HSBC 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

99

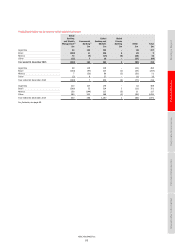

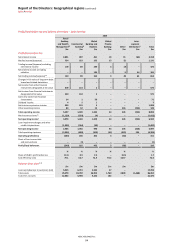

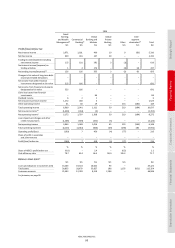

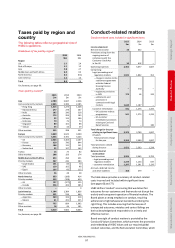

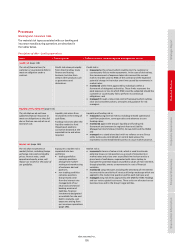

Strategic Report Financial Review Corporate Governance Financial Statements Shareholder Information

Footnotes to pages 48 to 98

Use of non-GAAP financial measures

1 Net operating income before loan impairment charges and other credit risk provisions, also referred to as revenue.

2 ‘Own credit spread’ includes the fair value movements on our long-term debt attributable to credit spread where the net result of such movements

will be zero upon maturity of the debt. This does not include fair value changes due to own credit risk in respect of trading liabilities or derivative

liabilities.

Consolidated income statement/Group performance by income and expense item

3 Dividends recorded in the financial statements are dividends per ordinary share declared in a year and are not dividends in respect of, or for, that

year.

4 Dividends per ordinary share expressed as a percentage of basic earnings per share.

5 Net interest income includes the cost of internally funding trading assets, while the related external revenues are reported in ‘Trading income’. In our

global business results, the cost of funding trading assets is included with Global Banking and Market’s net trading income as interest expense.

6 Gross interest yield is the average annualised interest rate earned on average interest-earning assets (‘AIEA’).

7 Net interest spread is the difference between the average annualised interest rate earned on AIEA, net of amortised premiums and loan fees, and the

average annualised interest rate paid on average interest-bearing funds.

8 Net interest margin is net interest income expressed as an annualised percentage of AIEA.

9 Interest income on trading assets is reported as ‘Net trading income’ in the consolidated income statement.

10 Interest income on financial assets designated at fair value is reported as ‘Net income from financial instruments designated at fair value’ in the

consolidated income statement.

11 Including interest-bearing bank deposits only.

12 Interest expense on financial liabilities designated at fair value is reported as ‘Net income on financial instruments designated at fair value’ in the

consolidated income statement, other than interest on own debt which is reported in ‘Interest expense’.

13 Including interest-bearing customer accounts only.

14 Trading income also includes movements on non-qualifying hedges. These hedges are derivatives entered into as part of a documented interest rate

management strategy for which hedge accounting was not, nor could be, applied. They are principally cross-currency and interest rate swaps used to

economically hedge fixed rate debt issued by HSBC Holdings and floating rate debt issued by HSBC Finance. The size and direction of the changes in

the fair value of non-qualifying hedges that are recognised in the income statement can be volatile from year-to-year, but do not alter the cash flows

expected as part of the documented interest rate management strategy for both the instruments and the underlying economically hedged assets and

liabilities if the derivative is held to maturity.

15 Net insurance claims and benefits paid and movement in liabilities to policyholders arise from both life and non-life insurance business. For non-life

business, amounts reported represent the cost of claims paid during the year and the estimated cost of incurred claims. For life business, the main

element of claims is the liability to policyholders created on the initial underwriting of the policy and any subsequent movement in the liability that

arises, primarily from the attribution of investment performance to savings-related policies. Consequently, claims rise in line with increases in sales of

savings-related business and with investment market growth.

16 The cost efficiency ratio is defined as total operating expenses divided by net operating income before loan impairment charges and other credit risk

provisions.

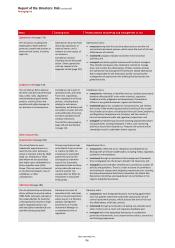

Consolidated balance sheet

17 Net of impairment allowances.

18 On 1 January 2014, CRD IV came into force and the calculation of capital resources and risk-weighted assets for 2014 and 2015 are calculated and

presented on this basis. 2011 to 2013 comparatives are on a Basel 2.5 basis.

19 Capital resources are total regulatory capital, the calculation of which is set out on page 234.

20 Including perpetual preferred securities, details of which can be found in Note 30 on the Financial Statements.

21 The definition of net asset value per ordinary share is total shareholders’ equity, less non-cumulative preference shares and capital securities, divided

by the number of ordinary shares in issue excluding shares the company has purchased and are held in treasury.

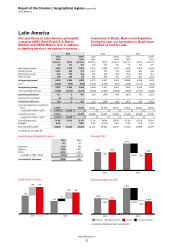

22 In the first half of 2015 our operations in Brazil were classified as held for sale. As a result, balance sheet accounts have been classified to ‘Assets held

for sale’ and ‘Liabilities of disposal groups held for sale’. There is no separate income statement classification.

23 France primarily comprises the domestic operations of HSBC Finance, HSBC Assurances Vie and the Paris branch of HSBC Bank plc.

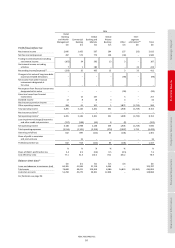

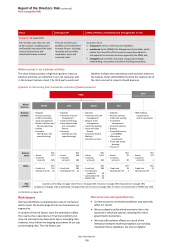

Reconciliation of RoRWA measures

24 Pre-tax return on average risk-weighted assets (‘RoRWA’) is calculated using pre-tax return and reported average RWAs. Adjusted RoRWA is

calculated using adjusted pre-tax return and adjusted average RWAs.

25 Reported average risk-weighted assets (‘average RWAs’) are calculated using an average of RWAs at quarter-ends on a Basel 2.5 basis for

31 December 2013 and a CRD IV end point basis from all periods from 1 January 2014. Adjusted average RWAs are calculated using reported average

RWAs adjusted for the effects of currency translation differences and significant items.

26 ‘Other’ includes treasury services related to the US Consumer and Mortgage Lending business and commercial operations in run-off. US CML includes

loan portfolios within the run-off business that are designated held for sale.

27 ‘Currency translation adjustment’ is the effect of translating the assets and liabilities of subsidiaries and associates for the previous year-end at the

rates of exchange applicable at the current year-end.

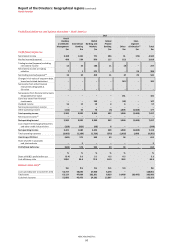

Global businesses and geographical regions

28 In the first half of 2015, a portfolio of customers was transferred from CMB to RBWM in Latin America in order to better align the combined banking

needs of the customers with our established global businesses. Comparative data have been re-presented accordingly.

29 The main items reported under ‘Other’ are the results of HSBC’s holding company and financing operations, which includes net interest earned on

free capital held centrally, operating costs incurred by the head office operations in providing stewardship and central management services to HSBC,

along with the costs incurred by the Group Service Centres and Shared Service Organisations and associated recoveries. The results also include fines

and penalties as part of the settlement of investigations into past inadequate compliance with anti-money laundering and sanctions laws, the UK

bank levy together with unallocated investment activities, centrally held investment companies, gains arising from the dilution of interests in

associates and joint ventures and certain property transactions. In addition, ‘Other’ also includes part of the movement in the fair value of long-term

debt designated at fair value (the remainder of the Group’s movement on own debt is included in GB&M).