Dish Network 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

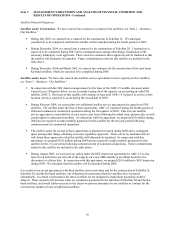

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

55

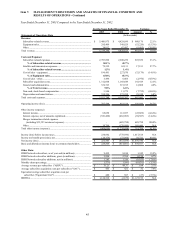

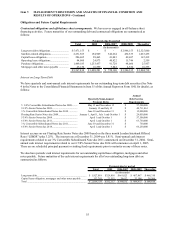

Obligations and Future Capital Requirements

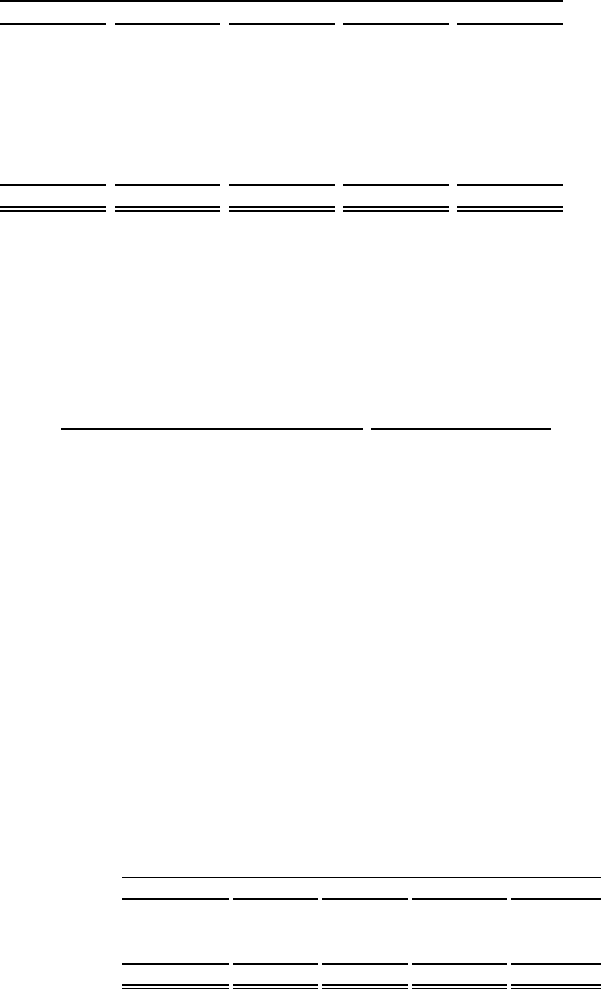

Contractual obligations and off-balance sheet arrangements. We have never engaged in off-balance sheet

financing activities. Future maturities of our outstanding debt and contractual obligations are summarized as

follows:

Payments due by period

Total 2005 2006-2007 2008-2009 Thereafter

(In thousands)

Long-term debt obligations............................ 5,471,153$ -$ -$ 2,946,153$ 2,525,000$

Satellite-related obligations........................... 2,231,363 184,909 546,664 432,335 1,067,455

Capital lease obligation................................. 286,605 28,463 41,043 49,687 167,412

Operating lease obligations........................... 84,000 24,873 40,822 15,746 2,559

Purchase obligations ..................................... 1,449,183 1,233,437 91,729 98,060 25,957

Mortgages and other notes payable .............. 45,130 16,599 7,842 4,354 16,335

9,567,434$ 1,488,281$ 728,100$ 3,546,335$ 3,804,718$

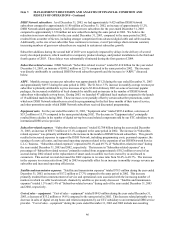

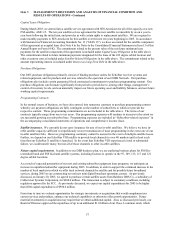

Interest on Long-Term Debt

We have quarterly and semi-annual cash interest requirements for our outstanding long-term debt securities (See Note

4 in the Notes to the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for details), as

follows:

Annual

Quarterly/Semi-Annual Debt Service

Payment Dates Requirements

5 3/4% Convertible Subordinated Notes due 2008......... May 15 and November 15 57,500,000$

9 1/8% Senior Notes due 2009........................................ January 15 and July 15 40,711,461$

3 % Convertible Subordinated Notes due 2010 .............. June 30 and December 31 15,000,000$

Floating Rate Senior Notes due 2008.............................. January 1, April 1, July 1 and October 1 29,050,000$

5 3/4% Senior Notes due 2008 ....................................... April 1 and October 1 57,500,000$

6 3/8% Senior Notes due 2011........................................ April 1 and October 1 63,750,000$

3 % Convertible Subordinated Notes due 2011............... June 30 and December 31 750,000$

6 5/8% Senior Notes due 2014........................................ April 1 and October 1 66,250,000$

Interest accrues on our Floating Rate Senior Notes due 2008 based on the three month London Interbank Offered

Rate (“LIBOR”) plus 3.25%. The interest rate at December 31, 2004 was 5.81%. Semi-annual cash interest

requirements related to our 3% Convertible Subordinated Note due 2011 commenced on December 31, 2004. Semi-

annual cash interest requirements related to our 6 5/8% Senior Notes due 2014 will commence on April 1, 2005.

There are no scheduled principal payment or sinking fund requirements prior to maturity on any of these notes.

We also have periodic cash interest requirements for our outstanding capital lease obligation, mortgages and other

notes payable. Future maturities of the cash interest requirements for all of our outstanding long-term debt are

summarized as follows:

Payments due by period

Total 2005 2006-2007 2008-2009 Thereafter

(In thousands)

Long-term debt............................................................................... 1,927,018$ 329,818$ 661,023$ 467,867$ 468,310$

Capital lease obligation, mortgages and other notes payable ......... 132,741 22,515 39,612 32,108 38,506

Total .............................................................................................. 2,059,759$ 352,333$ 700,635$ 499,975$ 506,816$