Dollar General 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

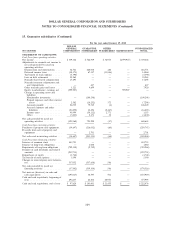

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued)

volatility based upon traded options, weighted equally, to calculate the volatility assumption, as it was

the Company’s belief that this methodology provided the best indicator of future volatility. For

historical volatility, the Company calculated daily market price changes from the date of grant over a

past period representative of the expected life of the options to determine volatility. Subsequent to the

Merger the expected volatilities have been based upon the historical volatilities of a peer group of four

companies, as the Company’s common stock has only been publicly traded for a limited period of time.

An increase in the expected volatility will increase compensation expense.

Weighted average risk-free interest rate—This is the U.S. Treasury rate for the week of the grant

having a term approximating the expected life of the option. An increase in the risk-free interest rate

will increase compensation expense.

Expected term of options—This is the period of time over which the options granted are expected

to remain outstanding. For pre-Merger options, the Company estimated expected term using a

computation based on an assumption that outstanding options would be exercised approximately

halfway through their contractual term, taking into consideration such factors as grant date, expiration

date, weighted-average time-to-vest, actual exercises and post-vesting cancellations. Options granted

have a maximum term of 10 years. Due to the limited historical data for grants issued subsequent to

the Merger, the Company has estimated the expected term as the mid-point between the vesting date

and the contractual term of the option. An increase in the expected term will increase compensation

expense.

At January 29, 2010, 617,817 Rollover Options were outstanding, all of which were exercisable.

The aggregate intrinsic value of these outstanding Rollover Options was $13.2 million with a weighted

average remaining contractual term of 5.4 years, and a weighted average exercise price of $2.1875.

During the Predecessor period from February 3, 2007 to July 6, 2007, the weighted average grant

date fair value of options granted was $5.37, and the total intrinsic value of stock options exercised was

$10.8 million.

All stock options granted prior to the Merger in the Predecessor period ended July 6, 2007 under

the terms of the Company’s pre-Merger stock incentive plan were non-qualified stock options issued at

a price equal to the fair market value of the Company’s common stock on the date of grant, were

originally scheduled to vest ratably over a four-year period, and were to expire 10 years following the

date of grant.

99