HTC 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

236 237

reporting period presented or retrospectively with the

cumulative effect of initially applying this Standard

recognized at the date of initial application.

Except for the above impact, as of the date the

consolidated financial statements were authorized

for issue, the Company is continuingly assessing the

possible impact that the application of other standards

and interpretations will have on the Company’s financial

position and financial performance, and will disclose the

relevant impact when the assessment is complete.

4. SIGNIFICANT ACCOUNTING POLICIES

Statement of Compliance

The consolidated financial statements have been prepared in

accordance with the Regulations Governing the Preparation

of Financial Reports by Securities Issuers, or other regulations

and IFRSs as endorsed by the FSC.

Basis of Preparation

The consolidated financial statements have been prepared on

the historical cost basis except for financial instruments that

are measured at fair value. Historical cost is generally based

on the fair value of the consideration given in exchange for

assets.

For readers’ convenience, the accompanying consolidated

financial statements have been translated into English

from the original Chinese version prepared and used in the

Republic of China. If inconsistencies arise between the

English version and the Chinese version or if differences arise

in the interpretations between the two versions, the Chinese

version of the consolidated financial statements shall prevail.

However, the accompanying consolidated financial statements

do not include the English translation of the additional

footnote disclosures that are not required under accounting

principles and practices generally applied in the Republic of

China but are required by the Securities and Futures Bureau

for their oversight purposes.

Classification of Current and Non-current Assets

and Liabilities

Current assets include:

a. Those assets held primarily for trading purposes;

b. Those assets to be realized within twelve months;

c. Cash and cash equivalents from the balance sheet date

unless the asset is to be used for an exchange or to settle

a liability, or otherwise remains restricted, at more than

twelve months after the balance sheet date.

Current liabilities are:

a. Obligations incurred for trading purposes;

b. Obligations to be settled within twelve months after the

reporting period, even if an agreement to refinance, or to

reschedule payments, on a long-term basis is completed

after the reporting period and before the consolidated

financial statements are authorized for issue; and

c. An unconditional right to defer settlement of the liability

for at least twelve months after the reporting period.

Terms of a liability that could, at the option of the

counterparty, result in its settlement by the issue of equity

instruments do not affect its classification.

Aforementioned assets and liabilities that are not classified as

current are classified as non-current.

Basis of Consolidation

a. Principles for preparing consolidated financial

statements

The consolidated financial statements incorporate

the financial statements of the HTC and the entities

controlled by the HTC (its subsidiaries).

Income and expenses of subsidiaries acquired or disposed

of during the period are included in the consolidated

statement of profit or loss and other comprehensive

income from the effective date of acquisition up to the

effective date of disposal, as appropriate.

When necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting

policies into line with those used by the Company.

All intra-group transactions, balances, income and

expenses are eliminated in full upon consolidation.

Changes in the Company’s ownership interests in existing

subsidiaries

Changes in the Company’s ownership interests in

subsidiaries that do not result in the Company losing

control over the subsidiaries are accounted for as equity

transactions. The carrying amounts of the Company’s

interests and the non-controlling interests are adjusted

to reflect the changes in their relative interests in the

subsidiaries. Any difference between the amount by

which the non-controlling interests are adjusted and

the fair value of the consideration paid or received is

recognized directly in equity and attributed to owners of

the parent.

When the Company loses control of a subsidiary, a gain

or loss is recognized in profit or loss and is calculated as

the difference between (i) the aggregate of the fair value of the consideration received and any investment retained in the former

subsidiary at its fair value at the date when control is lost and (ii) the assets (including any goodwill), and liabilities of the former

subsidiary and any non-controlling interests at their carrying amounts at the date when control is lost. If the Company loses control

of a subsidiary, the Company accounts for all amounts recognized in other comprehensive income in relation to that subsidiary on

the same basis as would be required if the Company had directly disposed of the related assets or liabilities.

The fair value of any investment retained in the former subsidiary at the date when control is lost is regarded as the fair value on

initial recognition for subsequent accounting under IAS 39 “Financial Instruments: Recognition and Measurement” or, when

applicable, the cost on initial recognition of an investment in an associate or a jointly controlled entity.

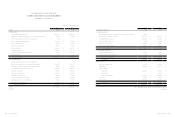

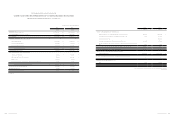

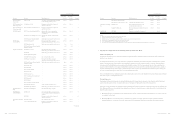

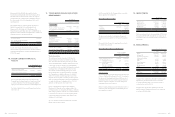

b. Subsidiary included in consolidated financial statements

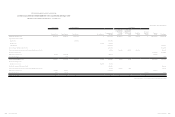

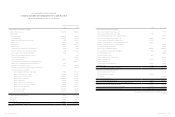

The consolidated entities as of December 31, 2014 and 2013 were as follows:

% of Ownership

Investor Investee Main Businesses

December

31, 2014

December

31, 2013 Remark

HTC Corporation H.T.C. (B.V.I.) Corp. International holding company 100.00 100.00 -

Communication Global Certification

Inc.

Import of controlled telecommunications

radio-frequency devices and software

services

100.00 100.00 -

High Tech Computer Asia Pacific Pte.

Ltd.

International holding company;

marketing, repair and after-sales services

100.00 100.00 -

HTC Investment Corporation General investing activities 100.00 100.00 -

PT. High Tech Computer Indonesia Marketing, repair and after-sales service 1.00 1.00 -

HTC I Investment Corporation General investing activities 100.00 100.00 -

HTC Holding Cooperatief U.A. International holding company 0.01 0.01 -

HTC Investment One (BVI)

Corporation

Holding S3 Graphics Co., Ltd. and general

investing activities

100.00 100.00 -

H.T.C. (B.V.I.) Corp. High Tech Computer Corp. (Suzhou) Manufacture and sale of smart mobile

devices

100.00 100.00 -

High Tech Computer

Asia Pacific Pte. Ltd.

High Tech Computer (H.K.) Limited Marketing, repair and after-sales service - 100.00 1)

HTC (Australia and New Zealand)

Pty. Ltd.

〃100.00 100.00 -

HTC Philippines Corporation 〃99.99 99.99 -

PT. High Tech Computer Indonesia 〃99.90 99.00 -

HTC (Thailand) Limited 〃100.00 100.00 -

HTC India Private Ltd. 〃99.00 99.00 -

HTC Malaysia Sdn. Bhd. 〃100.00 100.00 -

HTC Innovation Limited 〃- 100.00 2)

HTC Communication Co., Ltd. Manufacture and sale of smart mobile

devices and after-sales service

100.00 100.00 -

HTC HK, Limited International holding company;

marketing, repair and after-sales services

100.00 100.00 -

HTC Holding Cooperatief U.A. International holding company 99.99 99.99 -

HTC Communication Technologies

(SH)

Design, research and development of

application software

100.00 100.00 -

HTC Vietnam Services One Member

Limited Liability Company

Marketing, repair and after-sales services 100.00 - 3)

HTC Myanmar Company Limited 〃99.00 - 4)

(Continued)