Dollar General 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

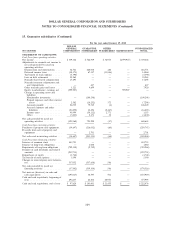

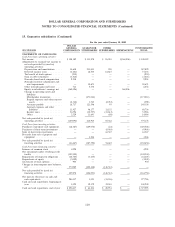

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

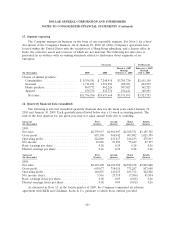

14. Quarterly financial data (unaudited) (Continued)

management and advisory services to the Company, which resulted in a pretax charge of approximately

$58.8 million ($46.2 million net of tax, or $0.14 per diluted share), which is included in SG&A

expenses.

As discussed in Note 7, in the fourth quarter of 2009, the Company repurchased $195.7 million

principal amount of its outstanding Senior Notes, $205.2 million principal amount of its outstanding

Senior Subordinated Notes, and repaid $325.0 million principal amount on the Term Loan Facility,

resulting in a pretax loss of $55.3 million ($33.8 million net of tax, or $0.10 per diluted share) which is

recognized as Other (income) expense.

As discussed in Note 11, in the fourth quarter of 2009 the Company incurred share-based

compensation expenses of $9.4 million ($5.8 million net of tax, or $0.02 per diluted share) for the

accelerated vesting of certain share-based awards in conjunction with the Company’s initial public

offering which is included in SG&A expenses.

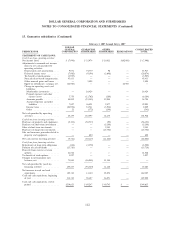

As discussed in Note 1, in the second, third, and fourth quarters of 2008, the Company recorded

LIFO provisions of $16.0 million ($9.7 million net of tax, or $0.03 per diluted share), $15.7 million

($9.6 million net of tax, or $0.03 per diluted share), and $12.1 million ($7.4 million net of tax, or $0.02

per diluted share), respectively. These charges are reflected in Cost of goods sold.

As discussed in Note 9, in the third quarter of 2008, based on the agreement in principle to settle

the Merger-related shareholder litigation, the Company recorded charges of approximately

$34.5 million ($37.4 million net of tax, or $0.12 per diluted share) in connection with the proposed

settlement, which was net of anticipated insurance proceeds of $7.5 million. In the fourth quarter of

2008, the Company received insurance proceeds totaling $10.0 million, thus reducing the charges to

$32.0 million net of insurance proceeds and increasing operating profit by the incremental $2.5 million

($1.5 million net of tax, or less than $0.01 per diluted share). These amounts are reflected as Litigation

settlement and related costs, net in the respective quarters.

As discussed in Note 7, in the fourth quarter of 2008, the Company repurchased $44.1 million

principal amount of its outstanding Senior Subordinated Notes resulting in a net gain of $3.8 million

($2.3 million net of tax, or $0.01 per diluted share) which is recognized as Other (income) expense.

As discussed in Note 9, in the fourth quarter of 2008, the Company recorded an $8.6 million

charge ($5.3 million net of tax, or $0.02 per diluted share) included in Cost of goods sold related to the

markdown of certain products covered by the Consumer Products Safety Improvement Act of 2008.

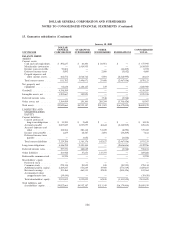

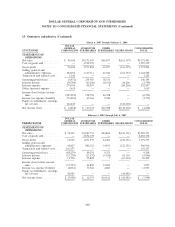

15. Guarantor subsidiaries

Certain of the Company’s subsidiaries (the ‘‘Guarantors’’) have fully and unconditionally

guaranteed on a joint and several basis the Company’s obligations under certain outstanding debt

obligations. Each of the Guarantors is a direct or indirect wholly-owned subsidiary of the Company.

104