HTC 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

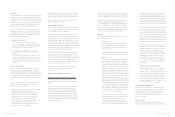

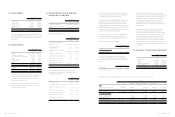

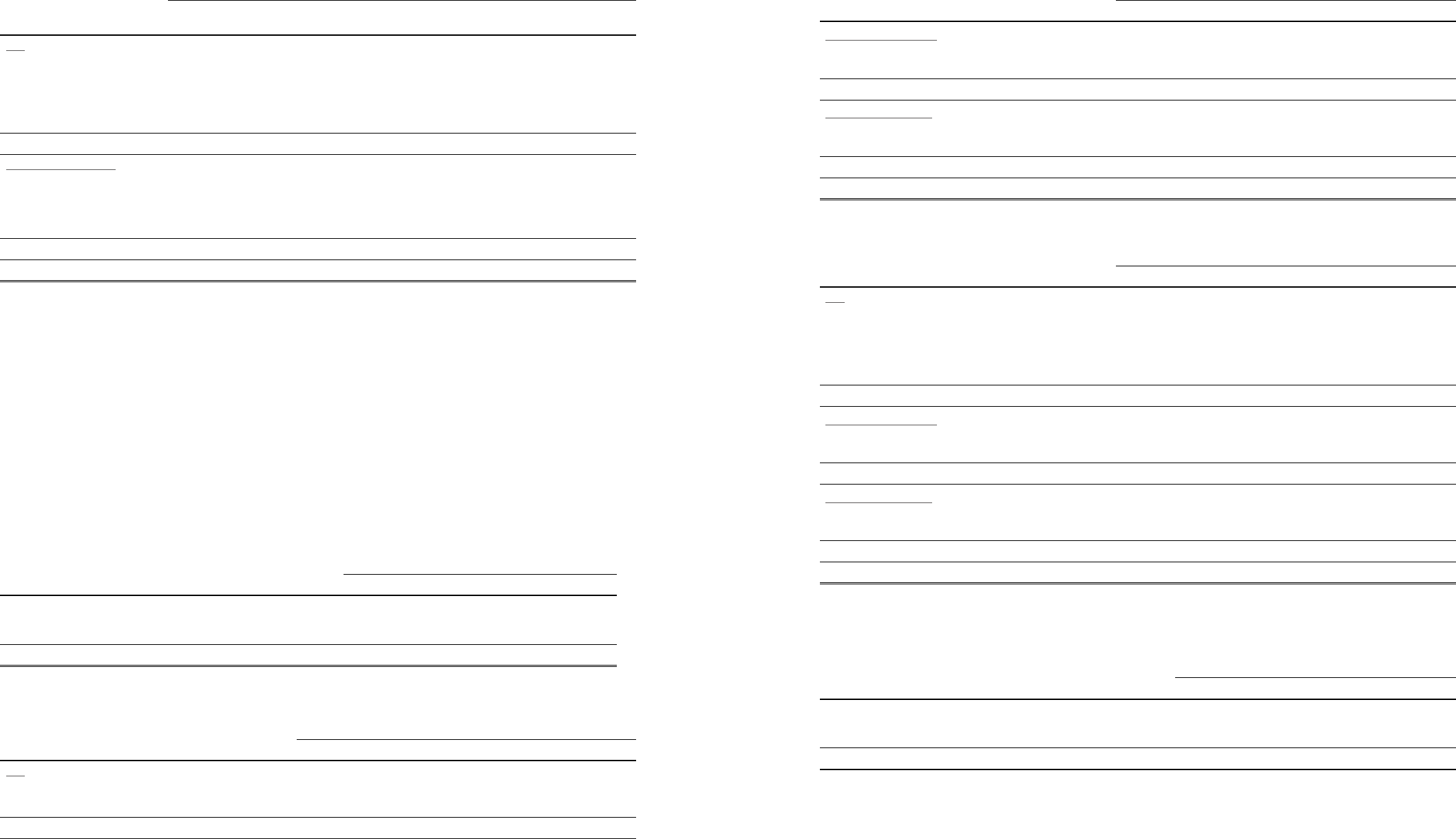

202 203

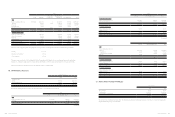

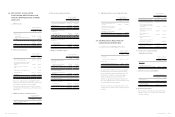

2013

Land Buildings

Property in

Construction

Machinery and

Equipment Other Equipment Total

Cost

Balance, beginning of the year

Additions

Disposal

Reclassification

Transfer to expense

$7,462,489

-

-

-

-

$9,520,993

270,787

(5,995)

