Dollar General 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

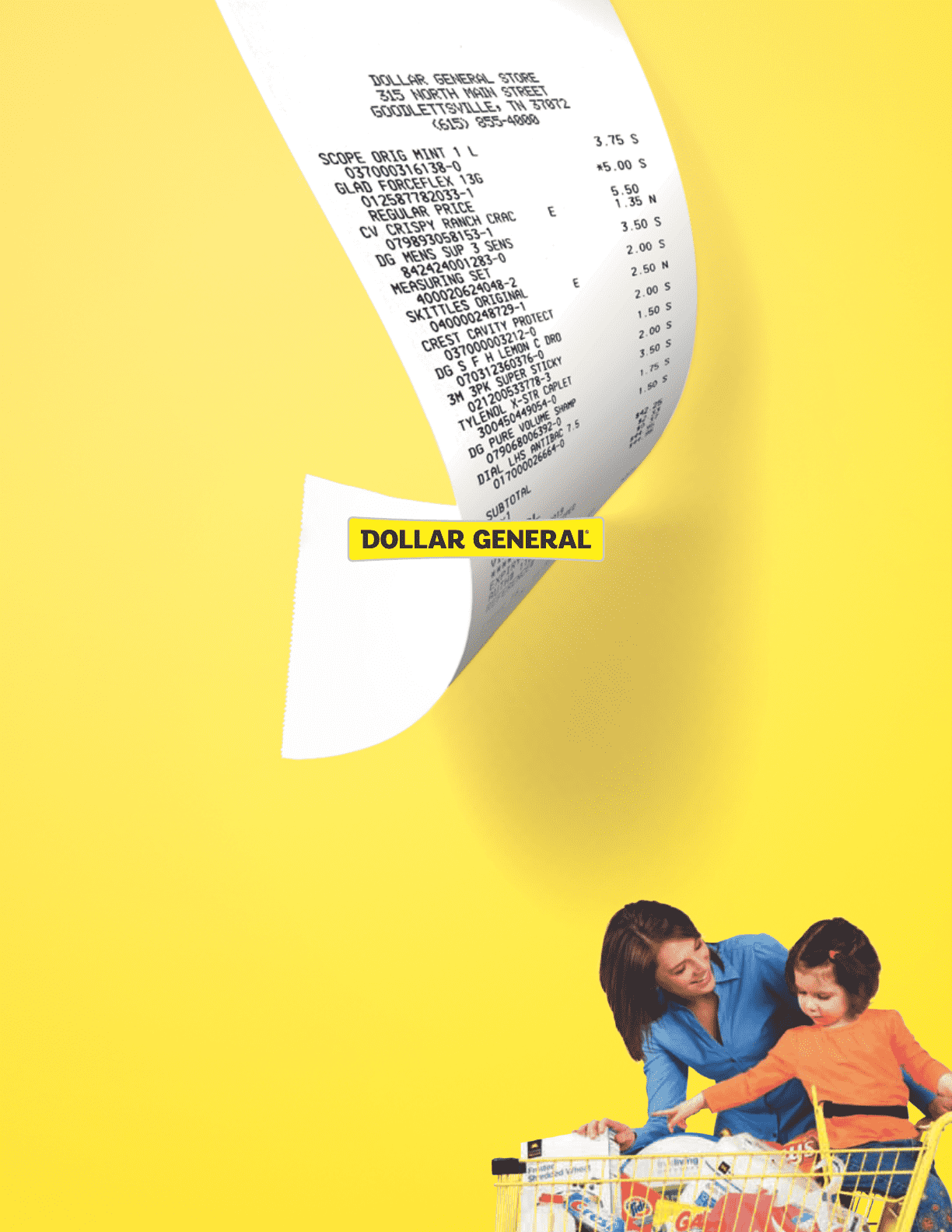

The New Dollar General

Winning with value and convenience. Every day!

