HTC 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Financial information Financial information •

198 199

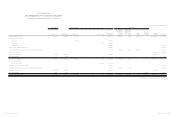

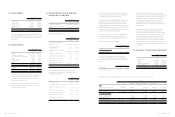

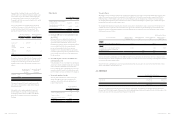

Forward Exchange Contracts

Buy/Sell Currency Maturity Date Notional Amount

(In Thousands)

December 31, 2014

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Buy

Buy

Buy

CAD/USD

EUR/USD

JPY/USD

GBP/USD

RMB/USD

USD/NTD

SGD/USD

2015.01.07-2015.03.17

2015.01.07

2015.01.07-2015.02.25

2015.01.07-2015.03.17

2015.01.07

2015.01.12-2015.03.04

2015.02.25-2015.03.04

CAD31,500

EUR6,000

JPY5,288,510

GBP30,100

RMB44,000

USD267,200

SGD88,985

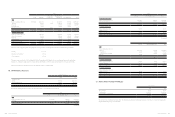

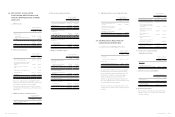

December 31, 2013

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Sell

Buy

Buy

Buy

Buy

Buy

EUR/USD

JPY/USD

GBP/USD

USD/NTD

CAD/USD

USD/RMB

CAD/USD

RMB/USD

EUR/USD

GBP/USD

2014.01.01-2014.01.29

2014.03.31

2014.01.15-2014.01.22

2014.01.06-2014.02.05

2014.01.13-2014.01.29

2014.01.08-2014.01.22

2014.01.13

2014.01.08

2014.01.15-2014.01.22

2014.01.15-2014.01.22

EUR61,000

JPY3,755,090

GBP12,000

USD391,700

CAD5,500

USD100,600

CAD4,000

RMB11,000

EUR18,000

GBP2,000

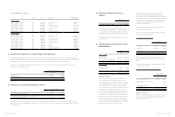

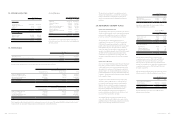

8. DERIVATIVE FINANCIAL INSTRUMENTS FOR HEDGING

The Company’s foreign-currency cash flows derived from the highly probable forecast transaction may lead to risks on foreign-currency

financial assets and liabilities and estimated future cash flows due to the exchange rate fluctuations. The Company assesses the risks may

be significant; thus, the Company entered into derivative contracts to hedge against foreign-currency exchange risks.

Gains and losses of hedging instruments transferred from equity to profit or loss were included in the following line items in the

statements of comprehensive income:

For the Year Ended December 31

2014 2013

Revenues

Other gains and losses

$102,057

1,939

$262,648

151,305

$103,996 $413,953

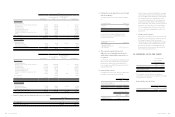

9. FINANCIAL ASSETS MEASURED AT COST

December 31

2014 2013

Domestic unlisted equity investment $515,861 $515,861

Classified according to financial asset measurement categories

Available-for-sale financial assets $515,861 $515,861

Management believed that the above unlisted equity investments held by the Company, whose fair value cannot be reliably measured

due to the range of reasonable fair value estimates was so significant; therefore, they were measured at cost less impairment at the end of

reporting period.

10. OTHER CURRENT FINANCIAL

ASSETS

December 31

2014 2013

Trust assets for employee benefit $- $2,359,041

To protect the rights and interests of its employees, the

Company deposited unpaid employee bonus in a new trust

account in September 2012. The Company had paid the

employee bonus and close the trust account in August 2014.

For details of pledged other current financial assets, please

refer to Note 30.

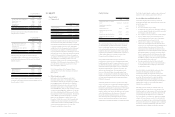

11. TRADE RECEIVABLES AND OTHER

RECEIVABLES

December 31

2014 2013

Trade receivables

Trade receivables

Trade receivables - related parties

Less: Allowances for impairment loss

$15,455,951

16,250,234

(3,050,907)

$17,017,529

13,203,577

(3,050,907)

$28,655,278 $27,170,199

Other receivables

VAT refund receivables

Interest receivables

Others

$58,468

8,592

257,367

$102,407

7,344

1,746,645

$324,427 $1,856,396

Trade Receivables

The credit period on sales of goods is 30-75 days. No

interest is charged on trade receivables before the due

date. Thereafter, interest is charged at 1%-18% per annum

on the outstanding balance, which is considered to be non-

controversial, to some of customers. In determining the

recoverability of a trade receivable, the Company considered

any change in the credit quality of the trade receivable

since the date credit was initially granted to the end of the

reporting period. For customers with low credit risk, the

Company has recognized an allowance for doubtful debts

of 1%-5% against receivables past due beyond 31-90 days

and of 5%-100% against receivables past due beyond 91

days. For customers with high credit risk, the Company has

recognized an allowance for impairment loss of 10%-100%

against receivables past due more than 31 days.

Before accepting any new customer, the Company’s

Department of Financial and Accounting evaluates the

potential customer’s credit quality and defines credit limits

and scorings by customer. The factor of overdue attributed

to customers are reviewed once a week and the Company

evaluates the financial performance periodically for the

adjustment of credit limits.

The concentration of credit risk is limited due to the fact

that the customer base is diverse.

As of the reporting date, the Company had no receivables

that are past due but not impaired.

Age of impaired trade receivables

December 31

2014 2013

1-90 days $8,233,369 $10,471,140

91-180 days 3,949,897 406,751

Over 181 days - -

$12,183,266 $10,877,891

The above was shown after deducting the allowance for

impairments loss and analyzed on the basis of the past due

date.

Movement in the allowance for impairment loss on trade

receivables were as follow:

Movement in the allowances for impairment loss

For the Year Ended

December 31

2014 2013

Balance, beginning of the year $3,050,907 $2,073,018

Add: Impairment losses recognized

on receivables

-

991,821

Less: Amounts written off as

uncollectible

- (13,932)

Balance, end of the year $3,050,907 $3,050,907

Other Receivables

Others were primarily prepayments on behalf of vendors or

customers, grants from suppliers and withholding income

tax of employees’ bonuses.