18,726

-

$-

1,581

-

-

(1,581)

$8,732,565

1,069,092

(56,518)

(1,664)

-

$969,180

309,839

(64,456)

(17,062)

-

$26,685,227

1,651,299

(126,969)

-

(1,581)

Balance, end of the year 7,462,489 9,804,511 - 9,743,475 1,197,501 28,207,976

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposal

Reclassification

-

-

-

-

1,190,386

356,332

(5,995)

18,726

-

-

-

-

5,158,999

1,113,388

(56,518)

(1,664)

609,006

133,226

(64,456)

(17,062)

6,958,391

1,602,946

(126,969)

-

Balance, end of the year - 1,559,449 - 6,214,205 660,714 8,434,368

Net book value, end of the year $7,462,489 $8,245,062 $- $3,529,270 $536,787 $19,773,608

The above items of property, plant and equipment were depreciated on a straight-line basis at the following rates per annum:

Building 5-50 years

Machinery and equipment 3-6 years

Other equipment 3-5 years

The major component parts of the buildings held by the Company included plants, electro-powering machinery and engineering

systems, etc., which were depreciated over their estimated useful lives of 40 to 50 years, 20 years and 5 to 10 years, respectively.

There were no interests capitalized for the years ended December 31, 2014 and 2013.

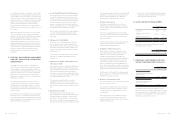

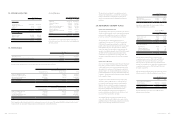

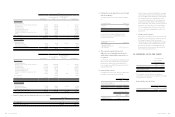

16. INTANGIBLE ASSETS

December 31

2014 2013

Carrying amounts

Patents

Other intangible assets

$579,118

643,603

$1,027,295

623,596

$1,222,721 $1,650,891

Movements of intangible assets for the years ended December 31, 2014 and 2013 were as follows:

2014

Patents Other Intangible Assets Total

Cost

Balance, beginning of the year

Additions

$2,516,290

-

$822,150

221,717

$3,338,440

221,717

Balance, end of the year 2,516,290 1,043,867 3,560,157

2014

Patents Other Intangible Assets Total

Accumulated amortization

Balance, beginning of the year

Amortization expenses

$1,377,910

448,177

$198,554

201,710

$1,576,464

649,887

Balance, end of the year 1,826,087 400,264 2,226,351

Accumulated impairment

Balance, beginning of the year

Impairment losses

111,085

-

-

-

111,085

-

Balance, end of the year 111,085 - 111,085

Net book value, end of the year $579,118 $643,603 $11,222,721

(Concluded)

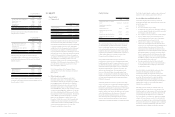

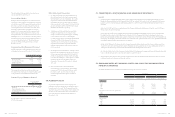

2013

Patents Other Intangible Assets Total

Cost

Balance, beginning of the year

Additions

Acquisition

Transfer from prepayment

Disposal

$2,500,854

22,214

-

(6,778)

$141,128

171,312

509,710

-

$2,641,982

193,526

509,710

(6,778)

Balance, end of the year 2,516,290 822,150 3,338,440

Accumulated amortization

Balance, beginning of the year

Amortization expenses

875,514

502,396

49,318

149,236

924,832

651,632

Balance, end of the year 1,377,910 198,554 1,576,464

Accumulated impairment

Balance, beginning of the year

Impairment losses

-

111,085

-

-

-

111,085

Balance, end of the year 111,085 - 111,085

Net book value, end of the year $1,027,295 $623,596 $1,650,891

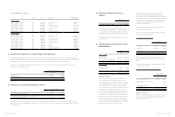

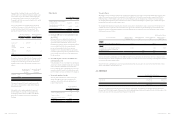

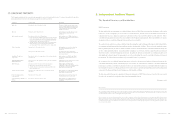

17. NOTE AND TRADE PAYABLES

December 31

2014 2013

Note payables

Trade payables

Trade payables - related parties

$1,073

40,814,737

6,508,521

$1,355

42,787,368

5,622,019

$47,324,331 $48,410,742

The average term of payment is four months. The Company has financial risk management policies in place to ensure that all payables

are paid within the pre-agreed credit terms.

(Continued)