Dish Network 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

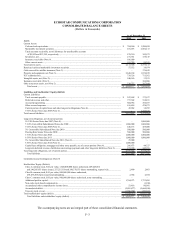

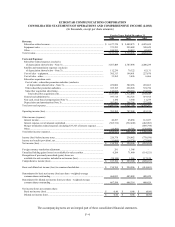

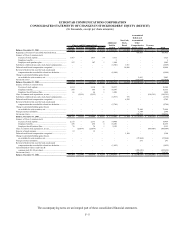

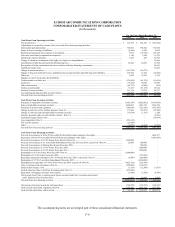

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

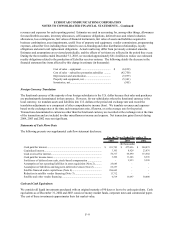

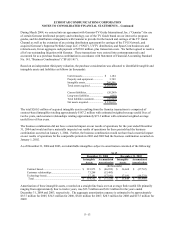

For the Years Ended December 31,

2004 2003 2002

Cash Flows From Operating Activities:

Net income (loss) ......................................................................................................................................................................... 214,769$ 224,506$ (852,034)$

Adjustments to reconcile net income (loss) to net cash flows from operating activities:

Depreciation and amortization ..................................................................................................................................................... 502,901 398,206 372,958

Equity in losses (earnings) of affiliates ........................................................................................................................................ (5,686) 1,649 8,012

Realized and unrealized losses (gains) on investments ................................................................................................................ 9,031 (19,784) 135,619

Non-cash, stock-based compensation recognized ........................................................................................................................ 1,180 3,544 11,279

Deferred tax expense (benefit)...................................................................................................................................................... 5,362 629 66,703

Change in valuation of contingent value rights, net of gain on extinguishment............................................................................ - - 19,645

Amortization of debt discount and deferred financing costs ........................................................................................................ 22,262 26,685 11,906

Recognition of bridge commitment fees from reduction of bridge financing commitments.......................................................... - - 48,435

Capitalized merger costs............................................................................................................................................................... - - 56,474

Change in noncurrent assets.......................................................................................................................................................... (114,705) (49,333) -

Change in long-term deferred revenue, distribution and carriage payments and other long-term liabilities................................. 109,522 11,434 (20,924)

Other, net ...................................................................................................................................................................................... 9,942 15,835 4,756

Changes in current assets and current liabilities:

Trade accounts receivable, net ..................................................................................................................................................... (125,629) (14,178) (10,619)

Inventories .................................................................................................................................................................................... (70,501) 18,020 69,709

Other current assets ...................................................................................................................................................................... (44,757) (6,860) (474)

Trade accounts payable ................................................................................................................................................................ 76,152 (91,176) 18,014

Deferred revenue and other........................................................................................................................................................... 211,161 71,074 84,333

Accrued programming and other accrued expenses ..................................................................................................................... 200,438 (14,670) 42,952

Net cash flows from operating activities ...................................................................................................................................... 1,001,442 575,581 66,744

Cash Flows From Investing Activities:

Purchases of marketable investment securities ............................................................................................................................. (1,932,789) (5,050,502) (5,770,963)

Sales of marketable investment securities .................................................................................................................................... 4,096,005 3,641,939 5,602,398

Purchases of property and equipment ........................................................................................................................................... (980,587) (321,819) (435,819)

Change in cash reserved for satellite insurance (Note 9)............................................................................................................... 176,843 (25,471) (29,304)

Change in restricted cash and marketable investment securities .................................................................................................. (10,918) (1,533) 1,288

Incentive payments under in-orbit satellite contract - Echo VI..................................................................................................... - - (8,441)

Capitalized merger-related costs .................................................................................................................................................. - - (38,644)

Asset acquisition (Note 2)............................................................................................................................................................. (238,610) - -

FCC auction deposits.................................................................................................................................................................... (26,684) - -

Other ............................................................................................................................................................................................ (4,979) (4,484) (2,902)

Net cash flows from investing activities ....................................................................................................................................... 1,078,281 (1,761,870) (682,387)

Cash Flows From Financing Activities:

Proceeds from issuance of Series D Convertible Preferred Stock and contingent value rights..................................................... - - 1,483,477

Repurchase of Series D Convertible Preferred Stock and contingent value rights........................................................................ - - (1,065,689)

Proceeds from issuance of 6 5/8% Senior Notes due 2014 (Note 4)............................................................................................. 1,000,000 - -

Proceeds from issuance of 3% Convertible Subordinated Notes due 2011 and 2010, respectively (Note 4)................................ 25,000 500,000 -

Proceeds from issuance of Floating Rate Senior Notes due 2008................................................................................................. - 500,000 -

Proceeds from issuance of 5 3/4% Senior Notes due 2008........................................................................................................... - 1,000,000 -

Proceeds from issuance of 6 3/8% Senior Notes due 2011........................................................................................................... - 1,000,000 -

Redemption of 10 3/8% Senior Notes due 2007 (Note 4)............................................................................................................. (1,000,000) - -

Redemption of 9 1/4% Senior Notes due 2006............................................................................................................................. - (375,000) -

Repurchase and partial redemption of 9 1/8% Senior Notes due 2009, respectively (Note 4)...................................................... (8,847) (245,000) -

Redemption of 4 7/8% Convertible Subordinated Notes due 2007............................................................................................... - (1,000,000) -

Redemption and repurchase of 9 3/8% Senior Notes due 2009, respectively (Note 4)................................................................. (1,423,351) (201,649) -

Class A common stock repurchases (Note 6)................................................................................................................................ (809,609) (190,391) -

Deferred debt issuance costs ........................................................................................................................................................ (3,159) (12,500) (1,837)

Cash dividend on Class A and Class B common stock (Note 6)................................................................................................... (455,650) - -

Repayment of mortgages and other notes payable ....................................................................................................................... (6,998) (1,828) (4,549)

Net proceeds from Class A common stock options exercised and Class A common stock issued

under Employee Stock Purchase Plan ....................................................................................................................................... 16,592 20,438 9,430

Net cash flows from financing activities ...................................................................................................................................... (2,666,022) 994,070 420,832

Net increase (decrease) in cash and cash equivalents ................................................................................................................... (586,299) (192,219) (194,811)

Cash and cash equivalents, beginning of period............................................................................................................................ 1,290,859 1,483,078 1,677,889

Cash and cash equivalents, end of period...................................................................................................................................... 704,560$ 1,290,859$ 1,483,078$

F–6