2009 Annual Report

Table of contents

-

Page 1

The New Dollar General Winning with value and convenience. Every day! 2009 Annual Report -

Page 2

... general and administrative expenses % of sales Operating profit % of sales Net Income Per Share Results Diluted earnings per share Financial Position Total assets Long-term obligations, including current portion Shareholders' equity Operating Data Retail stores at end of year 2008 Adjustments 2009... -

Page 3

... and convenience for over 70 years. Today, with more than 8,800 stores in 35 states and nearly 80,000 members of the Dollar General team, we are serving more customers than ever. Dollar General stores offer great values on quality consumables and basic everyday home, apparel and seasonal merchandise... -

Page 4

... us to execute our growth strategy. Having operated as a private company since July 2007, our initial public offering was yet another step in a long track record of success at Dollar General and, notably, was the largest retail IPO in nearly 14 years. Our long history of profitable growth is founded... -

Page 5

... key operating priorities that have been instrumental in our success over the past two years: • Driving productive sales growth; • Increasing gross margin; • Leveraging process improvements and information technology to reduce costs; and • Strengthening and expanding Dollar General's culture... -

Page 6

... "Save time. Save money. Every day!" We remain strongly committed to our customers as we continue creating the New Dollar General, driven by four key operating priorities: 1) Driving productive sales growth; 2) Increasing gross margin; 3) Leveraging process improvements and information technology to... -

Page 7

...Dollar General," with our new logo, bright yellow carts and baskets, updated outdoor signs and strong messaging throughout our stores communicating our value and convenience. 454 as of January 29, 2010 Increasing Gross Margin We've made important positive changes to the processes we use to manage... -

Page 8

... and girls and Open Trails for men and boys. at price points attractive to our customers. We are also launching our new trueliving™ home brand across home décor, including kitchen and bath, trueliving™ outdoors for lawn and garden products, and trueliving™ kids, our outdoor toy line. All... -

Page 9

...-trained managers are the key to operating profitable stores and are critical to our ability to successfully expand our store base. Dollar General continues to offer employees significant opportunities to grow in their careers. In addition to the benefits from our improved real estate site selection... -

Page 10

...and Public Relations Michael J. Kindy Distribution Centers Clayton E. Klutts Financial Planning & Analysis Maurice A. Laliberte Lease Administration Terry C. Lee Consumer Brands Executive Vice Presidents David M. Tehle†Chief Financial Officer John W. Flanigan, Jr.†Global Supply Chain Kathleen... -

Page 11

... aggregate fair market value of the registrant's common stock outstanding and held by non-affiliates as of July 31, 2009 was $10,484,239, all of which was owned by employees of the registrant and not traded on a public market at that time. For this purpose, directors, executive officers and greater... -

Page 12

...are included throughout this report, particularly under the headings ''Business'' and ''Management's Discussion and Analysis of Financial Condition and Results of Operations,'' among others. You can identify these statements because they are not solely statements of historical fact or they use words... -

Page 13

... business model: providing a broad base of customers with their basic everyday and household needs, supplemented with a variety of general merchandise items, at everyday low prices in conveniently located, small-box stores. Fiscal year 2009 represented our 20th consecutive year of same-store sales... -

Page 14

... offer everyday low prices on quality merchandise is supported by our low-cost operating structure and our strategy to maintain a limited number of stock keeping units (''SKUs'') per category, which we believe helps us maintain strong purchasing power. In Dollar General stores, most items are priced... -

Page 15

...at the Vice President level, have joined the Dollar General management team since our 2007 merger. These executives are primarily in merchandising, distribution and transportation functions, as well as key support roles including store development, human resources, finance and information technology... -

Page 16

... in improved product selection and pricing decisions, contributing to our improved gross profit margins. We plan to expand our category management processes, with the intent of positively impacting our overall sales and operating profit rates. • Sourcing. In 2009, we imported approximately $629... -

Page 17

..., our private brand selections offer consumers even greater value with options to purchase entry price point items and national brand equivalent products at substantial discounts to the national brand. Our stores generally offer approximately 10,000 to 12,000 total SKUs per store. The number of SKUs... -

Page 18

... locations, time-saving shopping experience and everyday low prices on quality merchandise make our stores a compelling alternative for purchasing everyday needs. In the last year, we have seen increases in the annual number of shopping trips that our existing customer makes to Dollar General... -

Page 19

... second largest suppliers, respectively. Our private brands rely upon a diversified supplier base. We directly imported approximately 8% of our purchases at cost (13% of our purchases at retail) in 2009. Our vendor arrangements generally provide for payment for such merchandise in U.S. dollars. We... -

