Dollar General 2009 Annual Report Download - page 84

Download and view the complete annual report

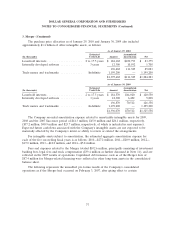

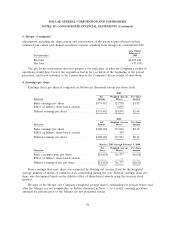

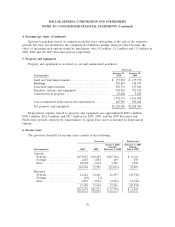

Please find page 84 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

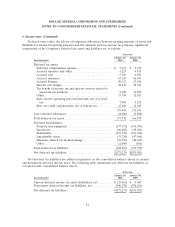

The fair value of each option grant is separately estimated and amortized into compensation

expense on a straight-line basis between the applicable grant date and each vesting date. The Company

has estimated the fair value of all stock option awards as of the grant date by applying the Black-

Scholes-Merton option pricing valuation model. The application of this valuation model involves

assumptions that are judgmental and highly sensitive in the determination of compensation expense.

The Company calculates compensation expense for nonvested restricted stock and similar awards

as the difference between the market price of the underlying stock on the grant date and the purchase

price, if any, and recognizes such amount on a straight-line basis over the period in which the recipient

earns the nonvested restricted stock and similar awards.

Store pre-opening costs

Pre-opening costs related to new store openings and the construction periods are expensed as

incurred.

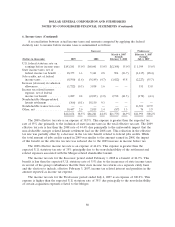

Income taxes

Under the accounting standards for income taxes, the asset and liability method is used for

computing the future income tax consequences of events that have been recognized in the Company’s

consolidated financial statements or income tax returns. Deferred income tax expense or benefit is the

net change during the year in the Company’s deferred income tax assets and liabilities.

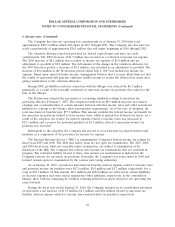

As discussed in Note 6, effective February 3, 2007 the Predecessor modified its method of

accounting for income taxes in connection with the adoption of an accounting standard pertaining to

uncertainty in income taxes. The adoption resulted in an $8.9 million decrease in retained earnings and

a reclassification of certain amounts between deferred income taxes and other noncurrent liabilities to

conform to the revised balance sheet presentation requirements. As of the date of adoption, the total

reserve for uncertain tax benefits was $77.9 million. This reserve excludes the federal income tax

benefit for the uncertain tax positions related to state income taxes, which is now included in deferred

tax assets. As a result of the adoption of this standard, the reserve for interest expense related to

income taxes was increased to $15.3 million and a reserve for potential penalties of $1.9 million related

to uncertain income tax positions was recorded. As of the date of adoption, approximately $27.1 million

of the reserve for uncertain tax positions would have impacted the Company’s effective income tax rate

subsequently if the Company were to recognize the tax benefit for these positions.

Effective February 3, 2007, the Company has elected to record income tax related interest and

penalties as a component of the provision for income tax expense.

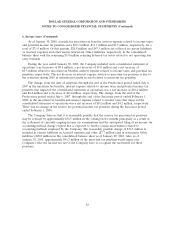

Income tax reserves are determined using a methodology which requires companies to assess each

income tax position taken using a two step process. A determination is first made as to whether it is

more likely than not that the position will be sustained, based upon the technical merits, upon

examination by the taxing authorities. If the tax position is expected to meet the more likely than not

criteria, the benefit recorded for the tax position equals the largest amount that is greater than 50%

likely to be realized upon ultimate settlement of the respective tax position. Uncertain tax positions

require determinations and estimated liabilities to be made based on provisions of the tax law which

may be subject to change or varying interpretation. If the Company’s determinations and estimates

73