Dollar General 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

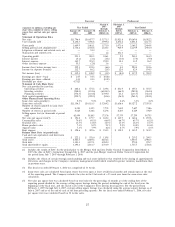

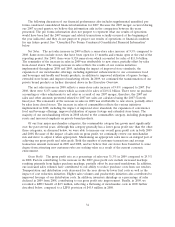

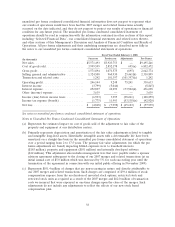

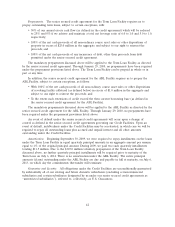

The following table contains results of operations data for fiscal years 2009 and 2008 and the

dollar and percentage variances among those years, as well as the 2007 pro forma, Successor and

Predecessor periods.

Successor Predecessor Pro Forma

Amount %

(amounts in millions, 2009 2008 Change Change 2007(a) 2007(b) 2007

except per share amounts)

Net sales by category:

Consumables ........... $8,356.4 $ 7,248.4 $1,108.0 15.3% $3,701.7 $2,615.1 $6,316.8

% of net sales .......... 70.84% 69.31% 66.44% 66.65% 66.53%

Seasonal .............. 1,711.5 1,521.5 190.0 12.5 908.3 604.9 1,513.2

% of net sales .......... 14.51% 14.55% 16.30% 15.42% 15.94%

Home products ......... 869.8 862.2 7.5 0.9 507.0 362.7 869.8

% of net sales .......... 7.37% 8.24% 9.10% 9.24% 9.16%

Apparel .............. 858.8 825.6 33.2 4.0 454.4 341.0 795.4

% of net sales .......... 7.28% 7.89% 8.16% 8.69% 8.38%

Net sales ............. $11,796.4 $10,457.7 $1,338.7 12.8% $5,571.5 $3,923.8 $9,495.2

Cost of goods sold ....... 8,106.5 7,396.6 709.9 9.6 3,999.6 2,852.2 6,852.5

% of net sales .......... 68.72% 70.73% 71.79% 72.69% 72.17%

Gross profit ........... 3,689.9 3,061.1 628.8 20.5 1,571.9 1,071.6 2,642.8

% of net sales .......... 31.28% 29.27% 28.21% 27.31% 27.83%

Selling, general and

administrative expenses . . 2,736.6 2,448.6 288.0 11.8 1,324.5 960.9 2,310.9

% of net sales .......... 23.20% 23.41% 23.77% 24.49% 24.34%

Litigation settlement and

related costs, net ...... — 32.0 (32.0) — ———

% of net sales .......... — 0.31% — — —

Transaction and related

costs ............... — — —— 1.2 101.4 1.2

% of net sales .......... — — 0.02% 2.58% 0.01%

Operating profit ........ 953.3 580.5 372.8 64.2 246.1 9.2 330.6

% of net sales .......... 8.08% 5.55% 4.42% 0.24% 3.48%

Interest income ......... (0.1) (3.1) 2.9 (95.3) (3.8) (5.0) (8.8)

% of net sales .......... (0.00)% (0.03)% (0.07)% (0.13)% (0.09)%

Interest expense ........ 345.7 391.9 (46.2) (11.8) 252.9 10.3 436.7

% of net sales .......... 2.93% 3.75% 4.54% 0.26% 4.60%

Other (income) expense . . . 55.5 (2.8) 58.3 — 3.6 — 3.6

% of net sales .......... 0.47% (0.03)% 0.07% — 0.04%

Income (loss) before income

taxes ............... 552.1 194.4 357.7 184.0 (6.6) 4.0 (100.9)

% of net sales .......... 4.68% 1.86% (0.12)% 0.10% (1.06)%

Income taxes ........... 212.7 86.2 126.5 146.7 (1.8) 12.0 (42.9)

% of net sales .......... 1.80% 0.82% (0.03)% 0.31% (0.45)%

Net income (loss) ....... $ 339.4 $ 108.2 $ 231.3 213.8% $ (4.8) $ (8.0) $ (57.9)

% of net sales .......... 2.88% 1.03% (0.09)% (0.20)% (0.61)%

Diluted earnings per share . $ 1.04 $ 0.34 $ 0.70 205.9% $ (0.02)

(a) Includes the results of operations of BAC for the period prior to its merger with and into Dollar General

Corporation from March 6, 2007 (the date of BAC’s formation) through July 6, 2007 (reflecting the change in

fair value of interest rate swaps), and the post-merger results of Dollar General Corporation for the period

from July 7, 2007 through February 1, 2008.

(b) Includes the pre-merger results of Dollar General Corporation for the period from February 3, 2007 through

July 6, 2007.

33