Page 20

... impact of certain strategic real estate and inventory management initiatives during 2007. (d) Our 2007 merger with Buck Acquisition Corp. (''BAC''), an entity controlled by KKR, was completed during the second quarter of 2007. Net sales, Gross profit, and Net income (loss) were $1,648.5, $438.5 and... -

Page 21

... on a year-to-year basis, and a license to the Fisher Price brand for certain items of children's clothing through December 31, 2010. Available Information Our Web site address is www.dollargeneral.com. We file with or furnish to the Securities and Exchange Commission (the ''SEC'') annual reports on... -

Page 22

.... Our business, financial condition or results of operations could also be adversely affected by additional factors that apply to all companies generally, as well as other risks that are not currently known to us or that we currently view to be immaterial. In any such case, the trading price of our... -

Page 23

...and other covenants. The current recession and general economic factors may adversely affect our financial performance and other aspects of our business. We believe that many of our customers are on fixed or low incomes and generally have limited discretionary spending dollars. A further slowdown in... -

Page 24

..., greater markdowns on inventory, and a reduction in profitability due to lower margins. Many of those factors, as well as commodity rates, transportation costs, costs of labor, insurance and healthcare, foreign exchange rate fluctuations, lease costs, changes in other laws and regulations and other... -

Page 25

... increased the number of our private brand items, and the program is a sizable part of our future growth plans. We believe that our success in gaining and maintaining broad market acceptance of our private brands depends on many factors, including pricing, our costs, quality and customer perception... -

Page 26

... needs, while controlling our labor costs, is subject to many external factors, including competition for and availability of qualified personnel in a given market, unemployment levels within those markets, prevailing wage rates, minimum wage laws, health and other insurance costs, and changes in... -

Page 27

... into additional market areas depends in part on the following factors: the availability of attractive store locations; the absence of occupancy delays; the ability to negotiate acceptable lease terms; the ability to hire and train new personnel, especially store managers in a cost effective manner... -

Page 28

... limited to, vendor price increases). This limitation may adversely affect our margins and financial performance. We compete for customers, employees, store sites, products and services and in other important aspects of our business with many other local, regional and national retailers. We compete... -

Page 29

...or other energy) prices or a fuel shortage, delays in opening new stores, the temporary lack of an adequate work force in a market, the temporary or long-term disruption in the supply of products from some local and overseas suppliers, the temporary disruption in the transport of goods from overseas... -

Page 30

... We do not currently maintain key person life insurance policies with respect to our executive officers or key personnel. We face risks related to protection of customers' credit card data. In connection with credit card sales, we transmit confidential credit card information. Third parties may have... -

Page 31

... delaying, preventing or deterring a change of control of our company, could deprive shareholders of an opportunity to receive a premium for their common stock as part of a sale of our company and might ultimately affect the market price of our common stock. If we, the Investors or other significant... -

Page 32

... new stores have been subject to build-to-suit arrangements, including approximately 79% of our new stores in 2009. As of February 26, 2010, we operated nine distribution centers, as described in the following table: Location Year Opened Approximate Square Footage Approximate Number of Stores Served... -

Page 33

... largest drugstore chain in New York City, from November 2005 until January 2008 and as Chairman of the Board of Duane Reade from March 2007 until January 2008. Mr. Dreiling previously served as Executive Vice President-Chief Operating Officer of Longs Drug Stores Corporation, an operator of a chain... -

Page 34

... LLP. Mr. Ravener joined Dollar General as Senior Vice President and Chief People Officer in August 2008. He was promoted to Executive Vice President in March 2010. Prior to joining Dollar General, he served in human resources executive roles with Starbucks Coffee Company from September 2005 until... -

Page 35

...Sachs & Co. each have an indirect interest in more than 10% of our capital stock through their investment in Buck Holdings, L.P. and Buck Holdings, LLC, its general partner and a Delaware limited liability company controlled by investment funds affiliated with Kohlberg Kravis Roberts & Co., L.P. 24 -

Page 36

... common stock made during the quarter ended January 29, 2010 by or on behalf of Dollar General or any ''affiliated purchaser,'' as defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934: Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Maximum Number of... -

Page 37

... controlled by investment funds affiliated with Kohlberg Kravis Roberts & Co., L.P. As a result of the Merger of the Company and Buck Acquisition Corp. (''BAC''), the related purchase accounting adjustments, and a new basis of accounting beginning on July 7, 2007, the 2007 financial reporting... -

