Dish Network 2004 Annual Report Download - page 54

Download and view the complete annual report

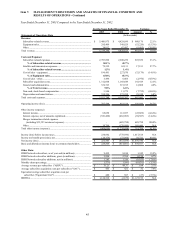

Please find page 54 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

46

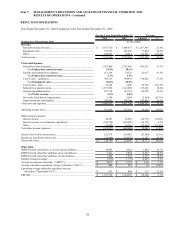

DISH Network subscribers. As of December 31, 2003, we had approximately 9.425 million DISH Network

subscribers compared to approximately 8.180 million at December 31, 2002, an increase of approximately 15.2%.

DISH Network added approximately 1.245 million net new subscribers for the year ended December 31, 2003

compared to approximately 1.350 million net new subscribers during the same period in 2002. We believe the

reduction in net new subscribers for the year ended December 31, 2003, compared to the same period in 2002,

resulted from a number of factors, including stronger competition from advanced digital cable and cable modems.

Additionally, as the size of our subscriber base continues to increase, even if percentage churn remains constant,

increasing numbers of gross new subscribers are required to sustain net subscriber growth.

Subscriber additions during the second half of 2003 were negatively impacted by delays in the delivery of several

newly developed products, which resulted in a temporary product shortage, and product installations in the third and

fourth quarter of 2003. These delays were substantially eliminated during the first quarter of 2004.

Subscriber-related revenue. DISH Network “Subscriber-related revenue” totaled $5.410 billion for the year ended

December 31, 2003, an increase of $980.2 million or 22.1% compared to the same period in 2002. This increase

was directly attributable to continued DISH Network subscriber growth and the increase in “ARPU” discussed

below.

ARPU. Monthly average revenue per subscriber was approximately $51.21during the year ended December 31, 2003

and approximately $49.37 during the same period in 2002. The $1.84 or 3.7% increase in monthly average revenue per

subscriber is primarily attributable to price increases of up to $2.00 in February 2003 on some of our most popular

packages, the increased availability of local channels by satellite and an increase in the number of DISH Network

subscribers with multiple set-top boxes. During 2003, we launched 47 additional local markets compared to the launch

of 18 additional markets during 2002. These increases were partially offset by certain subscriber promotions, under

which new DISH Network subscribers received free programming for the first three months of their term of service,

and other promotions under which DISH Network subscribers received discounted programming.

Equipment sales. For the year ended December 31, 2003, “Equipment sales” totaled $295.4 million, a decrease of

$53.2 million or 15.3% compared to the same period during 2002. The decrease in “Equipment sales” principally

resulted from a decline in the number of digital set-top boxes and related components sold by our ETC subsidiary to an

international DBS service provider.

Subscriber-related expenses. “Subscriber-related expenses” totaled $2.708 billion during the year ended December

31, 2003, an increase of $507.7 million or 23.1% compared to the same period in 2002. The increase in “Subscriber-

related expenses” was primarily attributable to the increase in the number of DISH Network subscribers. This growth

resulted in increased expenses to support the DISH Network, including programming costs, personnel expenses, the

opening of a new call center, and increased operating expenses related to the expansion of our DISH Network Service

L.L.C. business. “Subscriber-related expenses” represented 50.1% and 49.7% of “Subscriber-related revenue” during

the years ended December 31, 2003 and 2002, respectively. The increase in “Subscriber-related expenses” as a

percentage of “Subscriber-related revenue” primarily resulted from an approximately $30.2 million reversal of an

accrual during 2002 related to the replacement of smart cards in satellite receivers owned by us and leased to

consumers. This accrual reversal decreased the 2002 expense to revenue ratio from 50.4% to 49.7%. The increase

in the expense to revenue ratio from 2002 to 2003 was partially offset by an increase in monthly average revenue per

subscriber and increased operating efficiencies.

Satellite and transmission expenses. “Satellite and transmission expenses” totaled $79.3 million during the year ended

December 31, 2003, an increase of $17.2 million or 27.7% compared to the same period in 2002. This increase

primarily resulted from commencement of service and operational costs associated with the increasing number of

markets in which we offer local network channels by satellite as previously discussed. “Satellite and transmission

expenses” totaled 1.5% and 1.4% of “Subscriber-related revenue” during each of the years ended December 31, 2003

and 2002, respectively.

Cost of sales – equipment. “Cost of sales – equipment” totaled $194.5 million during the year ended December 31,

2003, a decrease of $33.2 million or 14.6% compared to the same period in 2002. This decrease related primarily to a

decrease in sales of digital set-top boxes and related components by our ETC subsidiary to an international DBS service

provider. “Cost of sales – equipment” during the years ended December 31, 2003 and 2002 include non-recurring