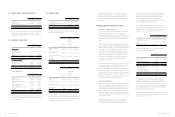

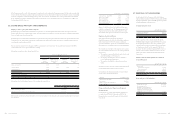

30. RELATED-PARTY TRANSACTIONS

Balance transactions, revenue and expenses between HTC

and its subsidiaries, which are related parties of HTC, have

been eliminated on consolidation and are not disclosed

in this note. Except disclosed in other notes, details of

transactions between the Company and other related parties

are disclosed below.

Operating Sales

For the Year Ended

December 31

2014 2013

Main management $ 2,430 $ 2,002

Other related parties - Employees’

Welfare Committee 22,404 23,454

Other related parties - other related

parties’ chairperson or its significant

stockholder, is HTC’s chairperson 10,463 12,439

$ 35,297 $ 37,895

The following balances of trade receivables from related

parties were outstanding at the end of the reporting period:

December 31

2014 2013

Other related parties - other related

parties’ chairperson or its significant

stockholder, is HTC’s chairperson $ 925 $ 1,309

The selling prices for products sold to related parties

were lower than those sold to third parties, except some

related parties have no comparison with those sold to third

parties. No guarantees had been given or received for trade

receivables from related parties. No bad debt expense had

been recognized for the years ended December 31, 2014 and

2013 for the amounts owed by related parties.

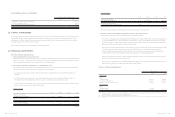

Purchase

For the Year Ended

December 31

2014 2013

Other related parties - other related

parties’ chairperson or its significant

stockholder, is HTC’s chairperson $ 4,454 $ 62,030

The following balances of trade payables from related parties

were outstanding at the end of the reporting period:

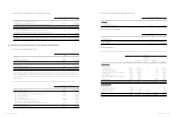

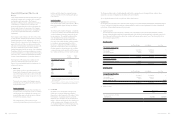

Other Related-party Transactions

a. To enhance product diversity, the Company entered

into a trademark and technology license agreement

with associate. The royalty expense was NT$219,026

thousand for the year ended December 31, 2013.

b. Other related parties provide business consulting

service to the Company. The business consulting service

fees were NT$1,400 thousand and NT$2,748 thousand

for the years ended December 31, 2014 and 2013,

respectively.

c. The Company leased staff dormitory owned by a related

party under an operating lease agreement. The term of

the lease agreement is from April 2012 to March 2015

and the rental payment is determined at the prevailing

rates in the surrounding area. The Company recognized

and paid rental expenses amounting to NT$5,209

thousand for the years ended December 31, 2014 and

2013, each.

d. Other related parties provided marketing and

advertising services to the Company. The marketing

expense was NT$16,150 thousand for the year ended

December 31, 2014. As of December 31, 2014, the

amount of unpaid marketing expense was NT$158

thousand.

e. In October, 2013, the Company sold back all of shares

in Beats Electronics, LLC to Beats Electronics, LLC

for US$265,000 thousand. This transaction resulted

in the recognition of a gain on disposal amounting to

NT$2,637,673 thousand. For the related information,

please refer to Note 14.

31. PLEDGED ASSETS

To protect the rights and interests of its employees, In

September 2012, the Company deposited unpaid employee

bonus in a new trust account. The Company had paid the

employee bonus and closed the trust account in August 2014.

The trust account, which is under other current financial

assets, had amounted to NT$2,359,041 thousand as of

December 31, 2013.

As of December 31, 2014 and 2013 the Company had provided

time deposits of NT$664 thousand and NT$1,090 thousand

had been classified as other current financial assets,

respectively, as collateral for rental deposits.

December 31

2014 2013

Other related parties - other related

parties’ chairperson or its significant

stockholder, is HTC’s chairperson $ - $ 8,303

Purchase prices for related parties and third parties were

similar. The outstanding of trade payables to related parties

are unsecured and will be settled in cash.

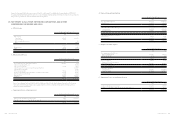

Loans to Related Parties

On July 19, 2012, the Company’s board of directors passed

a resolution to offer US$225,000 thousand short-term loan

to Beats Electronics, LLC to support the transition of Beats

Electronics, LLC into a product company. This loan was

secured by all the assets of Beats Electronics, LLC. Term

loan must be repaid in full no later than one year from

signing date of loan agreement and the repayment can be

made in full at any time during the term of the loan or at

the repayment date. The calculation of interest is based on

LIBOR plus 1.5%, 3.5%, 5.5% and 7.5% for the first quarter to

the fourth quarter, respectively. The principal and interest

were received in full in June 2013. The interest income

amounted to NT$211,139 thousand for the year ended

December 31, 2013.

Compensation of Key Management Personnel

For the Year Ended

December 31

2014 2013

Short-term benefits

Post-employment benefits

Termination benefits

Share-based payments

$ 528,353

2,381

-

60,921

$ 577,638

2,979

165

5,634

$ 591,655 $ 586,416

The remuneration of directors and key executives was

determined by the remuneration committee having regard

to the performance of individuals and market trends.

Property, Plant and Equipment Acquired

For the Year Ended

December 31

2014 2013

Other related parties - other related

parties’ chairperson or its significant

stockholder, is HTC’s chairperson $ - $ 3,238

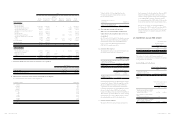

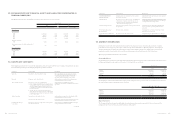

32. COMMITMENTS, CONTINGENCIES

AND SIGNIFICANT CONTRACTS

Lawsuit

a. In April 2008, IPCom GMBH & CO., KG (“IPCom”)

filed a multi-claim lawsuit against the Company with

the District Court of Mannheim, Germany, alleging that

the Company infringed IPCom’s patents. In November

2008, the Company filed declaratory judgment action

for non-infringement and invalidity against three of

IPCom’s patents with the Washington Court, District of

Columbia.

In October 2010, IPCom filed a new complaint against

the Company alleging patent infringement of patent

owned by IPCom in District Court of Dusseldorf,

Germany.

In June 2011, IPCom filed a new complaint against

the Company alleging patent infringement of patent

owned by IPCom with the High Court in London, the

United Kingdom. In September 2011, the Company filed

declaratory judgment action for non-infringement and

invalidity in Milan, Italy. Legal proceedings in above-

mentioned courts in Germany and the United Kingdom

are still ongoing. The Company evaluated the lawsuits

and considered the risk of patents-in-suits are low. Also,

preliminary injunction and summary judgment against

the Company are very unlikely.

In March 2012, Washington Court granted on the

Company’s summary judgment motion and ruled on

non-infringement of two of patents-in-suit. As for the

third patents-in-suit, the Washington Court has granted

a stay on case pending appeal decision. In January 2014,

the Court of Appeal for the Federal Circuit affirmed the

Washington Court’s decision.

As of the date that the board of directors approved and

authorized for issuing consolidated financial statements,

there had been no critical hearing nor had a court

decision been made, except for the above.

b. On the basis of its past experience and consultations

with its legal counsel, the Company has measured

the possible effects of the contingent lawsuits on its

business and financial condition.