Dish Network 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

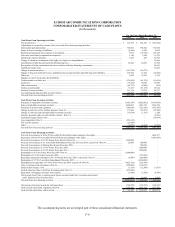

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

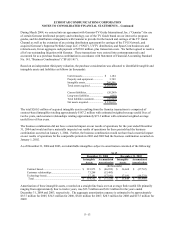

During March 2004, we entered into an agreement with Gemstar-TV Guide International, Inc. (“Gemstar”) for use

of certain Gemstar intellectual property and technology, use of the TV Guide brand on our interactive program

guides, and for distribution arrangements with Gemstar to provide for the launch and carriage of the TV Guide

Channel as well as the extension of an existing distribution agreement for carriage of the TVG Network, and

acquired Gemstar’s Superstar/Netlink Group LLC (“SNG”), UVTV distribution, and SpaceCom businesses and

related assets, for an aggregate cash payment of $238.0 million, plus transaction costs. We further agreed to resolve

all of our outstanding litigation with Gemstar. These transactions were entered into contemporaneously and

accounted for as a purchase business combination in accordance with Statement of Financial Accounting Standard

No. 141, “Business Combinations” (“SFAS 141”).

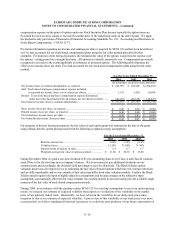

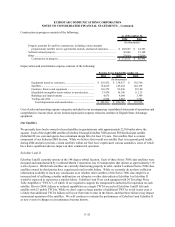

Based on an independent third-party valuation, the purchase consideration was allocated to identifiable tangible and

intangible assets and liabilities as follows (in thousands):

Current assets............................... 1,184$

Property and equipment............... 3,749

Intangible assets........................... 260,546

Total assets acquired.................... 265,479$

Current liabilities......................... (26,269)

Long-term liabilities..................... (600)

Total liabilities assumed............... (26,869)

N

et assets acquired....................... 238,610$

The total $260.5 million of acquired intangible assets resulting from the Gemstar transactions is comprised of

contract-based intangibles totaling approximately $187.2 million with estimated weighted-average useful lives of

twelve years, and customer relationships totaling approximately $73.3 million with estimated weighted-average

useful lives of four years.

The business combination did not have a material impact on our results of operations for the year ended December

31, 2004 and would not have materially impacted our results of operations for these periods had the business

combination occurred on January 1, 2004. Further, the business combination would not have had a material impact

on our results of operations for the comparable periods in 2003 and 2002 had the business combination occurred on

January 1, 2002.

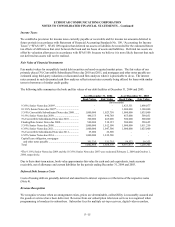

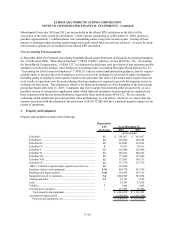

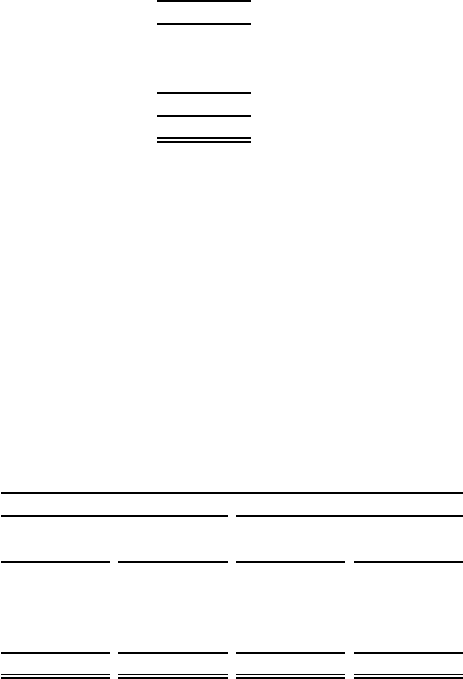

As of December 31, 2004 and 2003, our identifiable intangibles subject to amortization consisted of the following:

As of

December 31, 2004 December 31, 2003

Intangible Accumulated Intangible Accumulated

Assets Amortization Assets Amortization

(In thousands)

Contract based......................................................... 223,873$ (46,852)$ 36,668$ (27,767)$

Customer relationships............................................ 73,298 (13,493) - -

Technology based.................................................... 17,181 (17,181) 17,181 (16,221)

Total ..................................................................... 314,352$ (77,526)$ 53,849$ (43,988)$

Amortization of these intangible assets, recorded on a straight line basis over an average finite useful life primarily

ranging from approximately four to twelve years, was $33.5 million and $10.3 million for the years ended

December 31, 2004 and 2003, respectively. The aggregate amortization expense is estimated to be approximately

$35.7 million for 2005, $34.5 million for 2006, $34.0 million for 2007, $20.3 million for 2008 and $15.5 million for

2009.

F–13