Page 38

... results of Dollar General Corporation for the period from July 7, 2007 through February 1, 2008. Includes the effects of certain strategic merchandising and real estate initiatives that resulted in the closing of approximately 460 stores and changes in the Company's inventory management model which... -

Page 39

... quality private brand selections with prices at substantial discounts to national brands. We offer our customers these national brand and private brand products at everyday low prices (typically $10 or less) in our convenient small-box (small store) locations. On July 6, 2007, we completed a merger... -

Page 40

... in 2008 and 2009, reporting our highest gross profit rate in the last 25 years in 2009. Under new leadership, our merchandising team has been successful in our efforts to upgrade our merchandise selection to better serve our customers, while managing our everyday low price strategy. We constantly... -

Page 41

... million in September 2009. • During 2009, we opened 500 new stores, remodeled or relocated 450 stores, and closed 34 stores, resulting in a store count of 8,828 on January 29, 2010. In addition, we made good progress during the year in our efforts to better utilize existing square footage and to... -

Page 42

... need, the opportunity for sales improvement at the location and an expectation of a desirable return on investment. Key Financial Metrics. 2010: We have identified the following as our most critical financial metrics for • Same-store sales growth; • Sales per square foot; • Gross profit, as... -

Page 43

... of the business combination and associated purchase price allocation of the merger of Dollar General Corporation and Buck Acquisition Corp. (''BAC''), from July 7, 2007 to February 1, 2008. BAC was formed on March 6, 2007, and its results of operations prior to our 2007 merger, which related solely... -

Page 44

... results of operations of BAC for the period prior to its merger with and into Dollar General Corporation from March 6, 2007 (the date of BAC's formation) through July 6, 2007 (reflecting the change in fair value of interest rate swaps), and the post-merger results of Dollar General Corporation for... -

Page 45

... of square footage, extended store hours and improved marketing efforts. In 2009, we continued the transformation of our private brand products as further discussed above in the Executive Overview. The net sales increase in 2008 reflects a same-store sales increase of 9.0% compared to 2007. For... -

Page 46

...to the closing of stores and the implementation of new inventory strategies; a $12.0 million loss in the 2007 pro forma period compared to a $5.0 million gain in 2008 relating to possible losses on distribution center leases; and decreases in workers compensation and other insurance-related costs in... -

Page 47

... credit agreement and senior subordinated notes, along with lower interest rates. See the detailed discussion under ''Liquidity and Capital Resources'' regarding indebtedness incurred to finance our 2007 merger along with subsequent repurchases of various long-term obligations and the related... -

Page 48

...and Successor relating to the periods preceding and succeeding the merger, respectively. As a result of the merger, we applied purchase accounting standards and a new basis of accounting effective July 7, 2007. The unaudited pro forma condensed consolidated statement of operations for the year ended... -

Page 49

... also includes management fees that were payable under a sponsor advisory agreement subsequent to the closing of our 2007 merger and related transactions (at an initial annual rate of $5.0 million which was increased by 5% for each succeeding year until the termination of the agreement in connection... -

Page 50

... the senior notes, 10 years for the senior subordinated notes and 8 years for other capitalized debt issuance costs. Also includes the amortization of debt discount of the senior notes. (8) Represents interest expense on long-term liabilities which were discounted as a result of our 2007 merger. 39 -

Page 51

... decisions which slowed our store growth in 2007 and 2008, but we accelerated store growth in 2009 and currently plan to continue that strategy in 2010 and beyond. On September 8, 2009, our Board of Directors declared a special dividend on our outstanding common stock of approximately $239.3 million... -

Page 52

... Loan Facility'') with cash generated from operations. At January 29, 2010, we had total outstanding debt (including the current portion of long-term obligations) of $3.40 billion. We also had an additional $930.6 million available for borrowing under our senior secured asset-based revolving credit... -

Page 53

... The mandatory prepayments discussed above will be applied to the Term Loan Facility as directed by the senior secured credit agreement. Through January 29, 2010, no prepayments have been required under the prepayment provisions listed above. The Term Loan Facility can be prepaid in whole or in part... -

Page 54

... secured credit agreements contain a number of covenants that, among other things, restrict, subject to certain exceptions, our ability to: • incur additional indebtedness; • sell assets; • pay dividends and distributions or repurchase our capital stock; • make investments or acquisitions... -

