Dollar General 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

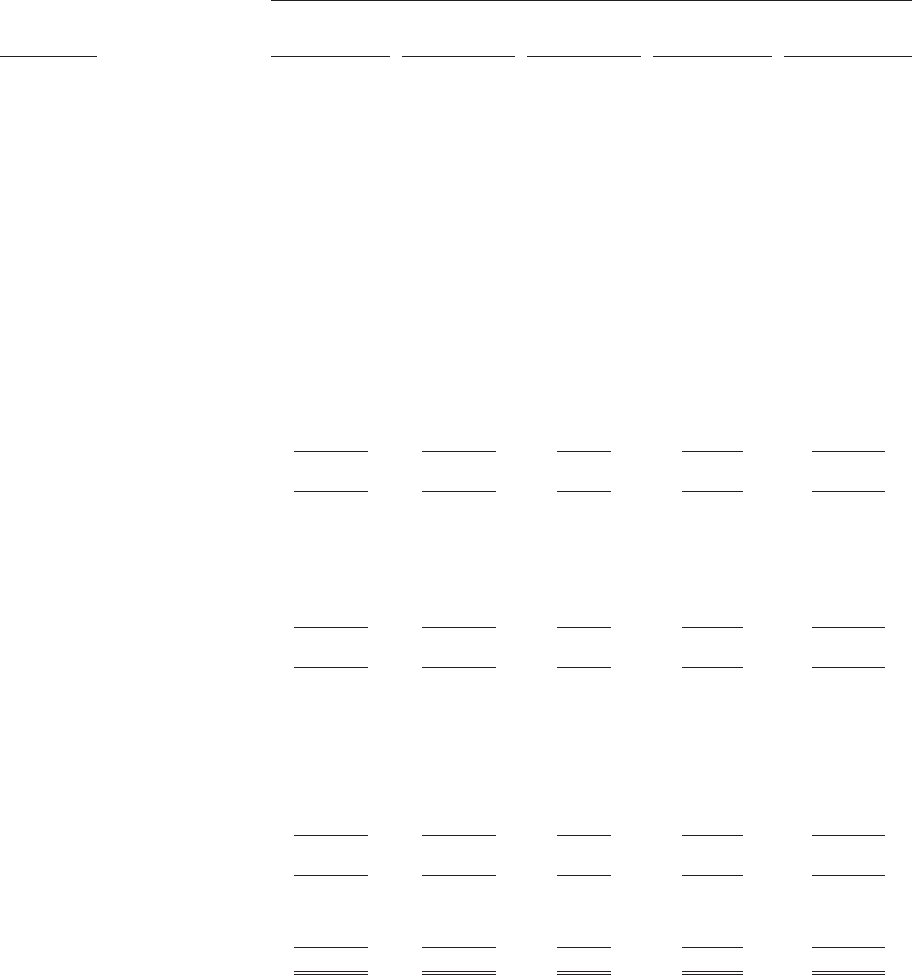

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

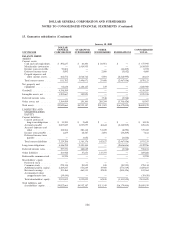

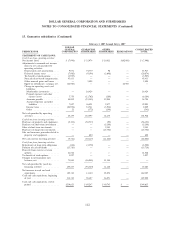

15. Guarantor subsidiaries (Continued)

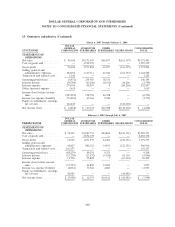

March 6, 2007 through February 1, 2008

DOLLAR

GENERAL GUARANTOR OTHER CONSOLIDATED

SUCCESSOR CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF CASH FLOWS:

Cash flows from operating activities:

Net income (loss) ............. $ (4,818) $ 127,632 $ 16,598 $(144,230) $ (4,818)

Adjustments to reconcile net income

(loss) to net cash provided by (used

in) operating activities:

Depreciation and amortization .... 21,634 128,431 148 — 150,213

Deferred income taxes ......... (2,120) 20,208 1,463 — 19,551

Loss on debt retirement ........ 1,249 — — — 1,249

Noncash share-based compensation . 3,827 — — — 3,827

Noncash inventory adjustments and

asset impairments .......... — 6,113 — — 6,113

Other noncash gains and losses . . . 3,705 571 — — 4,276

Equity in subsidiaries’ earnings, net . (144,230) — — 144,230 —

Change in operating assets and

liabilities:

Merchandise inventories ...... — 73,356 — — 73,356

Prepaid expenses and other

current assets ........... (1,120) 4,783 76 — 3,739

Accounts payable ........... (40,745) 12,428 (13,078) — (41,395)

Accrued expenses and other

liabilities .............. (7,456) 6,418 17,099 — 16,061

Income taxes ............. (45,416) 44,829 7,935 — 7,348

Other .................. (3,169) 3,675 (422) — 84

Net cash provided by (used in)

operating activities ........... (218,659) 428,444 29,819 — 239,604

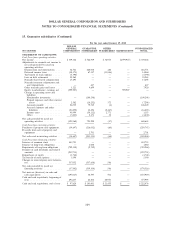

Cash flows from investing activities:

Merger, net of cash acquired ...... (5,649,182) (1,129,953) 40,744 — (6,738,391)

Purchases of property and equipment . (1,617) (82,003) (21) — (83,641)

Purchases of short-term investments . . — — (3,800) — (3,800)

Sales of short-term investments ..... — — 21,445 — 21,445

Purchases of long-term investments . . — (37,047) (7,473) — (44,520)

Proceeds from sale of property and

equipment ................ — 533 — — 533

Net cash provided by (used in)

investing activities ............ (5,650,799) (1,248,470) 50,895 — (6,848,374)

Cash flows from financing activities:

Issuance of common stock ........ 2,759,540 — — — 2,759,540

Net borrowings (repayments) under

revolving credit facility ......... 102,500 — — — 102,500

Issuance of long-term obligations .... 4,176,817 — — — 4,176,817

Repayments of long-term obligations . . (236,084) (5,861) — — (241,945)

Debt issuance costs ............ (87,392) — — — (87,392)

Repurchases of equity ........... (541) — — — (541)

Changes in intercompany note

balances, net ............... (837,062) 885,266 (48,204) — —

Net cash provided by (used in)

financing activities ........... 5,877,778 879,405 (48,204) — 6,708,979

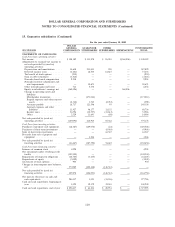

Net increase in cash and cash

equivalents ................ 8,320 59,379 32,510 — 100,209

Cash and cash equivalents, beginning

of period ................. — — — — —

Cash and cash equivalents, end of year $ 8,320 $ 59,379 $ 32,510 $ — $ 100,209

111