HSBC 2015 Annual Report Download - page 491

Download and view the complete annual report

Please find page 491 of the 2015 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490 -

491

491 -

492

492 -

493

493 -

494

494 -

495

495 -

496

496 -

497

497 -

498

498 -

499

499 -

500

500 -

501

501 -

502

502

|

|

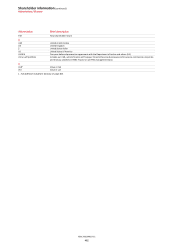

HSBC HOLDINGS PLC

489

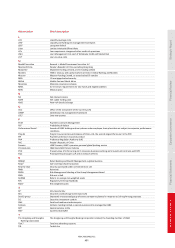

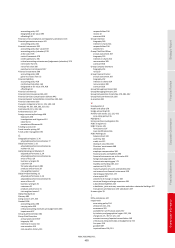

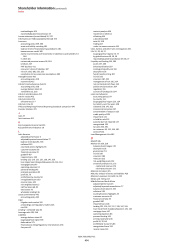

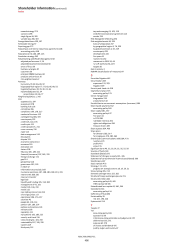

Strategic Report Financial Review Corporate Governance Financial Statements Shareholder Information

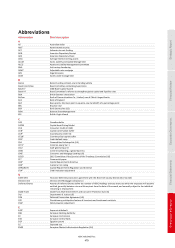

Term Definition

R

Refi rate The refi (or refinancing) rate is set by the European Central Bank (‘ECB’) and is the price banks pay to borrow from

ECB.

Regulatory capital The capital which HSBC holds, determined in accordance with CRDIV as implemented by the PRA for the

consolidated Group and by local regulators for individual Group companies.

Regulatory matters Investigations, reviews and other actions carried out by, or in response to the actions of, regulators or law

enforcement agencies in connection with alleged wrongdoing by HSBC.

Renegotiated loans Loans for which the contractual payment terms have been changed because of significant concerns about the

borrower’s ability to meet the contractual payments when due.

Repo/reverse repo

(or sale and repurchase

agreement)

A short-term funding agreement that allows a borrower to create a collateralised loan by selling a financial asset to a

lender. As part of the agreement the borrower commits to repurchase the security at a date in the future repaying

the proceeds of the loan. For the party on the other end of the transaction (buying the security and agreeing to

sell in the future) it is reverse repurchase agreement or a reverse repo.

Reputational risk The risk that illegal, unethical or inappropriate behaviour by the Group itself, members of staff or clients or

representatives of the Group will damage HSBC’s reputation, leading, potentially, to a loss of business, fines or

penalties.

Restricted Shares Awards that define the number of HSBC Holdings ordinary shares to which the employee will become entitled,

generally between one and three years from the date of the award, and normally subject to the individual

remaining in employment. The shares to which the employee becomes entitled may be subject to retention

requirement.

Retail loans Money lent to individuals rather than institutions. This includes both secured and unsecured loans such as mortgages

and credit card balances.

Return on equity Profit attributable to ordinary shareholders of the parent company divided by average ordinary shareholders’ equity.

Return on tangible equity

(‘ROTE’)

Profit attributable to ordinary shareholders of the parent company, adjusted for movements in PVIF and

impairments of goodwill divided by average ordinary shareholders’ equity, adjusted for PVIF, goodwill and other

intangibles (net of deferred tax).

Risk appetite The aggregate level and types of risk a firm is willing to assume within its risk capacity to achieve its strategic

objectives and business plan.

Risk capacity The maximum level of risk the firm can assume before breaching constraints determined by regulatory capital and

liquidity needs and its obligations, also from a conduct perspective, to depositors, policyholders, other customers

and shareholders.

Risk-weighted assets (‘RWAs’) Calculated by assigning a degree of risk expressed as a percentage (risk weight) to an exposure value.

Run-off portfolios Legacy credit in GB&M, the US CML portfolio and other US run-off portfolios, including the treasury services related

to the US CML businesses and commercial operations in run-off. Origination of new business in the run-off

portfolios has been discontinued and balances are being managed down through attrition and sale.

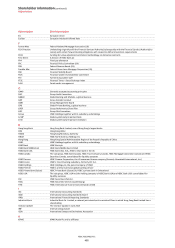

S

Sale and repurchase agreement See repo above.

Second lien A security interest granted over an item of property to secure the repayment of a debt that is issued against the

same collateral as a first lien but that is subordinate to it. In the case of default, repayment for this debt will only

be received after the first lien has been repaid.

Securitisation A transaction or scheme whereby the credit risk associated with an exposure, or pool of exposures, is tranched and

where payments to investors in the transaction or scheme are dependent upon the performance of the exposure

or pool of exposures. A traditional securitisation involves the transfer of the exposures being securitised to a SPE

which issues securities. In a synthetic securitisation, the tranching is achieved by the use of credit derivatives and

the exposures are not removed from the balance sheet of the originator.

Securitisation swap An interest rate or cross currency swap with notional linked to the size of the outstanding asset portfolio in a

securitisation. Securitisation swaps are typically executed by securitisation vehicles to hedge interest rate risk

arising from mismatches between the interest rate risk profile of the asset portfolio and that of the securities

issued by the vehicle.

Short sale In relation to credit risk management, a ‘short sale’ is an arrangement in which a bank permits the borrower to sell

the property for less than the amount outstanding under a loan agreement. The proceeds are used to reduce the

outstanding loan balance and the borrower is subsequently released from any further obligations on the loan.

Single-issuer liquidity facility A liquidity or stand-by line provided to a corporate customer which is different from a similar line provided to a

conduit funding vehicle.

Social security financing

contribution (‘COFINS’)

A federal tax imposed monthly on gross revenue earned by legal entities in Brazil. It is a contribution to finance the

social security system.

Sovereign exposures Exposures to governments, ministries, departments of governments, embassies, consulates and exposures on

account of cash balances and deposits with central banks.

Special Purpose Entity (‘SPE’) A corporation, trust or other non-bank entity, established for a narrowly defined purpose, including for carrying on

securitisation activities. The structure of the SPE and its activities are intended to isolate its obligations from those

of the originator and the holders of the beneficial interests in the securitisation.