Page 55

... under our Credit Facilities. We may redeem some or all of the Notes at any time at redemption prices described or set forth in the indentures. We also may seek, from time to time, to retire some or all of the Notes through cash purchases on the open market, in privately negotiated transactions... -

Page 56

... on distribution center leases ...Impact of markdowns related to inventory clearance activities, net of purchase accounting adjustments Hurricane-related expenses and write-offs ...Advisory and consulting fees to affiliates ...Non-cash expense for share-based awards ...Indirect merger-related costs... -

Page 57

... 2010, the net credit valuation adjustments reduced the settlement values of our derivative liabilities by $2.0 million. Various factors impact changes in the credit valuation adjustments over time, including changes in the credit spreads of the parties to the contracts, as well as changes in market... -

Page 58

... for interest payments on long-term debt and capital lease obligations, and includes projected interest on variable rate long-term debt, based upon 2009 year end rates. (b) We retain a significant portion of the risk for our workers' compensation, employee health insurance, general liability... -

Page 59

... principal factor in the increase in income taxes paid in 2009 compared to 2008. Changes in Accrued expenses and other were affected in part by the timing of the payments related to the Litigation settlement and related costs discussed above under ''Results of Operations,'' as the insurance proceeds... -

Page 60

... for new stores; $17 million for distribution and transportation-related capital expenditures; and $13 million for information systems upgrades and technology-related projects. During 2008 we opened 207 new stores and remodeled or relocated 404 stores. Purchases and sales of short-term investments... -

Page 61

... the revolving credit agreements in 2008 and the 2007 Successor period were primarily a result of activity associated with periodic cash needs. Critical Accounting Policies and Estimates The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and... -

Page 62

... testing process may include projecting future cash flows, determining appropriate discount rates and other assumptions. Projections are based on management's best estimates given recent financial performance, market trends, strategic plans and other available information and in recent years have... -

Page 63

...recorded at cost. We group our assets into relatively homogeneous classes and generally provide for depreciation on a straight-line basis over the estimated average useful life of each asset class, except for leasehold improvements, which are amortized over the lesser of the applicable lease term or... -

Page 64

... have stores subject to shorter-term leases (usually with initial or current terms of 3 to 5 years), and many of these leases have multiple renewal options. As of January 29, 2010, approximately 38% of our stores had provisions for contingent rentals based upon a percentage of defined sales volume... -

Page 65

...based on a peer group of publicly traded companies), applicable interest rates and the dividend yield of our stock. Our volatility estimates are based on a peer group due to the fact that our stock was publicly traded for only a small portion of our most recently completed fiscal year. Other factors... -

Page 66

... general standards of accounting for and disclosures of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. In particular, this topic sets forth the period after the balance sheet date during which management of a reporting... -

Page 67

... in the value of the financial instruments are generally offset by reciprocal changes in the value of the underlying economic exposure. Interest Rate Risk We manage our interest rate risk through the strategic use of fixed and variable interest rate debt and, from time to time, derivative financial... -

Page 68

... we are unable to enter into new swap agreements on terms favorable to us, our ability to effectively manage our interest rate risk may be materially impaired. We attempt to manage counterparty credit risk by periodically evaluating the financial position and creditworthiness of such counterparties... -

Page 69

... effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant... -

Page 70

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts) Successor January 29, January 30, 2010 2009 ASSETS Current assets: Cash and cash equivalents ...Merchandise inventories ...Income taxes receivable ...Deferred income taxes ...Prepaid ... -

Page 71

...operations of Buck Acquisition Corp. (''BAC'') for the period prior to its Merger with and into Dollar General Corporation from March 6, 2007 (the date of BAC's formation) through July 6, 2007 (reflecting the change in fair value of interest rate swaps), and the post-Merger results of Dollar General... -

Page 72

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In thousands except per share amounts) Retained Accumulated Common Additional Earnings Other Other Stock Common Paid-in (Accumulated Comprehensive Shareholders' Shares Stock Capital Deficit) Loss Equity ... -

Page 73

... of property and equipment awaiting processing for payment, included Accounts payable ...Purchases of property and equipment under capital lease obligations ...Expiration of equity repurchase rights ...Exchange of shares and stock options in business combination ...(a) ...in ... $ 328,433 187... -

