Dollar General 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

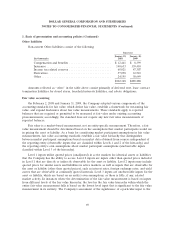

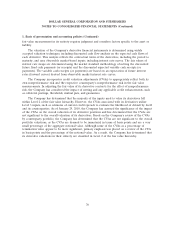

Other liabilities

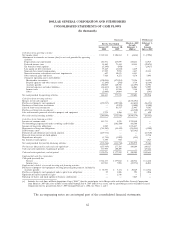

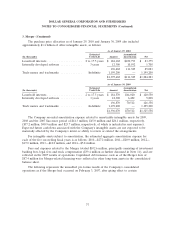

Non-current Other liabilities consist of the following:

Successor

January 29, January 30,

(In thousands) 2010 2009

Compensation and benefits ......................... $ 12,441 $ 8,399

Insurance ...................................... 140,633 139,410

Income tax related reserves ......................... 68,021 47,307

Derivatives ..................................... 57,058 63,523

Other ......................................... 24,195 30,649

$302,348 $289,288

Amounts reflected as ‘‘other’’ in the table above consist primarily of deferred rent, lease contract

termination liabilities for closed stores, leasehold interests liabilities, and rebate obligations.

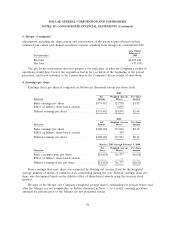

Fair value accounting

On February 2, 2008 and January 31, 2009, the Company adopted various components of the

accounting standards for fair value, which define fair value, establish a framework for measuring fair

value, and expand disclosures about fair value measurements. These standards apply to reported

balances that are required or permitted to be measured at fair value under existing accounting

pronouncements; accordingly, the standard does not require any new fair value measurements of

reported balances.

Fair value is a market-based measurement, not an entity-specific measurement. Therefore, a fair

value measurement should be determined based on the assumptions that market participants would use

in pricing the asset or liability. As a basis for considering market participant assumptions in fair value

measurements, fair value accounting standards establish a fair value hierarchy that distinguishes

between market participant assumptions based on market data obtained from sources independent of

the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and

the reporting entity’s own assumptions about market participant assumptions (unobservable inputs

classified within Level 3 of the hierarchy).

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities

that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included

in Level 1 that are directly or indirectly observable for the asset or liability. Level 2 inputs may include

quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for

the asset or liability (other than quoted prices), such as interest rates, foreign exchange rates, and yield

curves that are observable at commonly quoted intervals. Level 3 inputs are unobservable inputs for the

asset or liability, which are based on an entity’s own assumptions, as there is little, if any, related

market activity. In instances where the determination of the fair value measurement is based on inputs

from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the

entire fair value measurement falls is based on the lowest level input that is significant to the fair value

measurement in its entirety. The Company’s assessment of the significance of a particular input to the

69