Dish Network 2004 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

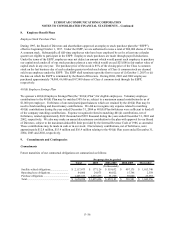

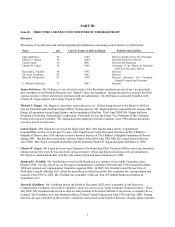

10. Segment Reporting

Financial Data by Business Unit

Statement of Financial Accounting Standards No. 131, “Disclosures About Segments of an Enterprise and Related

Information” (“SFAS 131”) establishes standards for reporting information about operating segments in annual

financial statements of public business enterprises and requires that those enterprises report selected information

about operating segments in interim financial reports issued to shareholders. Operating segments are components of

an enterprise about which separate financial information is available and regularly evaluated by the chief operating

decision maker(s) of an enterprise. Under this definition we currently operate as two business units. The All Other

column consists of revenue from other satellite services and expenses from other operating segments for which the

disclosure requirements of SFAS 131 do not apply.

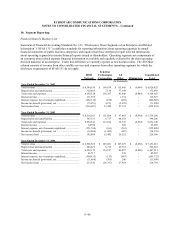

EchoStar

DISH Technologies All Consolidated

Network Corporation Other Eliminations Total

(In thousands)

Year Ended December 31, 2002

Total revenue .................................................................... 4,544,550$ 169,674$ 113,445$ (6,844)$ 4,820,825$

Depreciation and amortization .......................................... 328,495 7,114 37,349 - 372,958

Total costs and expenses ................................................... 4,158,324 136,387 81,440 (6,844) 4,369,307

Interest income .................................................................. 111,593 - 1,334 - 112,927

Interest expense, net of amounts capitalized ..................... (482,512) (188) (203) - (482,903)

Income tax benefit (provision), net ................................... (75,253) 4,233 (2,078) - (73,098)

Net income (loss) .............................................................. (916,607) 37,440 27,133 - (852,034)

Year Ended December 31, 2003

Total revenue .................................................................... 5,518,183$ 131,684$ 97,983$ (8,554)$ 5,739,296$

Depreciation and amortization .......................................... 347,331 6,717 44,158 - 398,206

Total costs and expenses ................................................... 4,852,543 115,012 72,747 (8,554) 5,031,748

Interest income .................................................................. 64,750 - 308 - 65,058

Interest expense, net of amounts capitalized ..................... (551,768) (161) (561) - (552,490)

Income tax benefit (provision), net ................................... (12,604) (1,085) (687) - (14,376)

Net income (loss) .............................................................. 182,809 15,445 26,252 - 224,506

Year Ended December 31, 2004

Total revenue .................................................................... 6,926,528$ 125,881$ 107,675$ (8,868)$ 7,151,216$

Depreciation and amortization .......................................... 446,822 6,718 49,361 - 502,901

Total costs and expenses ................................................... 6,222,175 154,147 80,457 (8,868) 6,447,911

Interest income .................................................................. 41,717 - 570 - 42,287

Interest expense, net of amounts capitalized ..................... (504,612) (133) (987) - (505,732)

Income tax benefit (provision), net ................................... (11,464) (385) 240 - (11,609)

Net income (loss) .............................................................. 215,582 (28,767) 27,954 - 214,769

F–46