Page 74

... reflect the reverse stock split. The Company completed the initial public offering of its common stock on November 18, 2009, as described in more detail in Note 2. Business description The Company sells general merchandise on a retail basis through 8,828 stores (as of January 29, 2010) in 35 states... -

Page 75

... and supplemental retirement plans, as further discussed in Note 10) are stated at fair value, with changes in fair value recorded as a component of Selling, general and administrative (''SG&A'') expense. As of January 29, 2010 and January 30, 2009, the Company had investments in trading securities... -

Page 76

... retail value of sales at a department level. Costs directly associated with warehousing and distribution are capitalized into inventory. The excess of current cost over LIFO cost was approximately $47.5 million and $50.0 million at January 29, 2010 and January 30, 2009, respectively. Current cost... -

Page 77

... value is estimated based primarily upon estimated future cash flows (discounted at the Company's credit adjusted risk-free rate) or other reasonable estimates of fair market value. Assets to be disposed of are adjusted to the fair value less the cost to sell if less than the book value. The Company... -

Page 78

..., lease contract termination liabilities for closed stores, common area and other maintenance charges, store insurance liabilities and income tax related reserves. Insurance liabilities The Company retains a significant portion of risk for its workers' compensation, employee health, general... -

Page 79

.... ARIC currently insures no unrelated third-party risk. As a result of the Merger, the Company recorded its assumed self-insurance reserves as of the Merger date at their present value in accordance with applicable accounting standards for business combinations, using a discount rate of 5.4%. The... -

Page 80

...CONSOLIDATED FINANCIAL STATEMENTS (Continued) 1. Basis of presentation and accounting policies (Continued) Other liabilities Non-current Other liabilities consist of the following: Successor January 29, January 30, 2010 2009 (In thousands) Compensation and benefits Insurance ...Income tax related... -

Page 81

... GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 1. Basis of presentation and accounting policies (Continued) fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. The valuation of the Company... -

Page 82

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 1. Basis of presentation and accounting policies (Continued) The following table presents the Company's assets and liabilities measured at fair value on a recurring basis as of January 29, 2010, ... -

Page 83

... January 29, 2010, the Company has not recorded any breakage income related to its gift card program. Advertising costs Advertising costs are expensed upon performance, ''first showing'' or distribution, and are reflected net of qualifying cooperative advertising funds provided by vendors in SG... -

Page 84

...'s consolidated financial statements or income tax returns. Deferred income tax expense or benefit is the net change during the year in the Company's deferred income tax assets and liabilities. As discussed in Note 6, effective February 3, 2007 the Predecessor modified its method of accounting for... -

Page 85

... and accounting policies (Continued) prove to be inaccurate, the resulting adjustments could be material to the Company's future financial results. Management estimates The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted... -

Page 86

...Company paid a $4.8 million transaction fee to Kohlberg Kravis Roberts & Co., L.P. (''KKR'') and Goldman, Sachs & Co. in connection with the offering. Although this transaction fee was not paid from the net proceeds of the offering, it was directly related to the offering and accounted for as a cost... -

Page 87

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 3. Merger (Continued) Merger as a subsidiary of Buck. The Company's results of operations after July 6, 2007 include the effects of the Merger. The aggregate purchase price was approximately $7.1 ... -

Page 88

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 3. Merger (Continued) The purchase price allocation as of January 29, 2010 and January 30, 2009 also included approximately $1.4 billion of other intangible assets, as follows: Estimated Useful Life ... -

Page 89

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 3. Merger (Continued) adjustments, including the depreciation and amortization of the assets acquired based on their estimated fair values and changes in interest expense resulting from changes in ... -

Page 90

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. Earnings per share (Continued) Options to purchase shares of common stock that were outstanding at the end of the respective periods, but were not included in the computation of diluted earnings (... -

Page 91

...impact that the non-deductible, merger related lawsuit settlement had on the 2008 rate. This reduction in the effective tax rate was partially offset by a decrease in the tax rate benefit related to federal jobs credits. While the total amount of jobs credits earned in 2009 was similar to the amount... -

Page 92

...and other ...Accrued rent ...Accrued insurance ...Accrued bonuses ...Interest rate hedges ...Tax benefit of income tax and interest reserves related to uncertain tax positions ...Other ...State tax net operating loss carryforwards, net of federal tax ...State tax credit carryforwards, net of federal... -

