Dollar General 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Income taxes (Continued)

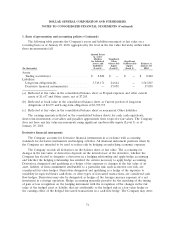

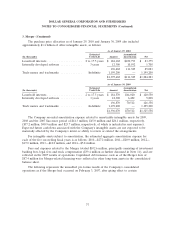

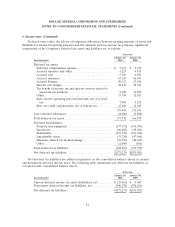

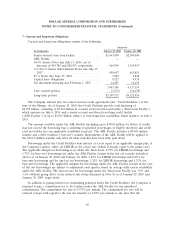

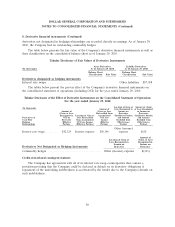

A reconciliation between actual income taxes and amounts computed by applying the federal

statutory rate to income before income taxes is summarized as follows:

Successor Predecessor

March 6, 2007 February 3, 2007

through through

(Dollars in thousands) 2009 2008 February 1, 2008 July 6, 2007

U.S. federal statutory rate on

earnings before income taxes $193,241 35.0% $68,041 35.0% $(2,308) 35.0% $ 1,399 35.0%

State income taxes, net of

federal income tax benefit . . 18,375 3.3 5,361 2.8 904 (13.7) (1,135) (28.4)

Jobs credits, net of federal

income taxes ............ (8,590) (1.6) (9,149) (4.7) (3,022) 45.8 (2,227) (55.7)

Increase (decrease) in valuation

allowances .............. (1,722) (0.3) 3,038 1.6 — — 551 13.8

Income tax related interest

expense, net of federal

income tax benefit ........ 1,289 0.2 (2,015) (1.0) 2,738 (41.5) (172) (4.3)

Nondeductible Merger-related

lawsuit settlement ........ (366) (0.1) 18,130 9.3 — — — —

Nondeductible transaction costs — — — — — — 13,501 337.9

Other, net ............... 10,447 2.0 2,815 1.4 (87) 1.3 76 1.9

$212,674 38.5% $86,221 44.4% $(1,775) 26.9% $11,993 300.2%

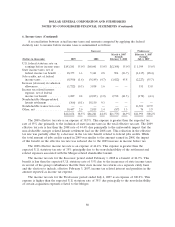

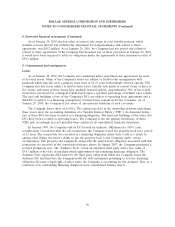

The 2009 effective tax rate is an expense of 38.5%. This expense is greater than the expected tax

rate of 35% due primarily to the inclusion of state income taxes in the total effective tax rate. The 2009

effective tax rate is less than the 2008 rate of 44.4% due principally to the unfavorable impact that the

non-deductible, merger related lawsuit settlement had on the 2008 rate. This reduction in the effective

tax rate was partially offset by a decrease in the tax rate benefit related to federal jobs credits. While

the total amount of jobs credits earned in 2009 was similar to the amount earned in 2008, the impact

of this benefit on the effective tax rate was reduced due to the 2009 increase in income before tax.

The 2008 effective income tax rate is an expense of 44.4%. This expense is greater than the

expected U.S. statutory tax rate of 35% principally due to the non-deductibility of the settlement and

related expenses associated with the Merger-related shareholder lawsuit.

The income tax rate for the Successor period ended February 1, 2008 is a benefit of 26.9%. This

benefit is less than the expected U.S. statutory rate of 35% due to the incurrence of state income taxes

in several of the group’s subsidiaries that file their state income tax returns on a separate entity basis

and the election to include, effective February 3, 2007, income tax related interest and penalties in the

amount reported as income tax expense.

The income tax rate for the Predecessor period ended July 6, 2007 is an expense of 300.2%. This

expense is higher than the expected U.S. statutory rate of 35% due principally to the non-deductibility

of certain acquisition expenses related to the Merger.

80