Dollar General 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

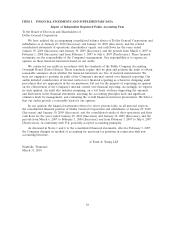

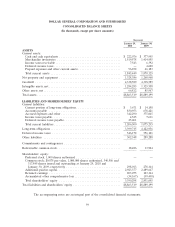

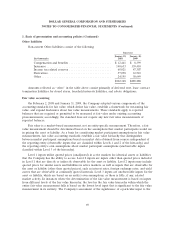

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

Successor

January 29, January 30,

2010 2009

ASSETS

Current assets:

Cash and cash equivalents .................................... $ 222,076 $ 377,995

Merchandise inventories ..................................... 1,519,578 1,414,955

Income taxes receivable ...................................... 7,543 6,392

Deferred income taxes ....................................... — 4,600

Prepaid expenses and other current assets ......................... 96,252 66,183

Total current assets ......................................... 1,845,449 1,870,125

Net property and equipment .................................... 1,328,386 1,268,960

Goodwill .................................................. 4,338,589 4,338,589

Intangible assets, net .......................................... 1,284,283 1,325,558

Other assets, net ............................................. 66,812 85,967

Total assets ................................................. $8,863,519 $8,889,199

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term obligations .......................... $ 3,671 $ 14,158

Accounts payable .......................................... 830,953 678,421

Accrued expenses and other ................................... 342,290 375,045

Income taxes payable ........................................ 4,525 7,611

Deferred income taxes payable ................................. 25,061 —

Total current liabilities ....................................... 1,206,500 1,075,235

Long-term obligations ......................................... 3,399,715 4,122,956

Deferred income taxes ........................................ 546,172 556,101

Other liabilities ............................................. 302,348 289,288

Commitments and contingencies .................................

Redeemable common stock ..................................... 18,486 13,924

Shareholders’ equity:

Preferred stock, 1,000 shares authorized .......................... — —

Common stock; $0.875 par value, 1,000,000 shares authorized, 340,586 and

317,845 shares issued and outstanding at January 29, 2010 and

January 30, 2009, respectively ................................ 298,013 278,114

Additional paid-in capital ..................................... 2,923,377 2,489,647

Retained earnings .......................................... 203,075 103,364

Accumulated other comprehensive loss ........................... (34,167) (39,430)

Total shareholders’ equity .................................... 3,390,298 2,831,695

Total liabilities and shareholders’ equity ............................ $8,863,519 $8,889,199

The accompanying notes are an integral part of the consolidated financial statements.

59