Dollar General 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. Commitments and contingencies (Continued)

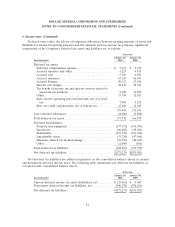

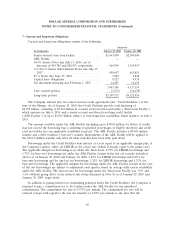

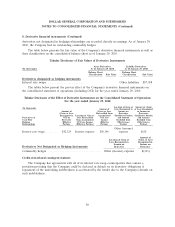

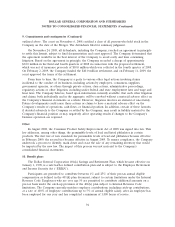

Future minimum payments as of January 29, 2010 for capital and operating leases are as follows:

Capital Operating

(In thousands) Leases Leases

2010 .......................................... $ 2,295 $ 423,813

2011 .......................................... 1,558 391,031

2012 .......................................... 1,135 342,811

2013 .......................................... 599 283,496

2014 .......................................... 602 226,189

Thereafter ...................................... 5,237 657,697

Total minimum payments ........................... 11,426 $2,325,037

Less: imputed interest ............................. (3,099)

Present value of net minimum lease payments ............ 8,327

Less: current portion, net ........................... (1,849)

Long-term portion ................................ $ 6,478

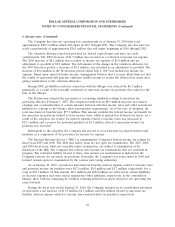

Capital leases were discounted at an effective interest rate of approximately 5.7% at January 29,

2010. The gross amount of property and equipment recorded under capital leases and financing

obligations at both January 29, 2010 and at January 30, 2009, was $34.8 million. Accumulated

depreciation on property and equipment under capital leases and financing obligations at January 29,

2010 and January 30, 2009, was $6.9 million and $5.3 million, respectively.

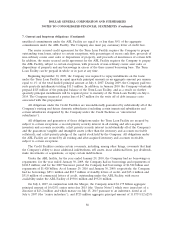

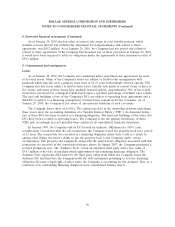

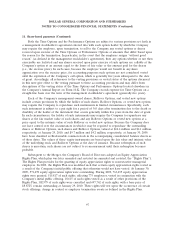

Rent expense under all operating leases is as follows:

Successor Predecessor

March 6, 2007 February 3, 2007

through through

(In thousands) 2009 2008 February 1, 2008 July 6, 2007

Minimum rentals(a) ..................... $407,379 $370,827 $205,672 $143,188

Contingent rentals ...................... 21,248 18,796 8,780 6,964

$428,627 $389,623 $214,452 $150,152

(a) Excludes net contract termination costs of $2.5 million, $2.4 million and $19.1 million for the

Successor periods ended January 30, 2009 and February 1, 2008 and the Predecessor period ended

July 6, 2007, respectively. These expenses were recorded in association with the closing of stores

associated with strategic initiatives implemented primarily in 2007. Also excludes amortization of

leasehold interests of $37.2 million, $40.9 million and $23.7 million included in rent expense for

the Successor periods ended January 29, 2010, January 30, 2009 and February 1, 2008, respectively.

Legal proceedings

On August 7, 2006, a lawsuit entitled Cynthia Richter, et al. v. Dolgencorp, Inc., et al. was filed in

the United States District Court for the Northern District of Alabama (Case No. 7:06-cv-01537-LSC)

(‘‘Richter’’) in which the plaintiff alleges that she and other current and former Dollar General store

managers were improperly classified as exempt executive employees under the Fair Labor Standards

91