Dollar General 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

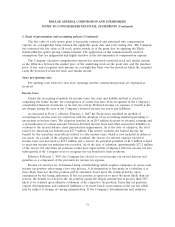

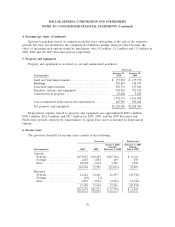

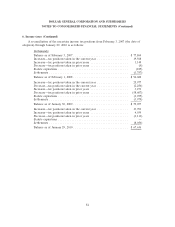

4. Earnings per share (Continued)

Options to purchase shares of common stock that were outstanding at the end of the respective

periods, but were not included in the computation of diluted earnings (loss) per share because the

effect of exercising such options would be antidilutive, were 0.2 million, 12.1 million and 12.5 million in

2009, 2008 and the 2007 Successor period, respectively.

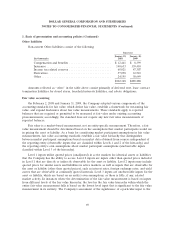

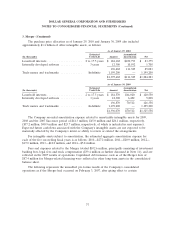

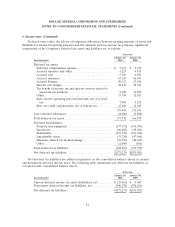

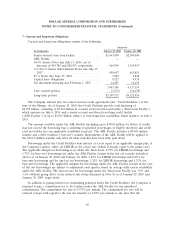

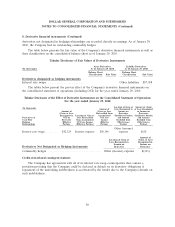

5. Property and equipment

Property and equipment is recorded at cost and summarized as follows:

Successor

January 29, January 30,

(In thousands) 2010 2009

Land and land improvements ...................... $ 137,903 $ 137,779

Buildings ..................................... 520,867 518,933

Leasehold improvements ......................... 130,774 117,846

Furniture, fixtures and equipment ................... 992,423 781,425

Construction in progress .......................... 10,406 5,025

1,792,373 1,561,008

Less accumulated depreciation and amortization ........ 463,987 292,048

Net property and equipment ....................... $1,328,386 $1,268,960

Depreciation expense related to property and equipment was approximately $201.1 million,

$190.5 million, $116.9 million, and $83.5 million for 2009, 2008, and the 2007 Successor and

Predecessor periods, respectively. Amortization of capital lease assets is included in depreciation

expense.

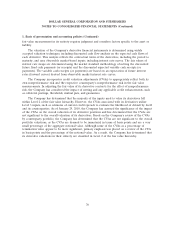

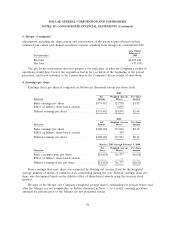

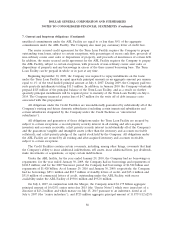

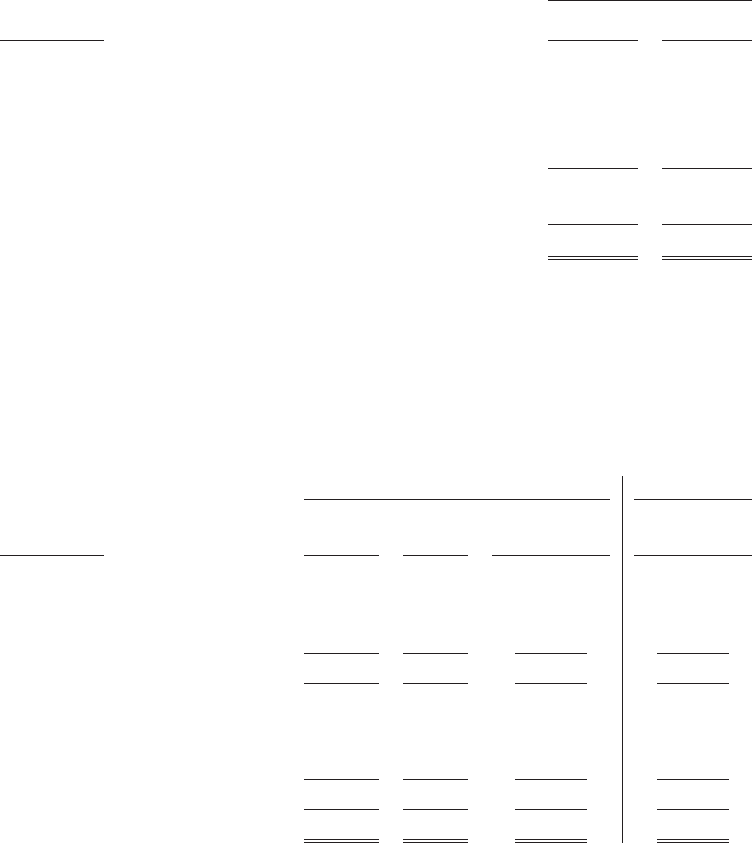

6. Income taxes

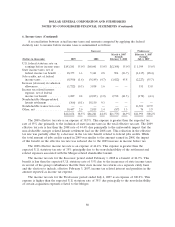

The provision (benefit) for income taxes consists of the following:

Successor Predecessor

March 6, 2007 February 3, 2007

through through

(In thousands) 2009 2008 February 1, 2008 July 6, 2007

Current:

Federal ................ $173,027 $10,489 $(25,726) $ 31,114

Foreign ................ 1,465 1,084 409 495

State .................. 21,002 1,214 4,306 1,258

195,494 12,787 (21,011) 32,867

Deferred:

Federal ................ 12,412 64,403 22,157 (18,750)

Foreign ................ (49) (3) — —

State .................. 4,817 9,034 (2,921) (2,124)

17,180 73,434 19,236 (20,874)

$212,674 $86,221 $ (1,775) $ 11,993

79