HTC 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Capital and shares Capital and shares •

114 115

(6) Dividend policy:

1. Dividend policy:

Since the Company is in the capital-intensive technology sector and growing, dividend policy is set with

consideration to factors such as current and future investment climate, demand for working capital, competitive

environment, capital budget, and interests of the shareholders, balancing dividends with long-term financial

planning of the Company. Dividends are proposed by the Board of Directors to the Shareholders' Meeting on a yearly

basis. Earnings may be allocated in cash or stock dividends, provided that the ratio of cash dividends may not be less

than 50% of total dividends.

According to the Company's Articles of Incorporation, earnings shall be allocated in the following order:

1. To pay taxes.

2. To cover accumulated losses, if any.

3. To appropriate 10% legal reserve unless the total legal reserve accumulated has already reached the amount of the

Company's authorized capital.

4. To recognize or reverse special reserve return earnings.

5. To pay remuneration to the Board of Directors and Supervisors at 0.3% maximum of the balance after withholding

the amounts under subparagraphs 1 to 4.

6. To pay bonus to employees at 5% minimum of the balance after withholding the amounts under subparagraphs

1 to 4, or such balance plus the unappropriated retained earnings of previous years. However, the bonus may

not exceed the limits on employee bonus distributions as set out in the Regulations Governing the Offering and

Issuance of Securities by Issuers. Where bonus to employees is allocated by means of new share issuance, the

employees to receive bonus may include employees serving with affiliates who meet specific requirements. Such

specific requirements shall be prescribed by the board of directors.

7. For any remainder, the board of directors shall propose allocation ratios based on the dividend policy set forth in

paragraph 2 of this Article and propose them at the shareholders' meeting.

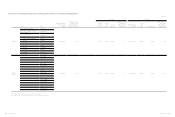

2. Dividend distribution proposed at the most recent shareholder's meeting:

(Proposal adopted by the Board pending approval by the Shareholders'

Meeting.)

On April 15, the Board of Directors adopted a resolution to distribute NT$ 314,635,792 in cash dividend. It translates

to NT$ 0.38 cash dividends per share (based on the number of outstanding shares as of book closure date for the 2015

Annual Shareholders' Meeting). The Board of Directors may necessary adjustments to the actual distribution ratio

on the basis of the number of issued and outstanding shares registered in the Common Stockholders' Roster as at the

record date.

3. There is no material change in dividend policy.

(7) Impact of the Stock Dividend Proposal on Operational Performance and

Earnings per Share:

HTC will not distribute stock dividends at the 2015 Annual Shareholders' Meeting; therefore it is not applicable.

(8) Employee Profit Sharing and Compensation for the Board of Directors and

Supervisors:

1. Percentage and scope of employee profit sharing and the Board of Director and

Supervisor remuneration as stipulated in the Company's Article of Incorporation.

The Company's Articles of Incorporation stipulate that earnings shall be allocated in the following order:

1. To pay taxes.

2. To cover accumulated losses, if any.

3. To appropriate 10% legal reserve unless the total legal reserve accumulated has already reached the amount of the

Company's authorized capital.

4. To recognize or reverse special reserve return earnings.

5. To pay remuneration to the Board of Directors and Supervisors at 0.3% maximum of the balance after withholding

the amounts under subparagraphs 1 to 4.

6. To pay bonus to employees at 5% minimum of the balance after withholding the amounts under subparagraphs 1

to 4, or such balance plus the unappropriated retained earnings of previous years.

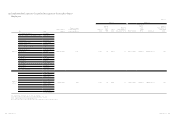

2. Employee Bonus proposal adopted by the Board

Unit: NT$ thousands

Distribution of 2014 Earnings Accrued Expenses for Employee Bonus Resolution Approved by the Board of Directors

Employee Bonus 88,333.5

2015.04.15

Employee Stock Bonus 0

Employee Cash Bonus 88,333.5

Total Amount 88,333.5

Directors' and Supervisors' Remuneration 0 0

Note: There is no difference between the value of employee bonuses and Director/Supervisor remunerations proposed by the Board and expenses accrued in the financial

reporting period.

3. Distributions of 2013 employees' bonus and remunerations for the Board of

Directors and Supervisors:

Since there was a net loss in fiscal 2013, the Company didn't distribute employees' bonus and remunerations for

Directors and Supervisors at the 2014 Annual Shareholders' Meeting.

(9) Share repurchases:

None