Page 93

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Income taxes (Continued) The Company has state net operating loss carryforwards as of January 29, 2010 that total approximately $203.9 million which will expire in 2017 through 2023. The Company ... -

Page 94

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Income taxes (Continued) As of January 30, 2009, accruals for uncertain tax benefits, interest expense related to income taxes and potential income tax penalties were $59.1 million, $11.3 million ... -

Page 95

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Income taxes (Continued) A reconciliation of the uncertain income tax positions from February 3, 2007 (the date of adoption) through January 29, 2010 is as follows: (In thousands) Balance as of ... -

Page 96

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 7. Current and long-term obligations Current and long-term obligations consist of the following: (In thousands) Successor January 29, 2010 January 30, 2009 Senior secured term loan facility ...ABL ... -

Page 97

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 7. Current and long-term obligations (Continued) unutilized commitments under the ABL Facility are equal to or less than 50% of the aggregate commitments under the ABL Facility. The Company also must ... -

Page 98

... or set forth in the indentures. In addition, the holders of the Notes can require the Company to redeem the Notes at 101% of the aggregate principal amount outstanding in the event of certain change in control events. In connection with the Company's November 2009 initial public offering, as... -

Page 99

... uncertainties of future market values caused by the fluctuation in the prices of commodities. From time to time the Company has entered into derivative financial instruments to protect against future price changes related to transportation costs associated with forecasted distribution of inventory... -

Page 100

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 8. Derivative financial instruments (Continued) derivatives not designated in hedging relationships are recorded directly in earnings. As of January 29, 2010, the Company had no outstanding commodity ... -

Page 101

... shorter-term leases (usually with initial or current terms of three to five years), and many of these leases have multiple renewal options. Approximately 38% of the leased stores have provisions for contingent rentals based upon a specified percentage of defined sales volume. The land and buildings... -

Page 102

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 9. Commitments and contingencies (Continued) Future minimum payments as of January 29, 2010 for capital and operating leases are as follows: (In thousands) Capital Leases Operating Leases 2010 ...... -

Page 103

...effect on the Company's financial statements as a whole. On May 18, 2006, the Company was served with a lawsuit entitled Tammy Brickey, Becky Norman, Rose Rochow, Sandra Cogswell and Melinda Sappington v. Dolgencorp, Inc. and Dollar General Corporation (Western District of New York, Case No. 6:06-cv... -

Page 104

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 9. Commitments and contingencies (Continued) Company opposed plaintiffs' motion. On November 30, 2007, the court conditionally certified a nationwide class of females under the Equal Pay Act who worked for Dollar General as store managers between... -

Page 105

... a process to identify, mark down and cease the sale of any remaining inventory that would be impacted by the new law. The impact of this process was not material to the Company's consolidated financial statements. 10. Benefit plans The Dollar General Corporation 401(k) Savings and Retirement Plan... -

Page 106

...CDP''), known as the Dollar General Corporation CDP/SERP Plan, for a select group of management and highly compensated employees. The supplemental retirement plan is a noncontributory defined contribution plan with annual Company contributions ranging from 2% to 12% of base pay plus bonus depending... -

Page 107

... event of an earlier change in control or certain public offerings of the Company's common stock. Each of these options, whether Time Options or Performance Options have a contractual term of 10 years and an exercise price equal to the fair value of the underlying common stock on the date of grant... -

Page 108

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Share-based payments (Continued) Both the Time Options and the Performance Options are subject to various provisions set forth in a management stockholder's agreement entered into with each option... -

Page 109

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Share-based payments (Continued) For the year ended January 29, 2010, the fair value method of accounting for share-based awards resulted in share-based compensation expense (a component of SG&A ... -

Page 110

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Share-based payments (Continued) volatility based upon traded options, weighted equally, to calculate the volatility assumption, as it was the Company's belief that this methodology provided the ... -

Page 111

... intrinsic value of all stock options repurchased by the Company under terms of the management stockholders' agreements during 2009, 2008 and the 2007 Successor period was $0.8 million, $2.5 million and $0.5 million, respectively. At January 29, 2010, the total unrecognized compensation cost related... -

Page 112

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Share-based payments (Continued) Through January 29, 2010, all Time Options and Performance Options have been granted to employees. During the fourth quarter of 2009, the Company granted 33,051 ... -

