Dollar General 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

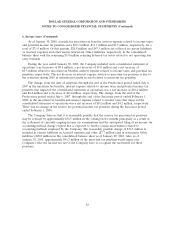

1. Basis of presentation and accounting policies (Continued)

The Company adopted the additional disclosure provisions of the ASC Derivatives and Hedging

Topic during the first quarter of 2009 as discussed in Note 8. These standards require entities to

provide greater transparency through additional disclosures about how and why an entity uses

derivative instruments, how derivative instruments and related hedged items are accounted for, and

how derivative instruments and related hedged items affect an entity’s financial position, results of

operations, and cash flows.

The Company changed its accounting for fair value of its nonfinancial assets and liabilities in

connection with the adoption of certain provisions of the ASC Fair Value Measurements and

Disclosures Topic effective January 31, 2009.

Reclassifications

Certain reclassifications of the 2007 and 2008 amounts have been made to conform to the 2009

presentation.

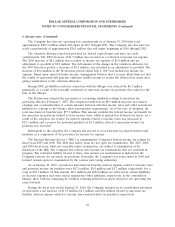

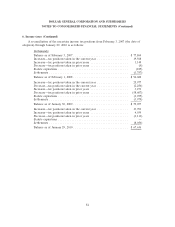

2. Initial public offering and special dividend

On November 18, 2009, the Company completed the initial public offering of its common stock.

The Company issued 22,700,000 shares in the offering, and an existing shareholder sold an additional

16,515,000 outstanding shares. Net proceeds to the Company from the offering of $446.0 million were

used to redeem outstanding debt, as discussed in more detail in Note 7 below. The Company paid a

$4.8 million transaction fee to Kohlberg Kravis Roberts & Co., L.P. (‘‘KKR’’) and Goldman,

Sachs & Co. in connection with the offering. Although this transaction fee was not paid from the net

proceeds of the offering, it was directly related to the offering and accounted for as a cost of raising

equity.

Upon the completion of the offering, the Company incurred additional charges of $58.8 million for

fees paid to terminate its advisory agreement with KKR and Goldman, Sachs & Co. The transaction

and termination fees paid to such parties are discussed in more detail in Note 12 below. The Company

also incurred charges of $9.4 million for the accelerated vesting of certain share-based awards as

discussed in more detail in Note 11 below.

On September 8, 2009, the Company’s Board of Directors declared a special dividend on the

Company’s outstanding common stock (including shares of restricted stock) of $0.7525 per share, or

approximately $239.3 million in the aggregate, which was paid on September 11, 2009 to shareholders

of record on September 8, 2009. The special dividend was paid with cash generated from operations.

Pursuant to the terms of the Company’s stock option plans, holders of stock options received either a

pro-rata adjustment to the terms of their share-based awards or a cash payment (totaling approximately

$0.5 million for all such grantees) in substitution for such adjustment as a result of the dividend.

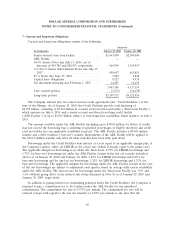

3. Merger

On March 11, 2007, the Company entered into an Agreement and Plan of Merger (the ‘‘Merger

Agreement’’) with Buck Holdings L.P., a Delaware limited partnership (‘‘Buck’’), and BAC, a Tennessee

corporation and wholly owned subsidiary of Buck. Buck is and BAC was (prior to the Merger)

controlled by investment funds affiliated with KKR. On July 6, 2007, the transaction was consummated

through a merger (the ‘‘Merger’’) of BAC with and into the Company. The Company survived the

75