HTC 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

268 269

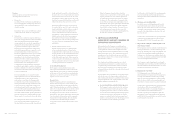

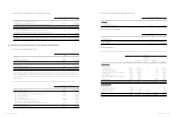

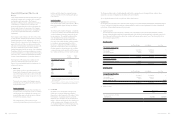

2013

Opening

Balance

Recognized in

Profit or Loss

Recognized

in Other

Comprehensive

Income

Disposal of

Subsidiaries

Translation

Adjustment

Closing

Balance

Deferred tax assets

Temporary differences

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Allowance for loss on decline in value of

inventory

Unrealized profit

Unrealized salary and welfare

Unrealized contingent losses on purchase

orders

Others

Loss carryforwards

$ 2,985,884

2,336,469

859,853

756,462

365,524

357,322

70,779

294,018

484

$ (556,451)

(57,711)

(162,739)

(220,526)

(63,257)

8,236

29,166

158,624

1,449,272

$ -

-

-

-

-

-

-

(915)

-

$ -

-

-

-

-

(1,416)

-

(3,295)

(508)

$ -

60,145

15,320

16,100

-

10,783

-

(42,758)

370

$ 2,429,433

2,338,903

712,434

552,036

302,267

374,925

99,945

405,674

1,449,618

Investment credits 663,047 (663,047) - - - -

$ 8,689,842 $ (78,433) $ (915) $ (5,219) $ 59,960 $ 8,665,235

Deferred tax liabilities

Temporary differences

Unrealized gain on investments

Financial assets at FVTPL

Defined benefit plans

Others

$ 470,743

2,961

35,034

139,198

$ (407,873)

16,515

(17,227)

(60,078)

$ -

-

(2,709)

-

$ -

-

-

(2,622)

$ 16,580

-

-

(39,400)

$ 79,450

19,476

15,098

37,098

$ 647,936 $ (468,663) $ (2,709) $ (2,622) $ (22,820) $ 151,122

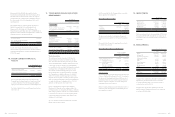

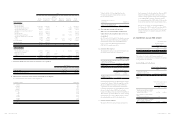

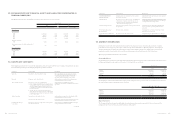

e. Items for which no deferred tax assets have been recognized

December 31

2014 2013

Loss carryforward $ 1,041,574 $ 553,280

Deductible temporary differences $ 3,470,768 $ 4,587,454

f. Information about unused loss carry-forward and tax-exemption

Loss carryforwards as of December 31, 2014 comprised of:

Remaining Carrying Expiry Year

$ 107,539

2,447,622

605,689

7,662,140

10,525,277

970

17,270

23,485

135,366

60,908

30,905

2015

2018

2019

2023

2024

2027

2028

2029

2030

2031

2032

$ 21,617,171

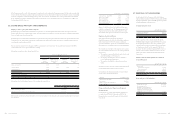

Under the Statute for Upgrading Industries, the

Company was granted exemption from corporate

income tax for as follows:

Item Exempt from Corporate

Income Tax Expiry Year

Sales of wireless and smartphone

which has 3.5G and GPS function 2015.01.01-2018.09.30

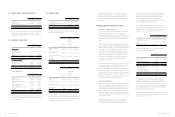

g. The aggregate amount of temporary

difference associated with investments for

which deferred tax liabilities have not been

recognized

As of December 31, 2014 and 2013, the taxable temporary

differences associated with investment in subsidiaries

and branch for which no deferred tax liabilities have

been recognized were NT$897,465 thousand and

NT$559,255 thousand, respectively.

h. Integrated income tax

The imputation credit account (“ICA”) information as of

December 31, 2014 and 2013, were as follows:

December 31

2014 2013

Unappropriated earnings

generated on and after January

1, 1998 $ 41,381,753 $ 47,282,820

Balance of ICA $ 8,164,935 $ 6,573,169

For the Year Ended December 31

2014

(Expected)

2013

(Actual)

Creditable ratio for

distribution of earning 19.73% -

Under the Income Tax Law, for distribution of earnings

generated after January 1, 1998, the imputation credits

allocated to ROC resident shareholders of HTC was

calculated based on the creditable ratio as of the date

of dividend distribution. The actual imputation credits

allocated to shareholders of HTC was based on the

balance of the ICA as of the date of dividend distribution.

Therefore, the expected creditable ratio for the earnings

may differ from the actual creditable ratio to be used in

allocating imputation credits to the shareholders.

i. Income tax assessments

Except 2011, HTC’s income tax returns through 2012

had been assessed by the tax authorities. However, HTC

disagreed with the tax authorities’ assessment on its

returns for unappropriated earnings of 2009 and applied

for the administrative remedial. Nevertheless, under

the conservatism guideline, HTC adjusted its income tax

for the tax shortfall stated in the tax assessment notices.

The income tax returns of Communication Global

Certification Inc., HTC Investment Corporation, HTC I

Investment Corporation and Yoda Co., Ltd. for the years

through 2012 have been examined and approved by the

tax authorities.

25. EARNINGS (LOSS) PER SHARE

Unit: NT$ Per Share

For the Year Ended

December 31

2014 2013

Basic earnings (loss) per share $ 1.80 $ (1.60)

Diluted earnings (loss) per share $ 1.80 $ (1.60)

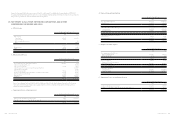

The earnings (loss) and weighted average number of

ordinary shares outstanding for the computation of earnings

(loss) per share were as follows:

Net Profit (Loss) for the Years

For the Year Ended December 31

2014 2013

Profit (loss) for the year

attributable to owners of the

parent $ 1,483,046 $ (1,323,785)

Shares

Unit: In Thousands of Shares

For the Year Ended

December 31

2014 2013

Weighted average number of ordinary

shares used in computation of basic

earnings (loss) per share 824,194 829,082

Effect of dilutive potential ordinary

shares:

Bonus issue to employees 622 -

Weighted average number of ordinary

shares used in the computation of

diluted earnings (loss) per share 824,816 829,082