Page 113

... the Company agreed to provide customary indemnification to such parties and their affiliates. From time to time, the Company uses Capstone Consulting, LLC, a team of executives who work exclusively with KKR portfolio companies providing certain consulting services. The Chief Executive Officer of... -

Page 114

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 13. Segment reporting The Company manages its business on the basis of one reportable segment. See Note 1 for a brief description of the Company's business. As of January 29, 2010, all of the Company... -

Page 115

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 14. Quarterly financial data (unaudited) (Continued) management and advisory services to the Company, which resulted in a pretax charge of approximately $58.8 million ($46.2 million net of tax, or $0.... -

Page 116

...) The following consolidating schedules present condensed financial information on a combined basis, in thousands. January 29, 2010 DOLLAR GENERAL CORPORATION GUARANTOR SUBSIDIARIES OTHER SUBSIDIARIES CONSOLIDATED TOTAL SUCCESSOR BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents... -

Page 117

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. Guarantor subsidiaries (Continued) January 30, 2009 DOLLAR GENERAL CORPORATION GUARANTOR SUBSIDIARIES OTHER SUBSIDIARIES CONSOLIDATED TOTAL SUCCESSOR BALANCE SHEET: ASSETS Current assets: Cash ... -

Page 118

... FINANCIAL STATEMENTS (Continued) 15. Guarantor subsidiaries (Continued) For the year ended January 29, 2010 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL SUCCESSOR STATEMENTS OF OPERATIONS: Net sales ...Cost of goods sold ...Gross profit... -

Page 119

... 6, 2007 through February 1, 2008 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL SUCCESSOR STATEMENTS OF OPERATIONS: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Transaction and related costs... -

Page 120

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. Guarantor subsidiaries (Continued) For the year ended January 29, 2010 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL SUCCESSOR STATEMENTS OF CASH FLOWS: Cash flows from operating activities... -

Page 121

... and other current assets ...Accounts payable ...Accrued expenses and other liabilities ...Income taxes ...Other ...Net cash provided by (used in) operating activities ...Cash flows from investing activities: Purchases of property and equipment . Purchases of short-term investments . Sales of short... -

Page 122

... CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. Guarantor subsidiaries (Continued) March 6, 2007 through February 1, 2008 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL SUCCESSOR STATEMENTS OF CASH FLOWS: Cash flows from operating activities... -

Page 123

... . . Sale and insurance proceeds related to property and equipment ...Net cash used in investing activities . . Cash flows from financing activities: Repayments of long-term obligations Payment of cash dividends ...Proceeds from exercise of stock options ...Tax benefit of stock options ...Changes in... -

Page 124

... ''Exchange Act''). Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. (b) Management's Annual Report on Internal Control Over Financial... -

Page 125

... to Dollar General Corporation, c/o Investor Relations Department, 100 Mission Ridge, Goodlettsville, TN 37072. We intend to provide any required disclosure of an amendment to or waiver from the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial... -

Page 126

...BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS (a) Equity Compensation Plan Information. The following table sets forth information about securities authorized for issuance under our compensation plans (including individual compensation arrangements) as of January 29, 2010: Number... -

Page 127

... All schedules for which provision is made in the applicable accounting regulations of the SEC are not required under the related instructions, are inapplicable or the information is included in the Consolidated Financial Statements and, therefore, have been omitted. Exhibits: See Exhibit Index... -

Page 128

... the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. DOLLAR GENERAL CORPORATION Date: March 31, 2010 By: /s/ RICHARD W. DREILING Richard W. Dreiling, Chairman and Chief Executive Officer We, the... -

Page 129

Name Title Date /s/ WILLIAM C. RHODES, III WILLIAM C. RHODES, III Director March 31, 2010 /s/ DAVID B. RICKARD DAVID B. RICKARD Director March 31, 2010 118 -

Page 130

... stock of Dollar General Corporation is traded on the New York Stock Exchange under the trading symbol "DG." The number of shareholders of record of the Company's common stock as of March 29, 2010 was 466. Store Support Center Dollar General Corporation 100 Mission Ridge Goodlettsville, Tennessee... -

Page 131

Good-buy! 100 Mission Ridge Goodlettsville, TN 37072 www.dollargeneral.com