Dollar General 2009 Annual Report Download - page 46

Download and view the complete annual report

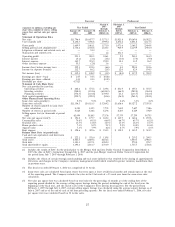

Please find page 46 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The gross profit rate as a percentage of sales was 29.3% in 2008 compared to 28.2% in the 2007

Successor period, 27.3% in the 2007 Predecessor period, and 27.8% for pro forma 2007. Factors

contributing to the increase in the 2008 gross profit rate include a lower inventory shrink rate; lower

promotional markdowns; improved leverage on distribution and transportation costs; and improved

markups related to changes resulting from the outcome of pricing analysis, our ability to react more

quickly to product cost changes and diligent vendor negotiations. In January 2009, we marked down

merchandise as the result of a late 2008 change in the interpretation of the phthalates provision of the

Consumer Product Safety Improvement Act of 2008 resulting in a charge of $8.6 million. Also in 2008,

we faced increased commodity cost pressures mainly related to food and pet products which were

driven by rising fruit and vegetable prices and freight costs. Increases in petroleum, resin, metals, pulp

and other raw material commodity driven costs also resulted in multiple product cost increases. Related

to these commodity cost increases, we recorded a LIFO expense of $43.9 million in 2008, compared to

the LIFO provision recorded in the 2007 Successor period of $6.1 million.

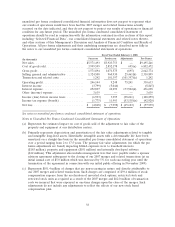

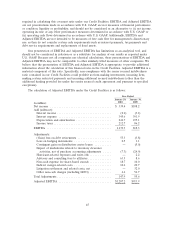

Selling, General and Administrative (‘‘SG&A’’) Expense. SG&A, as a percentage of sales, was

23.2% in 2009 compared to 23.4% in 2008, representing an improvement of 21 basis points. SG&A in

the 2009 period included expenses related to the completion of our initial public offering totaling

$68.3 million, or 58 basis points, including $58.8 million relating to the termination of an advisory

agreement among us, KKR and Goldman, Sachs & Co. and $9.4 million resulting from the acceleration

of certain equity based compensation. Our increased sales levels favorably impacted SG&A, as a

percentage of sales, with the most significant impact on store occupancy costs, including rent and

utilities. Our cost of utilities, as a percentage of sales, was further reduced by energy savings resulting

from our store energy management initiatives, including forward purchase contracts, increased

preventive maintenance and the installation of energy management systems in substantially all of our

new and relocated stores. In addition, we continued to significantly reduce our workers’ compensation

expense through safety initiatives implemented over the last several years, and legal expenses were

lower in 2009 than 2008, which included expenses incurred in connection with a shareholder litigation

settlement in 2008 relating to our 2007 merger.

SG&A expense as a percentage of sales decreased to 23.4% in 2008, compared to 23.8% and

24.5% in the 2007 Successor and Predecessor periods, respectively. The more significant items resulting

in the decrease in 2008 compared to the 2007 periods include: approximately $9.0 million and

$45.0 million in the 2007 Successor and Predecessor periods, respectively (including $2.4 million and

$4.1 million, respectively, also included in advertising costs discussed below) related to the closing of

stores and changes in our inventory strategy; a $12.0 million loss in the 2007 Successor period

compared to a $5.0 million gain in 2008 relating to potential losses on distribution center leases;

advertising costs of $27.8 million in 2008 compared to $23.6 million and $17.3 million in the 2007

Successor and Predecessor periods, respectively; and decreases in workers compensation and other

insurance-related costs compared to the 2007 periods. These decreases were partially offset by an

increase in incentive compensation and related payroll taxes in 2008 compared to the 2007 periods due

to improved overall financial performance, increased amortization of leasehold intangibles capitalized in

connection with the revaluation of assets at the date of our 2007 merger, and an increase in

professional fees in 2008 compared to the 2007 periods primarily reflecting legal expenses related to

shareholder litigation.

SG&A decreased to 23.4% in 2008 compared to 24.3% in pro forma 2007. The more significant

items resulting in the decrease from the 2007 pro forma results include: $54.0 million of costs in pro

forma 2007 SG&A relating to the closing of stores and the implementation of new inventory strategies;

a $12.0 million loss in the 2007 pro forma period compared to a $5.0 million gain in 2008 relating to

possible losses on distribution center leases; and decreases in workers compensation and other

insurance-related costs in 2008 of $10.4 million compared to the 2007 pro forma period. These

decreases were partially offset by an increase in incentive compensation and related payroll taxes of

35