Dollar General 2009 Annual Report Download - page 39

Download and view the complete annual report

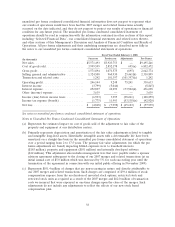

Please find page 39 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

This discussion and analysis should be read with, and is qualified in its entirety by, the Consolidated

Financial Statements and the notes thereto. It also should be read in conjunction with the Forward-Looking

Statements/Risk Factors disclosures set forth in the Introduction and in Item 1A of this report, respectively.

Executive Overview

We are the largest discount retailer in the United States by number of stores, with 8,877 stores

located in 35 states as of February 26, 2010, primarily in the southern, southwestern, midwestern and

eastern United States. We offer a broad selection of merchandise, including consumable products such

as food, paper and cleaning products, health and beauty products and pet supplies, and

non-consumable products such as seasonal merchandise, home decor and domestics, and apparel. Our

merchandise includes high quality national brands from leading manufacturers, as well as comparable

quality private brand selections with prices at substantial discounts to national brands. We offer our

customers these national brand and private brand products at everyday low prices (typically $10 or less)

in our convenient small-box (small store) locations.

On July 6, 2007, we completed a merger and, as a result, we are a subsidiary of Buck

Holdings, L.P. (‘‘Buck’’), a Delaware limited partnership controlled by investment funds affiliated with

Kohlberg Kravis Roberts & Co., L.P. (collectively, ‘‘KKR’’). The membership interests of Buck and

Buck Holdings, LLC (‘‘Buck LLC’’), the general partner of Buck, are held by a private investor group,

including affiliates of each of KKR and Goldman, Sachs & Co. and other equity investors (collectively,

the ‘‘Investors’’) The merger consideration was funded through the use of our available cash, cash

equity contributions from the Investors, equity contributions of certain members of our management

and certain debt financings discussed below under ‘‘Liquidity and Capital Resources.’’ On

November 13, 2009, we completed an initial public offering of approximately 39.2 million shares,

including 22.7 million newly issued shares and approximately 16.5 million outstanding shares sold by a

selling shareholder.

The customers we serve are value-conscious, and Dollar General has always been intensely focused

on helping our customers make the most of their spending dollars. We believe our convenient store

format and broad selection of high quality products at compelling values have driven our substantial

growth and financial success over the years. Like other companies, over the past two years, we have

been operating in an environment with heightened economic challenges and uncertainties. Consumers

are facing very high rates of unemployment, fluctuating food, gasoline and energy costs, rising medical

costs, and a continued weakness in housing and credit markets, and the timetable for economic

recovery is uncertain. Nonetheless, as a result of our long-term mission of serving the value-conscious

customer, coupled with a vigorous focus on improving our operating and financial performance, our

2009 and 2008 financial results were strong, and we remain optimistic with regard to executing our

operating priorities in 2010.

At the beginning of 2008, we defined four operating priorities, which we remain keenly focused on

executing. These priorities are: 1) drive productive sales growth, 2) increase our gross margins,

3) leverage process improvements and information technology to reduce costs, and 4) strengthen and

expand Dollar General’s culture of serving others.

Our first priority is driving productive sales growth by increasing shopper frequency and

transaction amount and maximizing sales per square foot. We have enhanced our category management

processes, allowing us to continue expanding our consumables offerings while also improving

profitability, by adding more productive items and eliminating unproductive items. We are utilizing the

space in our stores more productively by raising the height of our merchandise fixtures and

implementing more consistent space planning. In addition, we are making significant progress in

28