Dish Network 2004 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

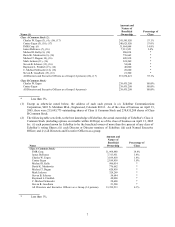

(3) Mr. Ergen beneficially owns all of the EchoStar Class A common stock owned by his spouse, Mrs. Ergen. Mr.

Ergen’s beneficial ownership includes: (i) 213,902 Class A shares; (ii) 18,141 Class A Shares held in

EchoStar’s 401(k) Employee Savings Plan (the “401(k) Plan”); (iii) the right to acquire 920,000 Class A

Shares within 60 days upon the exercise of employee stock options; (iv) 110 Class A shares held by Mr.

Ergen’s spouse, Cantey Ergen; (v) 749 Class A Shares held in the 401(k) Plan held by Mr. Ergen’s spouse,

Cantey Ergen; (vi) 16,800 Class A Shares held as custodian for his children, (vii) 350,000 Class A Shares held

as a trustee; and (viii) 238,435,208 Class A Shares issuable upon conversion of Mr. Ergen’s Class B Shares.

(4) The percentage of total voting power held by Mr. Ergen is approximately 92% after giving effect to the

exercise of Mr. Ergen's options exercisable within 60 days.

(5) Mrs. Ergen beneficially owns all of the EchoStar Class A common stock owned by her spouse, Mr. Ergen

except for Mr. Ergen’s right to acquire 920,000 Class A Shares within 60 days upon the exercise of employee

stock options.

(6) As known to EchoStar pursuant to a Schedule 13G/A filed on February 15, 2005. The address of FMR Corp.

is 82 Devonshire Street, Boston, Massachusetts 02109.

(7) Mr. DeFranco’s beneficial ownership includes: (i) 4,765,202 Class A shares; (ii) 18,141 Class A Shares held

in the 401(k) Plan; (iii) the right to acquire 224,000 Class A Shares within 60 days upon the exercise of

employee stock options; (iv) 56,608 Class A Shares held as custodian for his minor children; and (v) 2,250,000

Class A Shares controlled by Mr. DeFranco as general partner of a partnership.

(8) Mr. Kelly’s beneficial ownership includes: (i) 151,010 Class A shares; (ii) 320 Class A Shares held in the

401(k) Plan; (iii) the right to acquire 824,000 Class A Shares within 60 days upon the exercise of employee

stock options; (iv) 3,000 Class A Shares held as custodian for his minor children; (v) 3,500 Class A Shares

held in the names of his children; and (vi) 4,184 Class A Shares held in the employee stock purchase plan.

(9) Mr. Moskowitz’s beneficial ownership includes: (i) 509,970 Class A shares; (ii) 17,333 Class A Shares held in

the 401(k) Plan; (iii) the right to acquire 206,863 Class A Shares within 60 days upon the exercise of employee

stock options; (iv) 1,328 Class A Shares held as custodian for his minor children; (v) 8,184 Class A Shares

held as trustee for Mr. Ergen’s children; and (vi) 32,984 Class A Shares held by a charitable foundation for

which Mr. Moskowitz is a member of the Board of Directors.

(10) Mr. Dugan’s beneficial ownership includes: (i) 110,350 Class A shares; (ii) 17,654 Class A Shares held in the

401(k) Plan; and (iii) the right to acquire 492,814 Class A Shares within 60 days upon the exercise of

employee stock options.

(11) Mr. Jackson’s beneficial ownership includes: (i) 350 Class A shares; (ii) 11,919 Class A Shares held in the

401(k) Plan; and (iii) the right to acquire 312,000 Class A Shares within 60 days upon the exercise of

employee stock options.

(12) Mr. Schaver’s beneficial ownership includes: (i) 30,350 Class A shares; (ii) 16,294 Class A Shares held in the

401(k) Plan; and (iii) the right to acquire 8,000 Class A Shares within 60 days upon the exercise of employee

stock options.

(13) Mr. Friedlob’s beneficial ownership includes: (i) 28,000 Class A shares owned by his spouse; and (ii) the right

to acquire 20,000 Class A Shares within 60 days upon the exercise of nonemployee director stock options.

(14) Mr. Schroeder’s beneficial ownership includes: (i) 13,600 Class A shares; and (ii) the right to acquire 15,000

Class A Shares within 60 days upon the exercise of nonemployee director stock options.

(15) Mr. Goodbarn’s beneficial ownership includes: (i) 1,500 Class A shares; and (ii) the right to acquire 20,000

Class A Shares within 60 days upon the exercise of nonemployee director stock options.

(16) Class A and Class B Common Stock beneficially owned by both Mr. and Mrs. Ergen is only included once in

calculating the aggregate number of shares owned by directors and executive officers as a group. Includes: (i)

5,834,424 Class A shares; (ii) 105,408 Class A Shares held in the 401(k) Plan; (iii) the right to acquire

3,142,677 Class A Shares within 60 days upon the exercise of employee stock options; (iv) 2,250,000 Class A

Shares held in a partnership; (v) 238,435,208 Class A Shares issuable upon conversion of Class B Shares; (vi)

439,420 Class A Shares held in the name of, or in trust for, children and other family members; (vii) 32,984

Class A Shares held by a charitable foundation for which Mr. Moskowitz is a member of its board of directors;

and (viii) 4,184 Class A Shares held in the employee stock purchase plan.

(17) The number of shares shown for each of Mr. and Mrs. Ergen includes 1,590,116 Class A Shares over which

Mr. and Mrs. Ergen have voting power as trustee for EchoStar’s 401(k) Plan. These shares also are